Market Volume Profile Modes

- Индикаторы

- Zhen Yu Zheng

- Версия: 1.0

- Активации: 10

Market Volume Profile Modes is a powerful MT5 volume distribution indicator that integrates multiple Volume Profile variants. Users can switch between different analysis modes through a simple menu selection. This indicator helps traders identify key price levels, support and resistance zones, and market volume distribution.

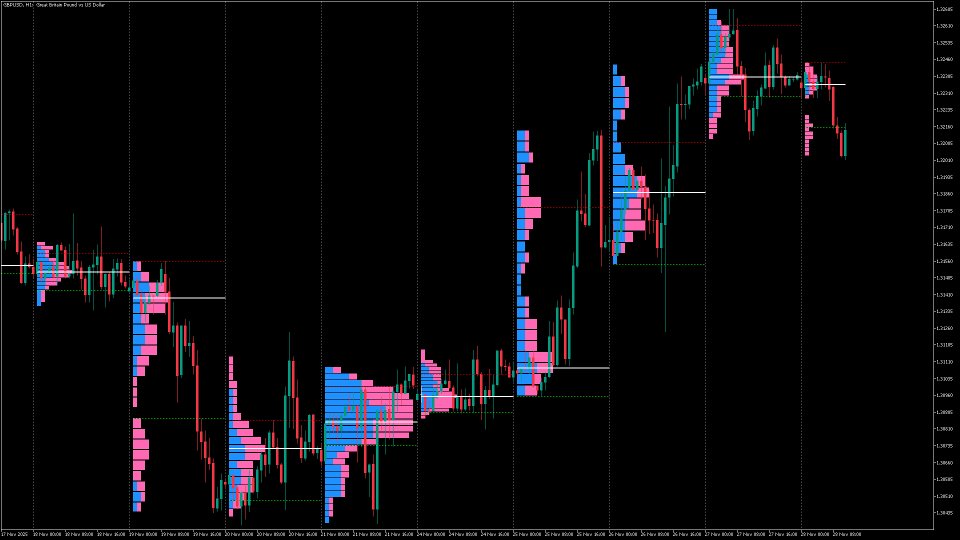

This indicator supports 8 different Volume Profile modes, suitable for various trading styles and analysis requirements:

| Mode Name | Description | Usage |

|---|---|---|

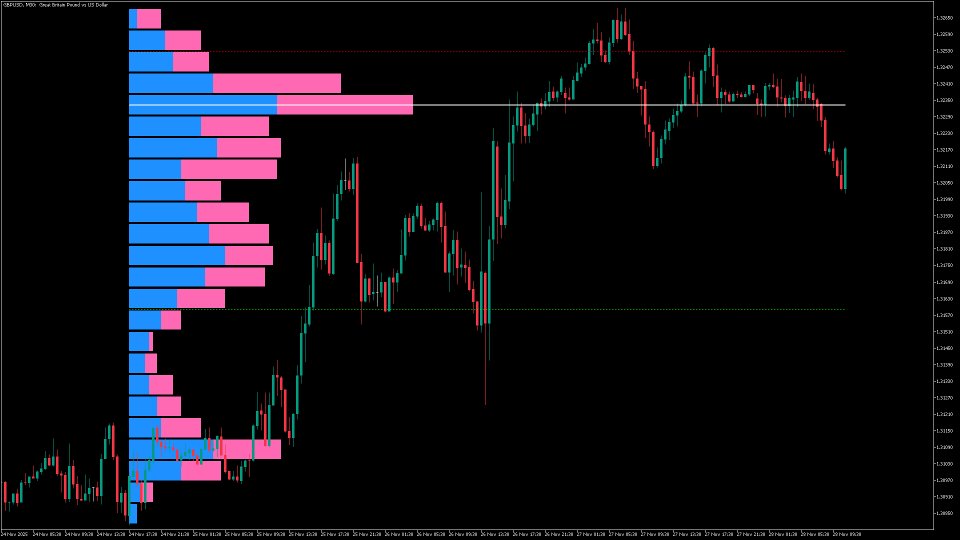

| Fixed Range (VPFR) | Manually drag rectangle to select any range | Click "+ Add Range" button to create rectangle, drag to adjust |

| Visible Range (VRVP) | Automatically calculate current visible chart range | Updates automatically with chart scrolling and zooming |

| Session (Daily) | Display separate Profile for each trading day | Auto-splits by date, shows daily volume distribution |

| Weekly | Display separate Profile for each week | Splits by week, suitable for weekly analysis |

| Monthly | Display separate Profile for each month | Splits by month, suitable for monthly analysis |

| Hourly | Display separate Profile for each hour | Suitable for intraday scalping traders |

| 4 Hour | Display separate Profile every 4 hours | Suitable for short to medium-term traders |

| Custom(N Bars) | Custom number of bars per period | Set via Custom Mode: Number of Bars parameter |

Parameter Settings

Below is a detailed description of all configurable parameters:

| Parameter Name | Description | Default Value |

|---|---|---|

| Volume Profile Mode | Select Profile calculation mode | Session (Daily) |

| Custom Mode: Number of Bars | Number of bars for custom mode | 20 |

| Max Profiles to Display | Maximum number of Profiles to show | 10 |

| Profile Position | Profile display position (Left/Right) | Left |

| Number of Rows | Number of Profile rows (precision) | 24 |

| Profile Width (%) | Profile width as percentage of period | 40.0 |

| Bar Gap (%) | Gap percentage between adjacent rows | 5.0 |

| Bullish Volume Color | Color for bullish volume | DodgerBlue |

| Bearish Volume Color | Color for bearish volume | HotPink |

| Show POC Line | Whether to display POC line | true |

| POC Color/Width/Style | POC line color, width, style | White / 2 / Solid |

| Show VAH Line | Whether to display Value Area High line | true |

| VAH Color/Width/Style | VAH line color, width, style | Red / 1 / Dot |

| Show VAL Line | Whether to display Value Area Low line | true |

| VAL Color/Width/Style | VAL line color, width, style | Lime / 1 / Dot |

| Value Area % | Value Area percentage | 70.0 |

| Range Rectangle Color | Rectangle color (Fixed Range mode) | Yellow |

| Range Rectangle Width | Rectangle line width | 1 |

| Range Rectangle Style | Rectangle line style | Dash |

| Show Session Divider | Whether to show period divider lines | true |

| Session Divider Color | Divider line color | Gray |

- After adding the indicator to the chart, set Volume Profile Mode to "Fixed Range (VPFR)"

- "+ Add Range" and "Clear All" buttons will appear in the top-left corner

- Click "+ Add Range" button to create a yellow dashed rectangle in the visible chart area

- Drag the rectangle corners or edges to adjust the analysis range

- Volume Profile will automatically be drawn within the rectangle

- You can create multiple rectangles for multi-area analysis

- Click "Clear All" button to remove all rectangles and Profiles

- Select the corresponding mode (e.g., Session)

- The indicator will automatically split by time period and draw Profiles

- Control the display quantity via Max Profiles to Display parameter

- Gray dotted lines indicate period dividers (can be disabled via parameter)

- POC levels typically form strong support or resistance

- VAH and VAL form value area boundaries; price tends to oscillate within this range

- Low Volume Nodes (sparse volume areas) - price tends to move quickly through these zones

- Consider entering when price retests the POC

- Price breaking through VAH/VAL and retesting can serve as entry signals

- Confirm with other technical indicators (e.g., candlestick patterns, momentum indicators)

- Stop loss can be placed below VAL (long) or above VAH (short)

- Take profit can reference the next Volume Profile's POC or VA boundaries