RISK MANAGEMENT - Ed Seykota & Trading Tribe Ideas on Avoiding Losses when Trend Following

Ed Seykota turned $5,000 into $15,000,000 over a 12 year time period in

his model account - an actual client account. He is a trend following

legend.I was speaking to a potential student and he asked me if I can

teach him how to avoid losses. This is the subject of this short

youtube video.

Ed Seykota : "Systems don't need to be changed. The trick

is for a trader to develop a system with which he is compatible."

----------

More on Ed Seykota website about Risk Management :

"RISK

is the possibility of loss. That is, if we own some

stock, and there is a possibility of a price decline, we are at risk. The stock

is not the risk, nor is the loss the risk. The possibility of loss is the risk.

As long as we own the stock, we are at risk. The only way to

control the risk is to buy or sell stock. In the matter of owning stocks, and

aiming for profit, risk is fundamentally unavoidable and the best we can do is

to manage the risk.

To manage is to direct

and control. Risk management is to direct and control the possibility of loss.

The activities of a risk manager are to measure risk and to increase and

decrease risk by buying and selling stock."

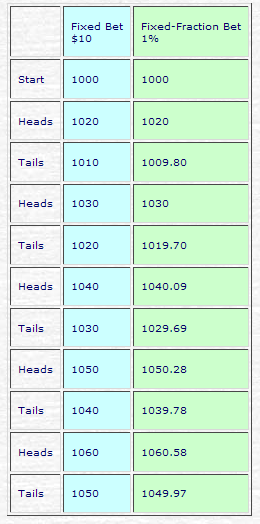

Simulation of Fixed-Bet and Fixed-Fraction Betting Systems:

"Pyramiding and Martingale. In the case of a random process, such as coin tosses, streaks of heads or tails do occur, since it would be quite improbable to have a regular alternation of heads and tails. There is, however, no way to exploit this phenomenon, which is, itself random. In non-random processes, such as secular trends in stock prices, pyramiding and other trend-trading techniques may be effective.

Pyramiding is a method for increasing a position, as it becomes profitable. While this technique might be useful as a way for a trader to pyramid up to his optimal position, pyramiding on top of an already-optimal position is to invite the disasters of over-trading. In general, such micro-tinkering with executions is far less important than sticking to the system. To the extent that tinkering allows a window for further interpreting trading signals, it can invite hunch trading and weaken the fabric that supports sticking to the system.

The Martingale system is

a method for doubling-up on losing bets. In case the doubled bet loses, the

method re-doubles and so on. This method is like trying to take nickels from in

front of a steam roller. Eventually, one losing streak flattens the account."

----------