Market Structure Oscillator MT4

- Индикаторы

- Mykola Khandus

- Версия: 1.0

- Активации: 20

Market Structure Oscillator

Overview

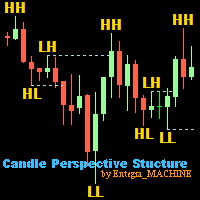

The Market Structure Oscillator is a technical indicator designed for MetaTrader platforms to analyze market trends across multiple timeframes. It provides a clear visualization of short-term, intermediate-term, and long-term market structures through an oscillator and histogram display in a separate window. The indicator also supports optional chart objects to highlight key market structure points.

Features

-

Displays a composite oscillator combining short-term, intermediate-term, and long-term market structure data.

-

Includes a cycle histogram to identify momentum shifts relative to an equilibrium level.

-

Optionally plots individual oscillator components for detailed analysis.

-

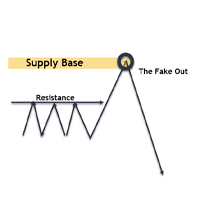

Draws trend lines and labels on the chart to mark significant market structure events, such as Changes of Character (CHoCH) and Break of Structure (BoS).

-

Customizable settings for weights, smoothing, colors, and display options.

Input Parameters

Market Structure Oscillator

-

Show Oscillator: Enable or disable the main oscillator display (default: true).

-

Short Term Weight: Weight for short-term data (default: 1.0).

-

Intermediate Term Weight: Weight for intermediate-term data (default: 3.0).

-

Long Term Weight: Weight for long-term data (default: 2.0).

-

Smoothing: Smoothing factor for the oscillator (default: 4).

-

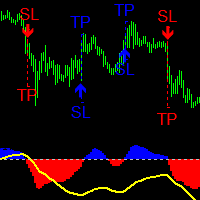

Crosses (Signals): Show bullish/bearish signal markers (default: false).

-

Bullish Signal Color: Color for bullish signals (default: RGB 49, 121, 245).

-

Bearish Signal Color: Color for bearish signals (default: RGB 158, 10, 10).

Cycle Oscillator

-

Show Histogram: Enable or disable the cycle histogram (default: true).

-

Signal Length: Smoothing period for the cycle histogram (default: 7).

-

Crosses (Signals): Show bullish/bearish signal markers for the cycle histogram (default: false).

-

Bullish Signal Color: Color for bullish cycle signals (default: RGB 144, 191, 249).

-

Bearish Signal Color: Color for bearish cycle signals (default: RGB 253, 112, 112).

Market Structures on Chart

-

Bars Limit: Maximum number of bars for drawing chart objects (default: 2000).

-

Short Term Structures: Enable short-term structure lines (default: false).

-

Short Term Lines Style: Line style for short-term structures (default: Dot).

-

Short Term Labels: Show labels for short-term structures (default: false).

-

Short Term Bullish Color: Color for bullish short-term structures (default: RGB 49, 121, 245).

-

Short Term Bearish Color: Color for bearish short-term structures (default: RGB 158, 10, 10).

-

Intermediate Term Structures: Enable intermediate-term structure lines (default: false).

-

Intermediate Term Lines Style: Line style for intermediate-term structures (default: Dash).

-

Intermediate Term Labels: Show labels for intermediate-term structures (default: false).

-

Intermediate Term Bullish Color: Color for bullish intermediate-term structures (default: RGB 49, 121, 245).

-

Intermediate Term Bearish Color: Color for bearish intermediate-term structures (default: RGB 158, 10, 10).

-

Long Term Structures: Enable long-term structure lines (default: false).

-

Long Term Lines Style: Line style for long-term structures (default: Solid).

-

Long Term Labels: Show labels for long-term structures (default: false).

-

Long Term Bullish Color: Color for bullish long-term structure (default: RGB 49, 121, 245).

-

Long Term Bearish Color: Color for bearish long-term structure (default: RGB 158, 10, 10).

Oscillator Components

-

Short Term Oscillator: Display the short-term oscillator component (default: false).

-

Intermediate Term Oscillator: Display the intermediate-term oscillator component (default: false).

-

Long Term Oscillator: Display the long-term oscillator component (default: false).

Usage

The indicator plots a composite oscillator ranging from 0 to 100, with key levels at 15, 50, and 85 to indicate potential overbought or oversold conditions. The cycle histogram oscillates around the 50 level, highlighting momentum shifts. When enabled, chart objects (trend lines and labels) mark significant market structure events, helping users identify trend changes or continuations.