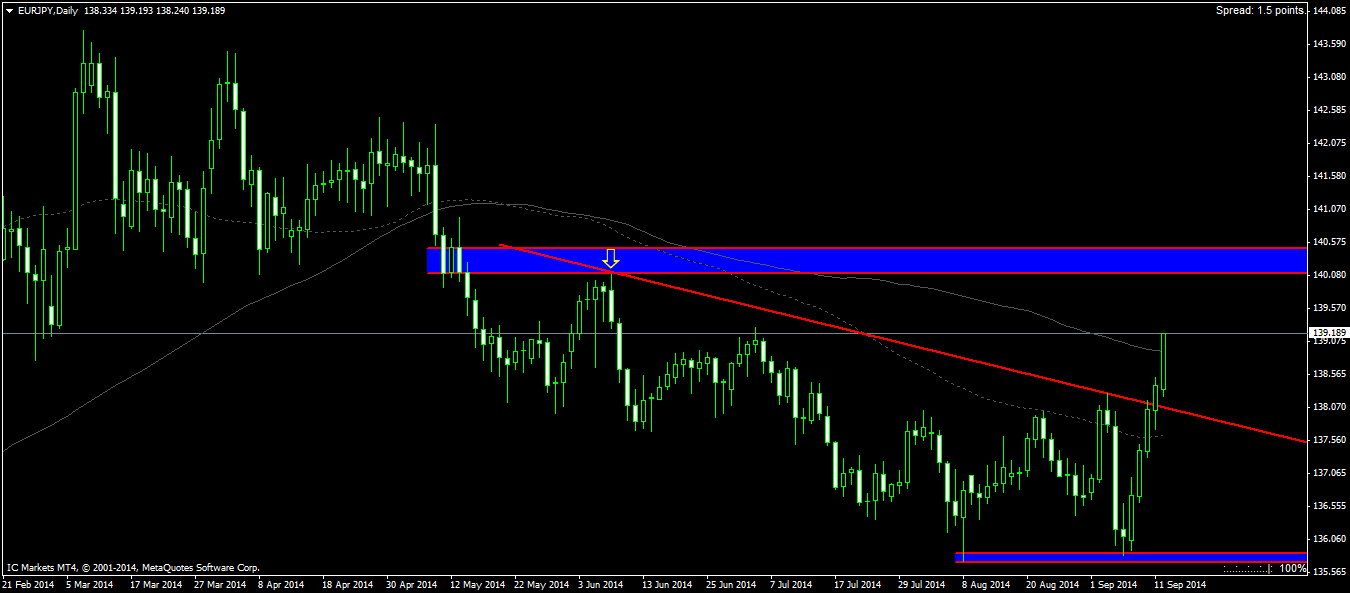

EURJPY broke out above a descending trend-line. Although this trend-line was only tested once, it was expected to be quite strong especially seeing the sharp fall afterwards. Only, now that price has broken out of this trend line, we are looking for the next available trade. I mentioned before that the EURJPY support will be tested and it in fact did get tested. For those that bought into this pair, you should look to close out at 140.

Taking a look at the daily chart, the supply zone starts at 140.111. A yellow down arrow has been drawn in to show that this level has been tested and succeeded. We can expect the price will near this price zone before making any signs of a turnaround. Since it has already been tested once, we might actually consider the next price level turn around point at 141.60.

Why hasn't 141.60 been drawn in? Overall, the Euro is very bearish. It is only gaining against the Yen because the Yen is even more bearish. By comparing a bearish currency within an even more bearish currency, the Euro does seem to be gaining value. As of right now, this pair is being treated as a daily range instead of trending. There is no major down trend formation actually. The trend strength is very weak and is best classified as ranging. Due to this, the key resistance level to eye is 140.111 and existing buyers should close out longs at about 140.