Volume Profile SAF

- Göstergeler

- Ebrah Ssali

- Sürüm: 1.3

- Etkinleştirmeler: 5

Volume Profile SAF - Institutional-Grade Volume-informed Market Structure Indicator

Unlock Professional Market Intelligence with less Effort

Stop guessing. Start seeing. The Volume Profile SAF (Set and Forget) transforms complex market structure analysis into crystal-clear, actionable trading signals that institutional traders pay thousands for. Experience the power of real-time volume profiling, value area tracking, and precision POC cross alerts - all in one lightweight, EA-ready indicator.

What Problem Does This Solve? (Trader's Questions Answered)

| Your Question | Volume Profile SAF Answers |

| Where is institutional money flowing? | Visual volume bars show exact price levels with highest trading activity |

| What's the current market structure? | Clear POC, VAH, VAL lines reveal support/resistance zones |

| When should I enter? | Automatic arrow signals on POC crosses with volume confirmation |

| How strong is the signal? | Bullish/bearish volume split percentages on each bar |

| Where to place stops? | Value Area boundaries provide natural stop loss levels |

| What's the risk? | Visual warnings when price approaches key distribution extremes |

Three Game-Changing Features That Give You An Edge

1. Smart Volume Profile Modes (Set-and-Forget Intelligence)

- Manual Mode: Deep historical analysis with draggable range lines

- Auto Mode: Rolling 100-bar profile perfect for scalping and execution

- Session Mode: Daily/weekly volume profiles for institutional workflow

No more babysitting charts. The indicator automatically maintains live profiles across all timeframes.

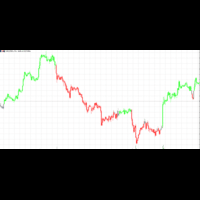

2. Real-Time POC Cross Signals (Precision Entries)

When price crosses the Point of Control (highest volume area), you get instant:

- Green Arrow → Price crosses POC upward → Buy Signal

- Red Arrow → Price crosses POC downward → Sell Signal

These aren't just random crosses - they represent price breaking through the most traded area, giving you institutional-level confirmation. (combine this with our Cumulative Volume Delta MAX for even more insightful confluence)

3. Value Area Analysis (Professional Risk Management)

The Value Area (containing 69% of volume) gives you:

- VAH (Value Area High): profit target for longs, stop loss for shorts

- VAL (Value Area Low): Take profit target for shorts, stop loss for longs Take

- Automatic evolution as new volume comes in

Signal Hierarchy and Confluence Framework (High-Confidence Trading)

Level 1: Basic Signal ✅

- POC cross alone (good for scalping)

Level 2: Volume-Confirmed Signal ✅✅

- POC cross + bullish/bearish volume dominance in that area

- Example: POC cross up + 70% bullish volume in that bar = High confidence buy

Level 3: Value Area Breakout ✅✅✅

- POC cross + price breaking through VAH/VAL

- This indicates institutional momentum - Highest confidence

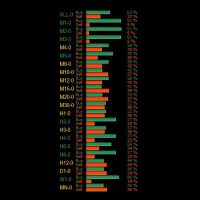

Level 4: Multiple Timeframe Alignment ✅✅✅✅

- POC crosses aligning across M15, H1, H4 timeframes

- The ultimate institutional confirmation (you have to check different time frame charts; we are working on Multi-timeframe version)

Ease of Use and Simple Configuration

Install → Attach → Trade. That's it.

Minimal Settings:

1. Choose Profile Mode (Auto/Session/Manual)

2. Set your preferred colours

3. Enable/disable features as needed

No complex optimization needed. The indicator uses intelligent default settings refined from institutional trading floors.

EA-Ready and Automation Friendly

Every signal is stored in accessible buffers, making this indicator perfect for:

- Automated trading systems (access signals via iCustom())

- Alert systems (email, push notifications, sounds)

- Multi-indicator strategies (combine with our Cumulative Volume Delta MAX, Dynamic Gradient Colour RSI v SMA etc.)

- Backtesting (clean signal history for strategy validation)

Buffer 0: Buy Signals | Buffer 1: Sell Signals - Simple, clean, automation-ready.

Performance and Resource Management

Lightweight Architecture ensures optimal performance:

- Intelligent recalculation only on new bars (not on every tick)

- Smart object management prevents chart clutter

- Minimal CPU usage even on M1 timeframes

- Clean memory handling prevents MT5 crashes

Trade with confidence knowing your platform stays responsive, even with multiple charts and timeframes open.

Who Is This For?

- Day Traders seeking institutional volume insights

- Swing Traders needing clear market structure

- Algorithmic Traders requiring clean signal outputs

- Risk Managers wanting value area boundaries

- All Traders tired of lagging, repainting indicators

What You're NOT Getting

- ❌ No repainting signals

- ❌ No lagging calculations

- ❌ No complicated setup

- ❌ No resource-hogging bloatware

- ❌ No vague, subjective interpretations

Professional-Grade Features Delivered

✅ Real-Time Volume Profile Analysis

✅ Automatic POC Cross Signals with Arrows

✅ Value Area Calculation (VAH/VAL)

✅ Bullish/Bearish Volume Split Visualization

✅ Multi-Mode Operation (Manual/Auto/Session)

✅ EA-Ready Signal Buffers

✅ Intelligent Resource Management

✅ Clean, Professional Visual Output

✅ All Timeframe Compatibility

✅ Institutional-Grade Market Structure Insights

Risk Management Integration

The indicator naturally answers "What's the risk?" by:

1. Visualizing Value Area → Shows high-probability price zones

2. Highlighting Low-Volume Nodes → Warns of potential stop-running areas

3. Showing Volume Imbalances → Identifies weak support/resistance

4. Providing Clear Stop Levels → VAH/VAL offer logical stop placement

Place stops beyond VAL for longs, beyond VAH for shorts - these are natural institutional pain points.

Filter Out Low-Probability Trades

Stop wasting time on weak setups. This filters out noise by:

- Ignoring POC touches - Only alerts on actual crosses

- Highlighting volume extremes - Shows where real interest lies

- Separating bullish/bearish volume - Reveals true market sentiment

- Focusing on value area - Concentrates on high-probability zones

Trade less. Win more. Focus only on institutional-quality setups.

The Ultimate Trading Decision Matrix

When the indicator shows:

1. POC cross + Volume confirmation + Value Area breakout = HIGHEST PROBABILITY TRADE

2. POC cross + Volume confirmation = MEDIUM PROBABILITY TRADE

3. POC cross alone = LOW PROBABILITY TRADE (consider filtering)

This simple framework eliminates emotional trading and provides clear, rules-based decisions.

See What Institutions See - Trade What They Trade

In trading, it's not about working harder - it's about seeing smarter. Volume Profile SAF adds to the "smarter" part.