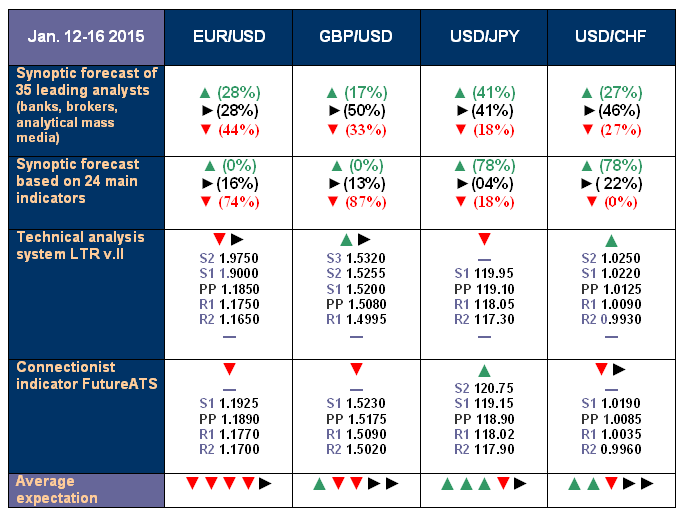

Generalising the opinions of 35 analysts from world leading banks and broker companies collected in a table as well as forecasts based on different methods of technical and graphical analysis, it becomes clear that one cannot be satisfyingly sure about any of the pairs:

- for example, for the pair EUR/USD almost one third of the analysts are pointing to its possible growth. The indicators readings for the nearest days differ 50-50, although afterwards all of them predict the continuation of the fall. Thus it is not excluded that at the start of the week the pair will still grow to the level of 1.9000, and then it will continue its main trend – down to the mark 1.1750, and then further to 1.1650;

- the British pound will probably follow the euro example – first growth, then fall. At the same time some analysts consider that the pair GBP/USD, being under the “bear” pressure, will still remain in the sideway trend;

- as for the pair USD/JPY, everyone expects its return to the zone of 120-121, and the medium-term goal is mentioned as 121.75;

- but for the USD/CHF pair, the forecast remains the same as for the previous week – sideway movement along the level 1.0000.

***

As for last week’s forecast, it can be said that the New Year surprises did not limit to the gap during the night 1-2 January – after five days the scenario repeated, pleasing the “bears” with another gap, and the pairs EUR/USD and GBP/USD continued their rapid fall. As a result the euro went down to the minimum of summer 2010, and now the ten year old June mark waits for its turn.

- the dollar has strengthened to the yen as well: the pair USD/JPY could not take the height of 121.00 and tumbled down to the level of mid December of the last year;

- and finally the last pair – USD/CHF. As was forecasted, it was fixed above the key mark of 1.0000 and finished on Friday with the result of 1.0140.

Roman Butko, NordFX & Sergey Ershov