Capital Abandoned Currencies and Fled to Gold — A Week When the Market Clearly Showed Its “Safe Haven”

Capital Abandoned Currencies and Fled to Gold —

A Week When the Market Clearly Showed Its “Safe Haven”

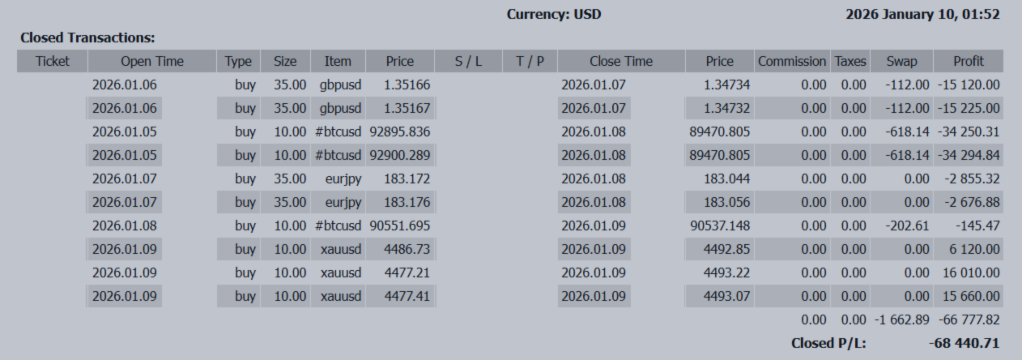

📊 Trading Results (Jan 5 – Jan 9)

Weekly P/L: -68,440 USD

This was not a week to “read currencies.”

It was a week to watch where money was escaping to.

And the answer was simple.

Capital was moving decisively into GOLD.

While FX, equities, and crypto were all hesitating, only gold functioned consistently as a true safe zone.

🧠 The Biggest Lesson This Week

Before the market shows direction,

it first shows where to hide.

There was no reason to buy risk assets.

It was clearly a “do not touch” environment.

Yet one asset alone kept giving the correct signal: Gold.

-

Currencies: unstable

-

Stocks: no direction

-

Crypto: capital outflows

-

GOLD: consistent inflows

This was not a week to ask,

“Which asset should I buy?”

but rather,

“Where is money running away from?”

🌍 The Market’s Real Message

Global markets are entering the next phase.

-

United States: Fewer reasons to cut rates

-

Japan: Fewer reasons to raise rates

This combination is powerful:

-

Strong dollar

-

Weak yen

-

Gold chosen as a substitute for cash

This week, that structure appeared in its purest form.

💴 The Atmosphere in FX Markets

USD/JPY looks like it is moving,

but in reality, it is trading after the direction has already been decided.

Japan faces:

-

Fiscal instability

-

Declining real wages

The U.S. faces:

-

Prolonged high interest rates

The idea that

“there is no reason to hold yen”

has already become a market premise.

FX is no longer driven by news.

It is being driven by structure.

🪙 The Reality of Each Currency

Euro

-

No longer a leading currency

-

Cannot move on its own

Pound

-

Powerful but unstable

-

Has both explosive upside and collapse risk

Canadian Dollar

-

Disadvantaged by geopolitics and commodities

-

The weakest position among commodity currencies

Australian Dollar

-

The only one still holding the “interest rate” weapon

-

Relatively stable

🔥 The True Main Character: CPI

The next real move will come

the moment U.S. CPI is released.

This is not just inflation data.

It is:

“The number that draws the map for 2026.”

If CPI is strong:

-

Rates will not fall

-

Stronger USD

-

Weaker JPY

-

Even stronger GOLD

If CPI is weak:

-

Temporary dollar selling

-

But the yen will not become strong

🧭 How to Fight From Here

This is not a phase to aim for victory.

It is a phase to survive.

-

Avoid aggressive FX trading

-

Keep positions light until trends are born

-

Treat gold as a separate category

-

Put crypto in full defense mode

🧨 Conclusion

This was not a losing week.

It was a week that taught us

where the minefield is.

The market is telling us:

-

Don’t fight in currencies

-

Don’t dream in equities

-

First, watch where capital is evacuating

And right now, that answer is crystal clear:

GOLD.

Next week is the entrance where a quiet market may shift into a real trend.

📜 Afterword

What Garlic and Honey Teach Us About Trading

Thank you, as always, for reading this FX Weekly Report.

Garlic and honey have long been known as a combination that “balances the body.”

Garlic is strong, antibacterial, and aggressive.

Honey is gentle, soothing, and stabilizing.

Opposites, yet together they create harmony.

This is exactly how we should face the market.

📊 Strength and Gentleness Create Stability

Trading requires:

-

The courage to attack (enter trades)

-

The calm to defend (stop-loss and risk control)

Garlic alone is too strong.

Honey alone never moves forward.

Survival belongs to those who can switch naturally

between attack and defense.

🧠 The Greatest Enemy: “Chronic Inflammation”

In medicine, chronic inflammation destroys the body.

In trading, it is:

-

Oversized positions

-

Emotional trading after losses

-

Constant impatience

This is mental “chronic inflammation.”

More than winning or losing,

what matters is whether you can stay calm and stable.

☕ Food for the Body, Rules for the Mind

Garlic and honey are not medicine.

They are daily adjusters.

Trading is the same.

Not secret strategies, but:

-

Money management

-

Entry conditions

-

Exit rules

These daily structures build long-term stability.

To keep winning is not about talent.

It is about having a system that does not destroy you.

Just as we care for our bodies with food,

we must care for our minds with rules.

Next week,

carry garlic’s decisiveness

and honey’s self-control,

and face the market quietly, calmly, and at your own pace.