VIDEO LESSON - How to Set Stops Using the Average True Range (ATR)

Although many traders will look at other things in conjunction, having an idea of the historical volatility of the instrument you are trading is always a good idea when thinking about your stop loss level. If for instance you are trading a $100 stock which moves $5 vs. a $100 stock that moves $1 a day on average, then this is going to tell you something about where you should place your stop. As it is probably already clear here, all else being equal, if you put a stop $5 away on both stocks, you are going to be much more likely to be stopped out on the stock which moves on average $5 a day than you are with the stock that moves on average $1 a day.

While I have seen successful traders who get to know a list of the things they are trading well enough to have a good idea of what their average daily ranges are, many traders will instead use an indicator which was designed to give an overview of this, which is known as the Average True Range (ATR)

Developed by J. Welles Wilder the ATR is designed to give traders a feel for what the historical volatility is for an instrument, or very simply how much it moves. Financial instruments that exhibit high volatility move a lot, and traders can there fore make or lose a lot of money in a short period of time. Conversely, financial instruments with low volatility move a relatively small amount so it takes longer to make or lose money in them all else being equal.

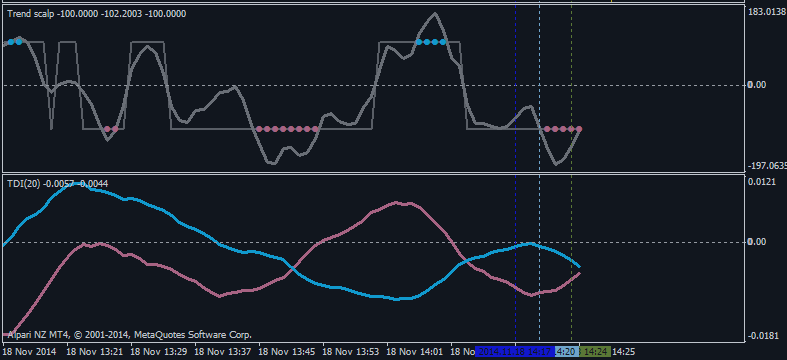

As with many of the other indicators we have studied in previous lessons, Wilder uses a moving average to smooth out the True Range numbers. When plotted on a graph it looks as follows:

What you are basically seeing here is a representation of the daily

movement of the EUR/USD. As you can see when the candles are longer

(which represents large trading ranges and volatility) the ATR moves up

and when the candles are smaller (representing smaller trading ranges

and volatility) it moves down.

So with this in mind, the most basic way that traders use the ATR in

setting their stops is to place their stop a set number of ATR’s away

from their entry price so they have less of a chance of being knocked

out of the market by “market noise”.