- Argentina refuses to be "extorted" and defaults on $539m.

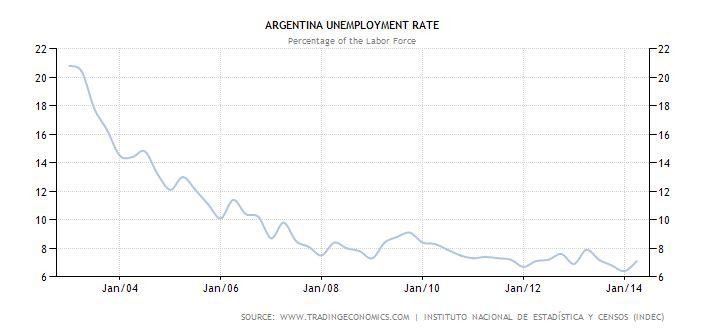

- Unemployment is declining and GDP is growing by 3%.

On Wednesday, Argentina defaulted failed to pay a $539 million interest payment. As a result, the S&P downgraded several Argentine bonds, the Merval stock exchange plunged, and many are fearing a repeat of the 2001-2002 crisis. Over the past few years hordes of investors have already fled the country as the socialist Kirchner government continuous to play dangerous political games with the economy. Kirchner's recent refusal to kowtow to a small group of vulture funds who are seen as "extorting" the country, may send more investors to the door.

The noise created by the vulture funds and their persistent lawsuits has shown that Argentina is far from perfect. In February, the Economist made this point clear in an article titled, "A century of decline". However, within Argentina's imperfection lies an economy that is resilient to crisis and in a position for future long-term growth as new leadership comes into power next year.

Argentina's economy will continue to grow especially in the energy sector. Unlike Argentina's 2001 default, the country's economy now stands comparatively much stronger. Many investors will be waiting (and praying) to see the outcome of general elections in October 2015.