Weekly Trading Fundamental Forecast: Dollar Index, GBPUSD, USDJPY, AUDUSD and GOLD (XAUUSD)

10 November 2014, 21:11

0

361

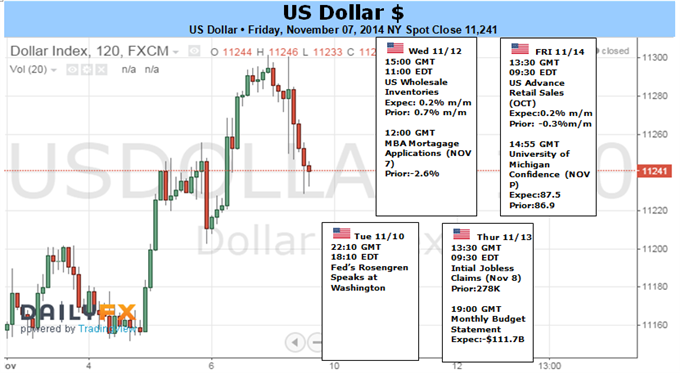

USD Dollar Forecasts - Dollar Climbs to Five Year High as Yields and FX Volatility Rebound

Global risk trends seems to be on a firm recovery while monetary policy softens from Europe to Asia. However, a the Fed’s own rate bearings are recovering and FX volatility is rising – giving strong support to the Dollar

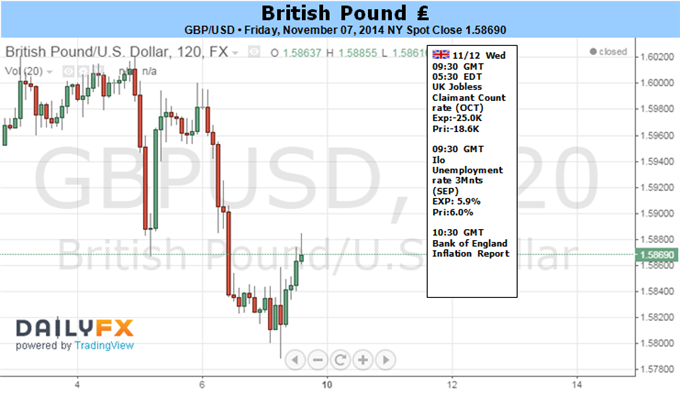

GBPUSD Forecasts - GBP/USD to Face Further Losses on Dovish BoE Inflation Report

The BoE Minutes due out on November 19 is likely to show another 7-2 split within the Monetary Policy Committee (MPC), and the British Pound remains at risk of facing a further decline over the remainder of the year should the fundamental developments coming out of the U.K. drag on interest rate expectations.

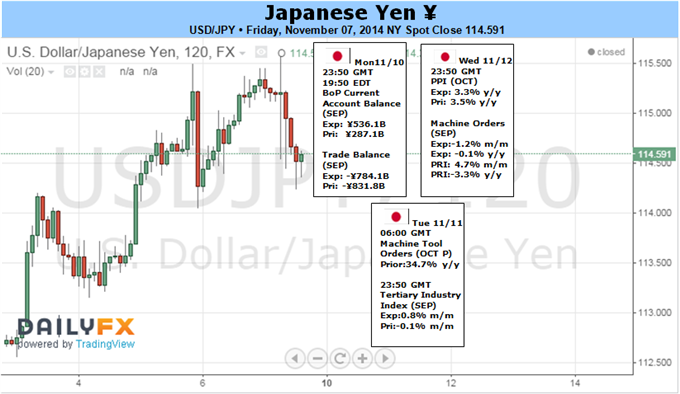

USDJPY Forecasts - Japanese Yen Eyes Global Growth Trends as Dust Settles on BOJ Action

Disappointing European and Chinese news-flow coupled with another round of evidence supporting the Fed’s steady progression toward interest rate hikes in 2015 will probably make for a toxic mix of sentiment cues. The ensuing bout of risk aversion threatens to trigger liquidation of Yen-funded carry trades, sending the Yen broadly higher against most of its counterparts.

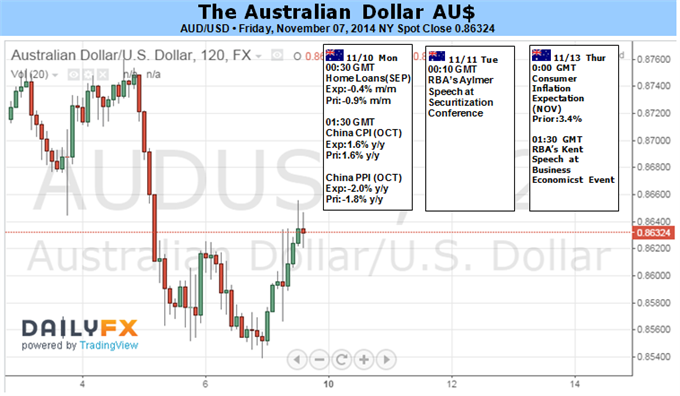

AUDUSD Forecasts - AUD Remains At Risk After Breaching Key Barrier Amid Volatility Spike

Chinese Retail Sales, Industrial Production, CPI and Aggregate Financing figures are on the docket. Yet the Aussie has witnessed a lackluster response to recent economic releases from the Asian giant. This suggests there is a high threshold for the upcoming China data to impact the commodity currency. From a technical standpoint; the clearance of 0.8660 may have potentially set the wheels in motion for a descent on the July 2010 low near 0.8320 over the coming weeks.

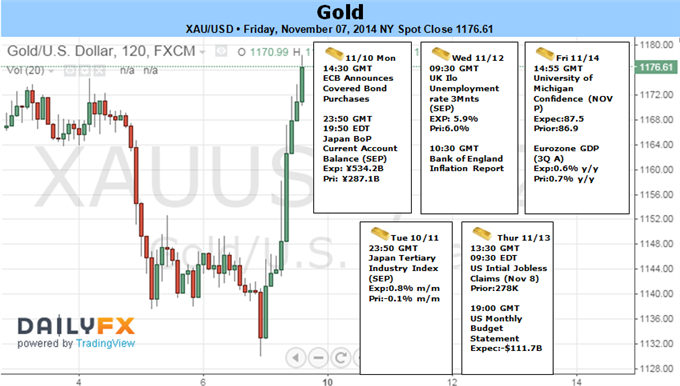

GOLD (XAUUSD) Forecasts - Gold Posts Outside Reversal- NFP Rebound Mired by Growth Concerns

Gold looks poised for further topside in the near-term with Friday’s price action posting a massive outside reversal candle. The snap-back from extremes in the momentum signature suggests this is likely to be a simple bear market rally with topside objectives eyed at $1180, 1192 & 1206/07 (where we would be looking for favorable short entries). Interim support stands at $1150 and is backed by $1125/30.

Global risk trends seems to be on a firm recovery while monetary policy softens from Europe to Asia. However, a the Fed’s own rate bearings are recovering and FX volatility is rising – giving strong support to the Dollar

GBPUSD Forecasts - GBP/USD to Face Further Losses on Dovish BoE Inflation Report

The BoE Minutes due out on November 19 is likely to show another 7-2 split within the Monetary Policy Committee (MPC), and the British Pound remains at risk of facing a further decline over the remainder of the year should the fundamental developments coming out of the U.K. drag on interest rate expectations.

USDJPY Forecasts - Japanese Yen Eyes Global Growth Trends as Dust Settles on BOJ Action

Disappointing European and Chinese news-flow coupled with another round of evidence supporting the Fed’s steady progression toward interest rate hikes in 2015 will probably make for a toxic mix of sentiment cues. The ensuing bout of risk aversion threatens to trigger liquidation of Yen-funded carry trades, sending the Yen broadly higher against most of its counterparts.

AUDUSD Forecasts - AUD Remains At Risk After Breaching Key Barrier Amid Volatility Spike

Chinese Retail Sales, Industrial Production, CPI and Aggregate Financing figures are on the docket. Yet the Aussie has witnessed a lackluster response to recent economic releases from the Asian giant. This suggests there is a high threshold for the upcoming China data to impact the commodity currency. From a technical standpoint; the clearance of 0.8660 may have potentially set the wheels in motion for a descent on the July 2010 low near 0.8320 over the coming weeks.

GOLD (XAUUSD) Forecasts - Gold Posts Outside Reversal- NFP Rebound Mired by Growth Concerns

Gold looks poised for further topside in the near-term with Friday’s price action posting a massive outside reversal candle. The snap-back from extremes in the momentum signature suggests this is likely to be a simple bear market rally with topside objectives eyed at $1180, 1192 & 1206/07 (where we would be looking for favorable short entries). Interim support stands at $1150 and is backed by $1125/30.