Bollinger Band Elmex

- Experts

- Olesia Lukian

- 버전: 1.43

- 업데이트됨: 4 5월 2025

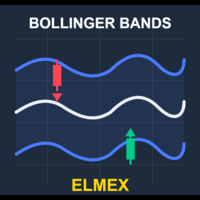

Introduction: Harnessing Statistical Volatility

Bollinger Bands, developed by John Bollinger in the 1980s, have become one of the most versatile technical indicators for identifying market volatility and potential reversal points. The indicator uses standard deviations to dynamically adjust band width based on recent price action, making it adaptive to changing market conditions.

This Expert Advisor implements a classic Bollinger Bands trading strategy that identifies price breakouts and potential reversals. By automating the process of detecting when price exceeds the statistical boundaries of recent volatility, this EA can capture profits from both range-bound markets and emerging trends.

Strategy Overview

The Elmex Bollinger Bands EA employs a systematic approach based on statistical price analysis:

-

Entry Rules:

- Buy Signal: When price closes below the lower Bollinger Band

- Sell Signal: When price closes above the upper Bollinger Band

-

Exit Strategy:

- Close Buy Position: When price crosses above the middle band or above the upper band

- Close Sell Position: When price crosses below the middle band or below the lower band

-

Risk Management:

- Multiple SL/TP calculation methods: Fixed Points, ATR-Based, or Percentage-Based

- Advanced trailing stop with customizable activation triggers and distance

- Multi-instrument monitoring and execution

- Pre-trade margin verification

- Symbol-specific risk controls

EA Parameters

Symbol Settings

- Multi-Symbol Mode: Option to trade multiple instruments simultaneously

- Symbol List: Define symbols to trade separated by semicolons (e.g., "EURUSD;USDJPY;GBPUSD")

Bollinger Bands Settings

- BB Period: Number of bars used for calculations (default: 20)

- Standard Deviation: Multiplier that determines band width (default: 2.0)

- Applied Price: Price type used for calculations (Close, Open, High, Low, etc.)

Stop Loss & Take Profit Settings

-

SL/TP Method: Choose between Fixed Points, ATR-Based, or Percentage-Based calculations

-

Fixed Take Profit: Target profit in points (when using Fixed Points method)

-

Fixed Stop Loss: Maximum acceptable loss in points (when using Fixed Points method)

-

ATR Period: Define lookback period for volatility calculation (default: 14)

-

ATR SL Multiplier: Set risk relative to market volatility (default: 1.5)

-

ATR TP Multiplier: Set profit targets relative to volatility (default: 2.5)

-

TP Percentage: Take profit as percentage of entry price (when using Percentage method)

-

SL Percentage: Stop loss as percentage of entry price (when using Percentage method)

Trailing Stop Settings

-

Use Trailing Stop: Enable or disable the trailing stop feature

-

Trailing Stop Method: Choose between Fixed Points, ATR-Based, or Percentage-Based calculations

-

TS Points Trigger: Minimum profit in points before trailing activates (Fixed Points method)

-

TS Points Distance: Distance in points to maintain between price and stop (Fixed Points method)

-

TS ATR Trigger: ATR multiplier for profit before trailing activates (ATR-Based method)

-

TS ATR Distance: ATR multiplier for distance between price and stop (ATR-Based method)

-

TS Percent Trigger: Profit percentage required before trailing activates (Percentage method)

-

TS Percent Distance: Percentage distance to maintain between price and stop (Percentage method)

Trade Parameters

- Lot Size: Fixed volume for each position

- Exit Strategy: Choose between Middle Line or Opposite Band for position exits

- Exit on Opposite Signal: Option to close positions when opposite signal appears

EA Identification

- EA Comment: Custom comment for trade identification

- Magic Number: Unique identifier for the EA's trades

Version History

- V1.0: Initial release with core Bollinger Bands strategy

- V1.2: Added ATR-based dynamic Stop Loss/Take Profit and Multi-Symbol Trading capabilities

- V1.41: Added flexible SL/TP toggle, exit on opposite signal option, and automatic broker compatibility

- V1.43: Added advanced trailing stop system with multiple calculation methods and customizable parameters

Past performance is not indicative of future results. Please test thoroughly on a demo account before live trading.

Very general model of incredible value, very happy to have gotten it for free. The multi asset feature is amazing, extremely useful