Nicholas Woodman founded GoPro (NASDAQ:GPRO) in 2004 and financed it from selling shell necklaces for $60, which he had purchased for $1.90 in Bali and borrowings from his parents of $235k. His inspiration for GoPro came when he traveled the world surfing and had difficulty capturing action photos of his activities. Ten years later, he becomes a billionaire. Not a bad return on investment.

For about 10 years since its founding in Feb 2014, GoPro has been at the forefront of developing wearable and mountable HD camera and accessories to capture activities of everyday people, professional athletes, celebrities and other entertainers.

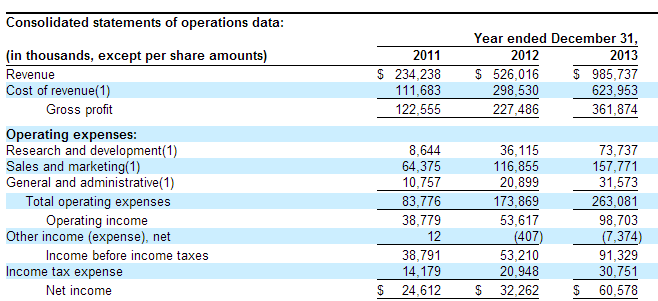

GoPro recently IPOed to raise capital to pay down their credit facility, which had an outstanding balance of $110 million as of March 14, 2014. Surprisingly the company churned a $60M in net income in 2013 even as it increased operating expenses from $143M to $263M. Last year, GoPro grew its gross profit by 59% from $227M to $361M. Much of the company's revenue is from outside of the United States, with 53% in 2013 coming from outside the U.S. The important thing is that this company is highly profitable.

The company's sales channels include direct sales to independent retailers, big box retailers such as Best Buy, Amazon, and Wal-Mart, mid-market retailers, and e-commerce.

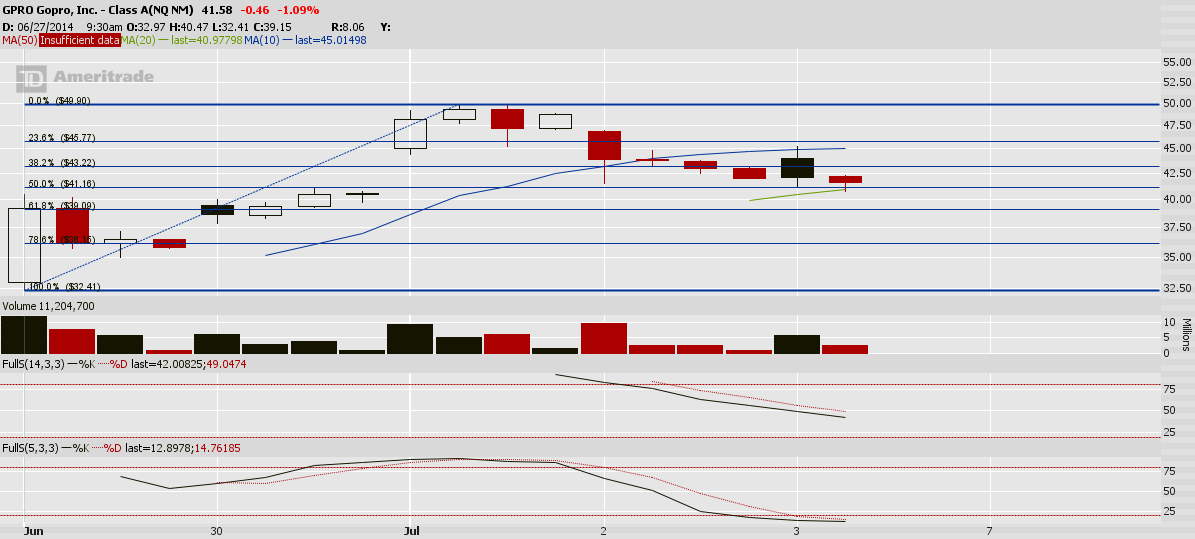

Highlight TechnicalsFrom a technical perspective, from GoPro's initial public offering at $24 it is clear that it has gone up 100% since. While many of us did not actually have the opportunity to buy at $24, the stock opening at $28.65 appears to have been a bargain - at least so far. The stock saw three consecutive days of advances before peeling back just before the July 4th weekend. As of July 4th, per Google Finance the company sits at a $5.14B market cap.

While it may be to early to draw any significant technical analysis conclusions, for those who are looking to ride this wild wave, the first entry point would be a 61.8% Fibonacci retracement. That price would be at $39.09, and then put stop just below what it opened at at its IPO of $32.41. The first target would be for it to take out the prior high of $49.90.