With a fluctuating stock market and tough economy, no wonder people have decided to explore new unconventional investment opportunities, with wine being one of them. During the past decade, wine has become an increasingly popular investment commodity, with its own index. The Liv-ex 100 is an index that tracks the 100 most sought-after wines, it is the industry benchmark. First-time wine investors, however, have a lot to learn before buying their first case of Bordeaux.

The Basics of Wine Investment Unveiled

The first thing novice investors should take into consideration is that wine is not a commodity that provides fast returns. WineFolly.com states that investors should expect to wait 6 to 10 years for their portfolio to achieve substantial value.

Moreover, putting a case or two in your cellar is not enough to become a wine investor. The first thing beginners need to understand is the wines themselves. Almost all wines worth investment come from five regions: Bordeaux, Champagne, Tuscany, Burgundy and the Rhone.

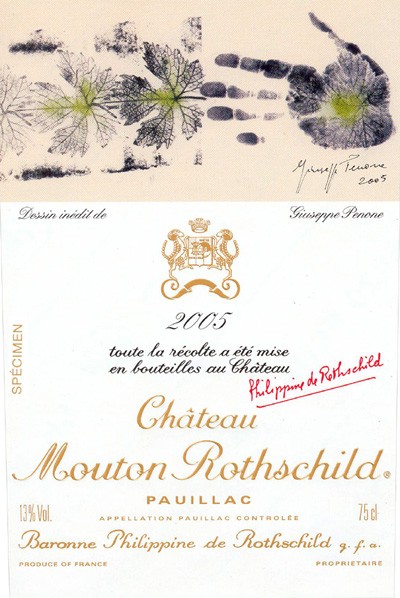

In fact, the Bordeaux region continues to serve as the gold standard for wine investors, while the four latter regions are still gaining in popularity. According to wine trading platform Cavex, two cases of Chateau Mouton Rothschild 2005—an iconic wine from the Bordeaux region of France—recently traded for £4,100 GBP (about $6,566 USD). Meanwhile, four cases of the Burgundy wine Ponsot Morey St. Denis Alouettes 2009 went for a more modest £275 GBP (about $440 USD).

Novice investors should be concerned about other things besides wine as well. Procuring investment-quality storage is an issue. As WineFolly.com reported, professional wine storage typically starts at around $18 per month for a locker that can hold seven to nine cases of wine. Though that’s certainly enough for most first-time investors, those who want to expand their collection will find themselves outgrowing the minimum storage solutions quickly.

Other expenses include insurance, broker fees and, if you choose, the cost of joining trading exchanges like Cavex and Liv-ex.

Chateau Mouton Rothschild 2005 label

A Risky, But Worth Vintage

Wine comes with its fair share of risks, just like all investment.

While the market for investment-quality wine stabilized last year, in 2013,

it had taken substantial tumbles in the past. Underpinned by new demand

from China, prices for the world’s most desired wines rose

by 250% from 2003 to early 2011. But when the bottom fell

out of the Chinese Bordeaux market, wine prices plunged across the

board.

Moreover, wine prices are affected by unpredictable factors, such as the weather and even negative reviews from respected wine critics.

Wine investing also attracts its share of fraudsters. Wine fraud at the investment level typically involves selling counterfeit versions of collectible wines, a scam made all the easier since many investors may never actually see—let alone taste—the wines they’ve purchased.

One high-profile example of wine fraud involved a counterfeiter who allegedly sold more than $35 million worth of counterfeit Bordeaux and Burgundy wines during the early 2000s.

And, yet, for committed investors and wine enthusiasts, the world’s most sought-after vintages offer an interesting opportunity to explore a unique market. Novice investors may face a steep learning curve, but if wine is your passion, you’ll already have a great contingency plan: You can always drink it.