Three Strategies, One System – Stability, Performance & Evolution

June 2025 marks a milestone for the Burning Grid Expert Advisor: not only due to another month of strong trading results across all three risk levels — Low, Medium, and High — but also because of a major technical update, introducing real-world usability features like Prop Firm Mode, Small Account Tools, and new risk shielding options for multi-symbol strategies.

Burning Grid continues to prove that grid trading doesn't have to mean chaos, overexposure or luck — when paired with structure, rules, and active development, it becomes a tool for consistency and growth.

🧠 Strategic Core: Structured Grid Logic

Burning Grid is built on a principle that grid strategies can be effective — if and only if they are risk-defined. The system does not rely on martingale or exponential lot sizing. Instead, it uses:

-

Fixed grid distance between entries

-

Strict cap on the number of active positions per symbol

-

Volume automatically calculated based on available capital

-

Loss exit logic that terminates failing clusters early

-

An integrated news filter to avoid high-volatility periods

-

Zero manual intervention

The difference between Low, Medium, and High Risk modes lies in how much capital pressure per symbol is tolerated — the engine and logic remain the same.

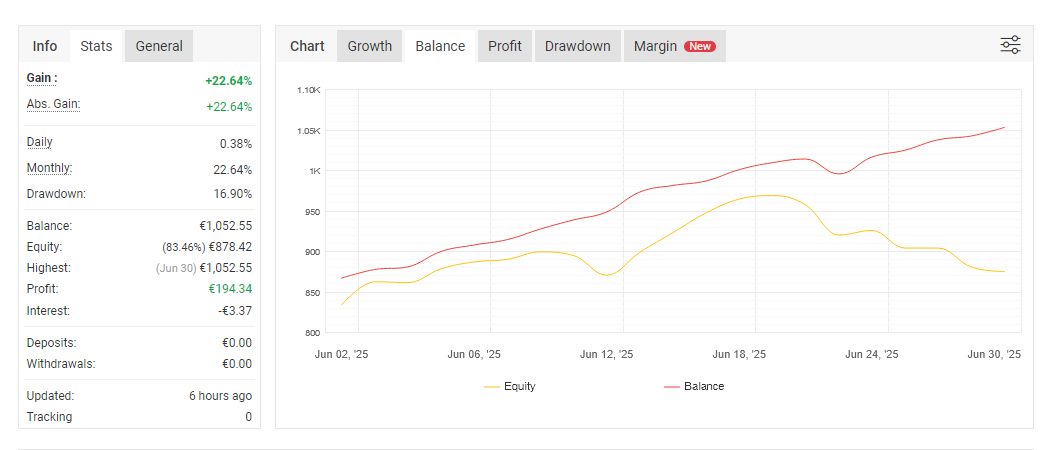

🔹 Low Risk – The Stable Growth Track

📊 June Stats:

-

Growth: +22.64 %

-

Profit: €194.34

-

Max Drawdown: 16.90 %

-

Total Trades: 324

-

Win Rate: 98 %

-

Profit Factor: 4.39

-

Avg. Trade Duration: 15h 15m

💬 Notes:

Low Risk continues to deliver methodical growth. Even in volatile conditions, trades were closed efficiently. Losing sequences were stopped with precision rather than extended. The system remains mechanically consistent and calm — a valuable asset for traders who prefer conservative, low-risk automation.

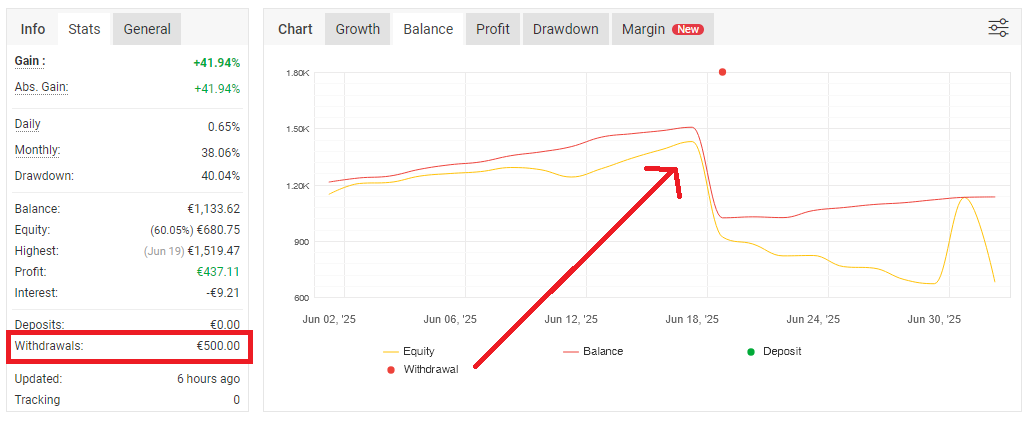

🔸 Medium Risk – Balanced, Resilient, Efficient

📊 June Stats:

-

Growth: +38.06 %

-

Profit: €437.11

-

Max Drawdown: 40.04 %

-

Total Trades: 607

-

Win Rate: 98 %

-

Profit Factor: 6.40

-

Avg. Trade Duration: 16h 41m

💬 Notes:

Medium Risk handled several complete grid cycles during June — including recovery from partial drawdown and account rebalancing. Notably, the EA continued uninterrupted even after external withdrawals, preserving trade logic and capital discipline. Despite increased frequency, risk remained contained — proving that balance is not a myth when properly engineered.

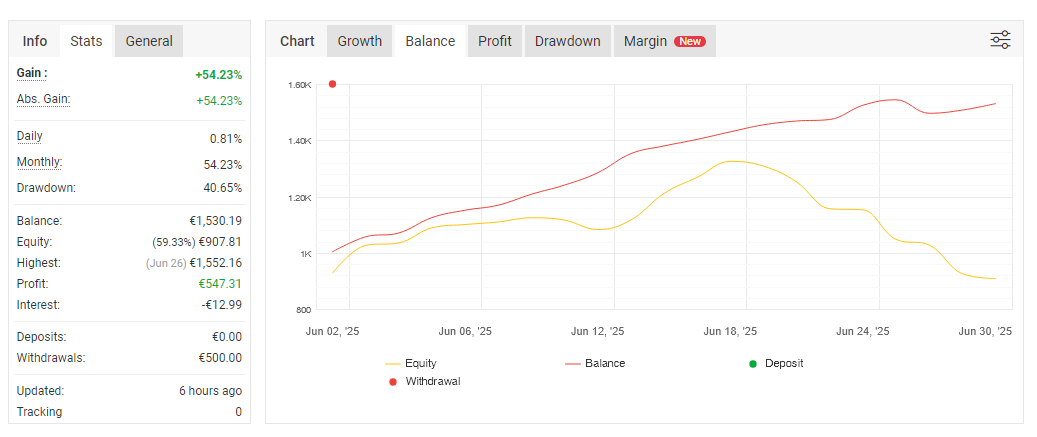

🔺 High Risk – Controlled Acceleration

📊 June Stats:

-

Growth: +54.23 %

-

Profit: €547.31

-

Max Drawdown: 40.65 %

-

Total Trades: 756

-

Win Rate: 97 %

-

Profit Factor: 4.43

-

Avg. Trade Duration: 18h 3m

💬 Notes:

High Risk pushes the system to its designed upper limits. Yet, even here, loss events are not destructive — the EA exits before risk escalates. With over 9,000 net pips and an exceptional win rate, High Risk demonstrates that performance and protection can coexist, as long as logic governs every layer of decision-making.

📊 Strategy Comparison

| Strategy | Growth | Drawdown | Profit | Win Rate | Profit Factor | Trades |

|---|---|---|---|---|---|---|

| Low Risk | +22.64 % | 16.90 % | €194.34 | 98 % | 4.39 | 324 |

| Medium Risk | +38.06 % | 40.04 % | €437.11 | 98 % | 6.40 | 607 |

| High Risk | +54.23 % | 40.65 % | €547.31 | 97 % | 4.43 | 756 |

🛠 Technical Development – June 2025 Update

While the trading engine remained stable, June brought significant backend upgrades to the EA — aimed at professional usability, security, and broker compatibility.

✅ 1. Prop Firm & Small Account Support

Two new built-in modes have been added for prop firm evaluations and restricted-capital accounts:

-

Daily Loss Limit Monitoring

-

Capital Guardrails / Static Max Loss Levels

-

Flexible Volume Handling for Low-Margin Environments

These changes make it possible to run the EA under firms like FTMO, MyForexFunds, and The5ers without needing external modifications — a critical step for professional traders.

✅ 2. “Block active Currencies or Symbols” Feature

This risk-reducing tool lets the EA prevent parallel trade interference across multiple instances or strategies.

Modes:

-

Disabled: No interference control

-

Block Running Symbols: Prevents duplicate trades on the same symbol

-

Block Running Currencies: Prevents new trades if the currency is already used in another active setup

This directly reduces symbol collisions, correlated risk buildup, and accidental overexposure — especially in multi-EA environments.

🙌 Built with the Community

Both new features were developed in response to real user feedback — not roadmap theory.

Discussions and requests from the official Burning Grid group have shaped everything from trade filters to volume control logic.

You're invited to join, test, and influence future development. This system grows with its traders — not in isolation.

🧾 Final Thoughts

June confirmed that Burning Grid is not just profitable — it’s structurally resilient. It doesn’t rely on tricks, hidden variables or optimism.

It runs on logic, and logic doesn’t panic.

🔗 Resources & References

🛒 Burning Grid on MQL5 Marketplace - https://www.mql5.com/en/market/product/135273📖 Read the Full Blog Article - https://www.mql5.com/en/blogs/post/762740

💬 Join the Community & Support Group - https://www.mql5.com/en/messages/0151274c579fdb01