MR Volume POC Levels 5

- インディケータ

- Sergey Khramchenkov

- バージョン: 3.2

- アップデート済み: 15 3月 2023

- アクティベーション: 20

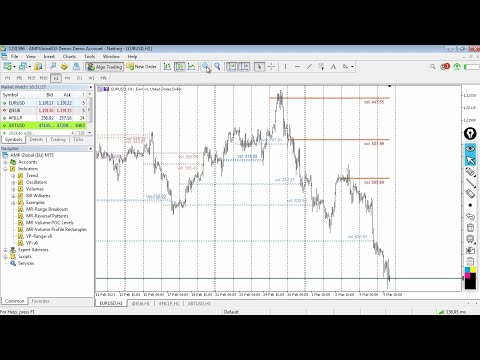

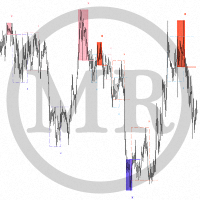

The idea of the indicator arose after the "MR Volume Profile Rectangles" indicator was made. When creating the "MR Volume Profile Rectangles" indicator, we spent a lot of time comparing the volumes with those from the volume profile in NinjaTrader 8 terminal with CQG datafeed. The settings of EURUSD-6E, GBPUSD-6B, AUDUSD-6A and other currency pairs were compared. After making sure that everything is working according to our requirements, we made the "MR Dynamic POC" indicator following the model used in NinjaTrader 8. Ultimately, we decided to take a step forward and create a new generation indicator that will track the actions of the "Big" players in the financial markets. This is how the "MR Volume POC Levels" indicator appeared. Over time, we further developed our idea...

Some of the most important benefits of the indicator are as follows:

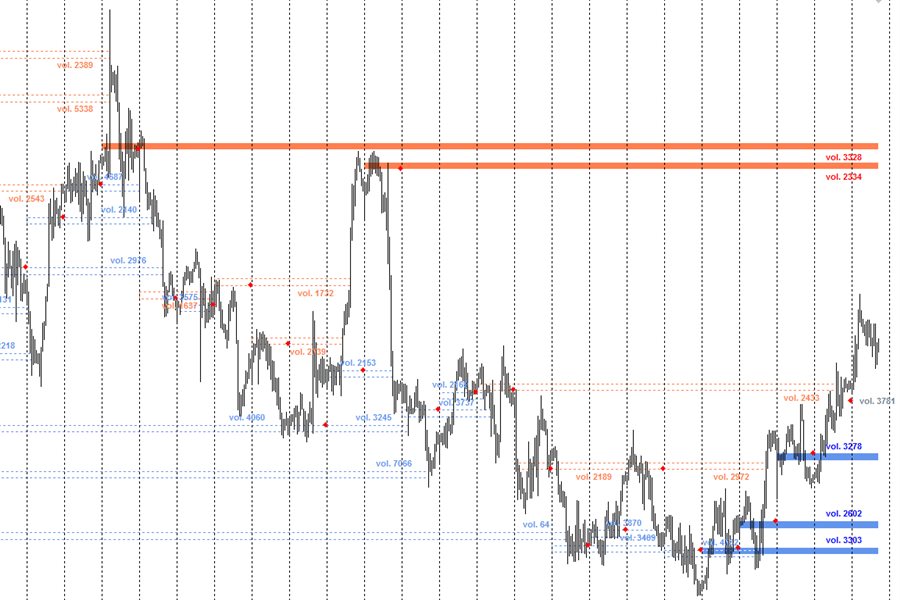

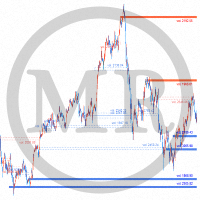

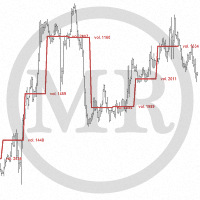

- Indicator shows the POC (Point of Control) volume levels for the selected period of time.

- "Point of Control" (POC) are not lines, they are zones.

- Which zones are relevant and which are not, is determined by the author's methodology.

- Using the indicator, you can track the actions of "Big" players in the market. At the extreme points of price movement (maximum, minimum), Market-Makers provide liquidity to "Big" players who change the direction of price movement.

- At Volume POC Levels there is always a reaction. Whether the price movement will reverse its direction is decided only by the "Big" players in the market.

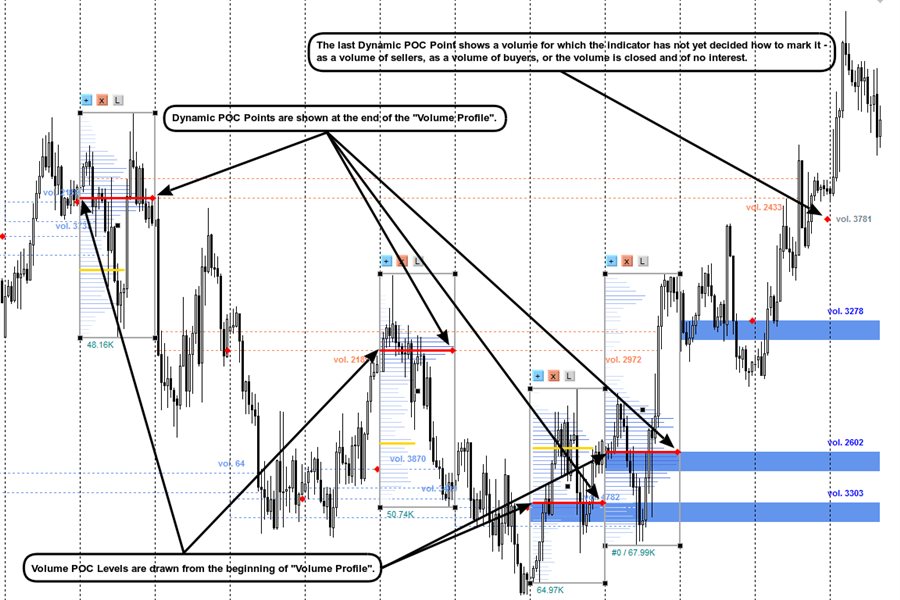

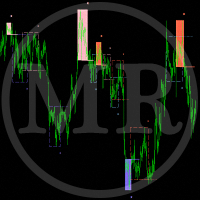

- The indicator shows "points" from the new concept of the "MR Dynamic POC" indicator. Dynamic POC points are shown from the end of the "Volume Profile".

- The last Dynamic POC Point (with gray text) shows a volume for which the indicator has not yet decided how to mark it - as a volume of sellers, as a volume of buyers, or the volume is closed and of no interest.

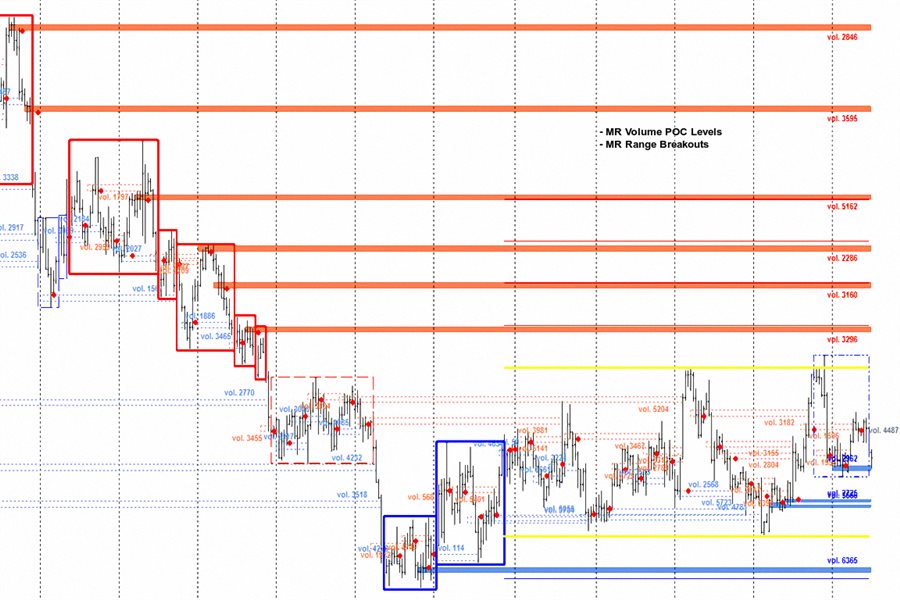

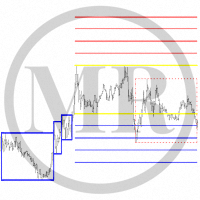

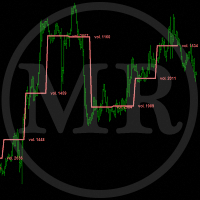

- In combination with the "MR Range Breakouts" indicator, you can see where important volumes are left after the exit from the "Balances" and "Ranges". In addition, you can see how the volumes are absorbed in the "Range" and accumulate positions of buyers and sellers.

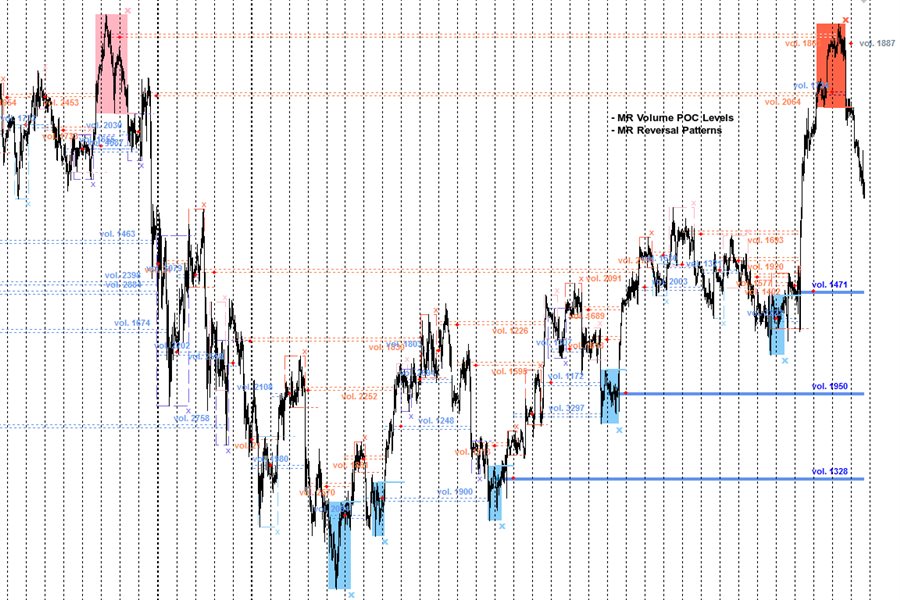

- In combination with the "MR Reversal Patterns" indicator, you can track key places where volumes are absorbed and then new volumes appear in the opposite direction.

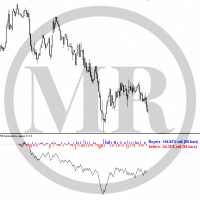

- In combination with the "MR Sentiments by volumes" indicator, you can see when the volumes are used in the direction of the price movement and when the true reversal of the price movement occurs.

- In combination with the "MR Trend Corrections" indicator, you can track the places where volumes are absorbed and accumulated. You will notice that in the "Impulse" movements, the volumes participate in the entrainment of the price movement in the direction of the "Impulse", and in the "Corrections" new places arise with volumes that keep the price movement in the range.

- "MR Volume POC Levels 5" is based on indicator "VP: Volume Profile v6.0. © FXcoder".

If you liked the indicator, please support our work by giving 5 stars!!!

For MetaTrader 4 https://www.mql5.com/en/market/product/63852

How to use indicators - Article

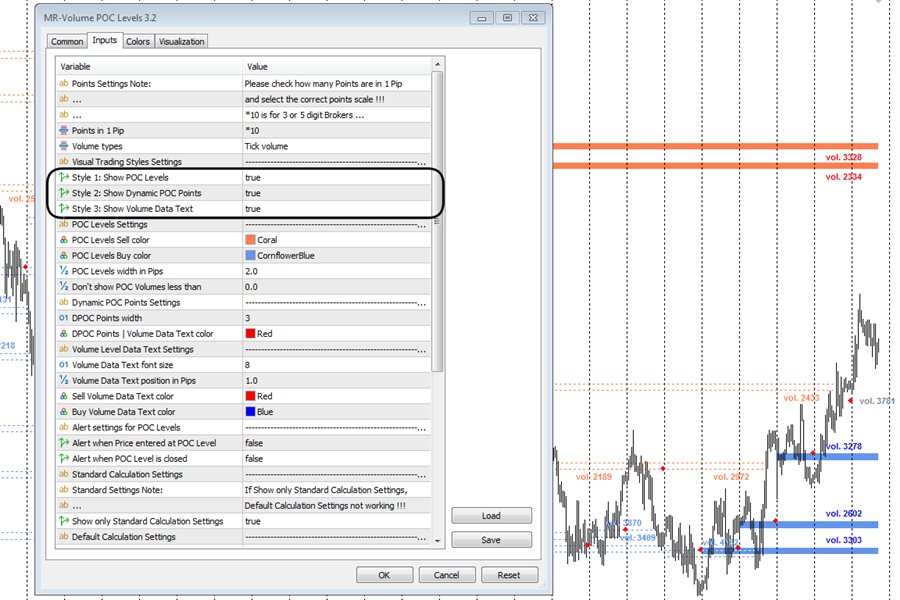

Indicator settings:

Points in 1 Pip - Offers you a choice of the number of Points in 1 Pip.

Volume types - Offers you a choice to use tic volumes or real volumes. Note: To use real volumes, your Broker must provide them in the MetaTrader terminal.

Section "Visual Trading Styles Settings"

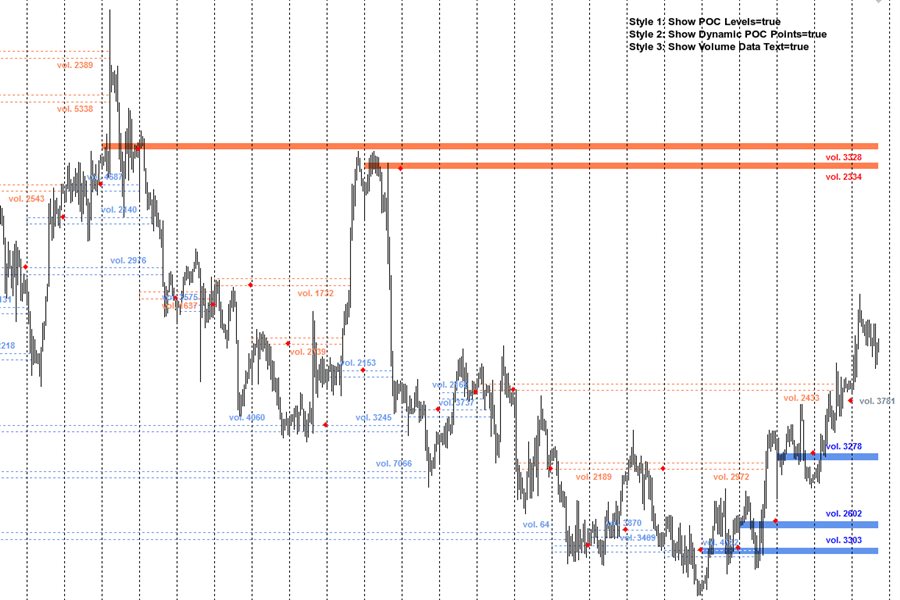

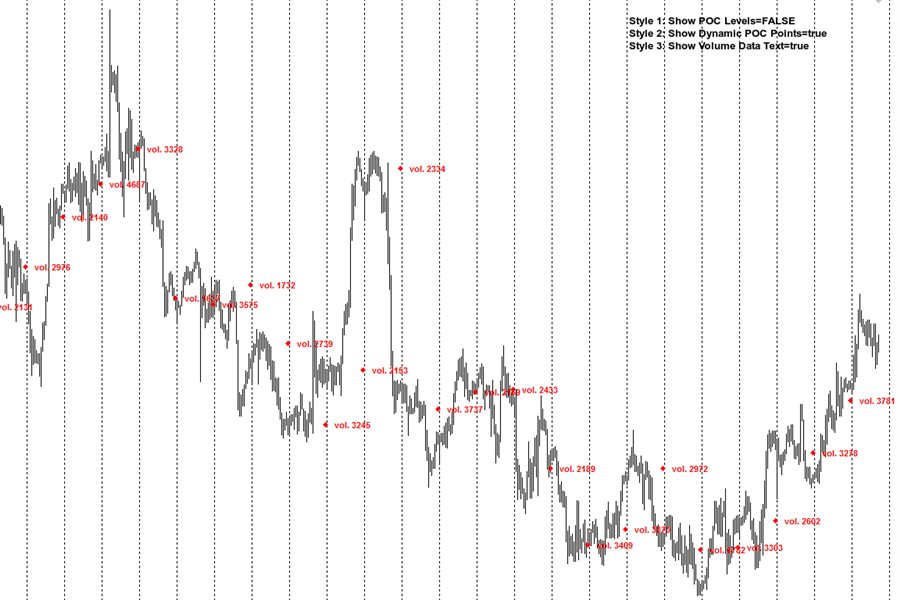

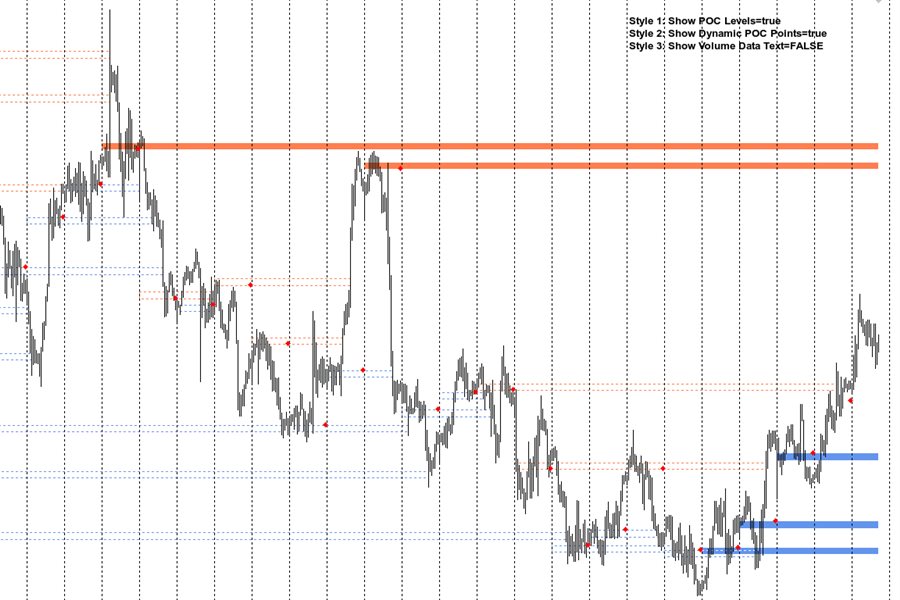

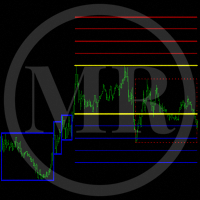

Style 1: Show POC Levels - Shows or not Volume POC Levels. If the option is turned off, the option to show Dynamic POC Points is turned on by default.

Style 2: Show Dynamic POC Points - Shows or not Dynamic POC Points.

Style 3: Show Volume Data Text - Shows or not to display text with information about the amount of volumes for the POC level.

Section "POC Levels Settings"

POC Levels Sell color - Background color of POC Levels for Sell.

POC Levels Buy color - Background color of POC Levels for Buy.

POC Levels width in Pips - Specifies the width of the zone for POC levels in pips.

Don't show POC Volumes less than - Filter to show or hide POC levels less than the specified amounts. When selected "0" displays all POC levels.

Section "Dynamic POC Points Settings"

DPOC Points width - Specifies the size of Dynamic POC Points.

DPOC Points | Volume Data Text color - Specifies the color of Dynamic POC Points and data text.

Section "Volume Level Data Text Settings"

Volume Data Text font size - You can choose the data text size.

Volume Data Text position in Pips - Position for displaying data text in pips.

Sell Volume Data Text color - Data text color for Sell.

Buy Volume Data Text color - Data text color for Buy.

Section "Alert settings for POC Levels"

Alert when Price entered at POC Level - Alert when price entered at POC Level.

Alert when POC Level is closed - An alert occurs when the price closes the POC level.

Section "Standard Calculation Settings"

Show only Standard Calculation Settings - Enables or disables the default settings. If show only Standard calculation settings, Default calculation settings not working.

Section "Default Calculation Settings"

Default Number of Bars to calculate - Default number of Bars to calculate indicator.

Default Volume Choice - You choose the volumes from which time frame to display on all lower time frames.

Section "Standard Bars Calculation Settings"

MN - Number of Bars to calculate - The number of monthly Bars to calculate the indicator.

W1 - Number of Bars to calculate - The number of weekly Bars to calculate the indicator.

D1 - Number of Bars to calculate - The number of daytime Bars to calculate the indicator.

H4 - Number of Bars to calculate - The number of 4 hour Bars to calculate the indicator.

H1 to M1 - Number of Bars to calculate - The number of Bars to calculate the indicator from a time frame lower than 4 hours.

Section "Standard Volume Choice"

In this section, you choose on which time frame to display the volumes of the time frame you have chosen for it...

On D1 show Volumes from - W1

On H4 show Volumes from - D1

On H1 show Volumes from - D1

On M30 show Volumes from - H4

On M15 show Volumes from - H4

On M5 show Volumes from - H4

On M1 show Volumes from - H1