💹 +79,597 USD | Jackson Hole Is the Biggest Risk! Winning Plan for Next Week

💹 +79,597 USD | Jackson Hole Is the Biggest Risk! Winning Plan for Next Week

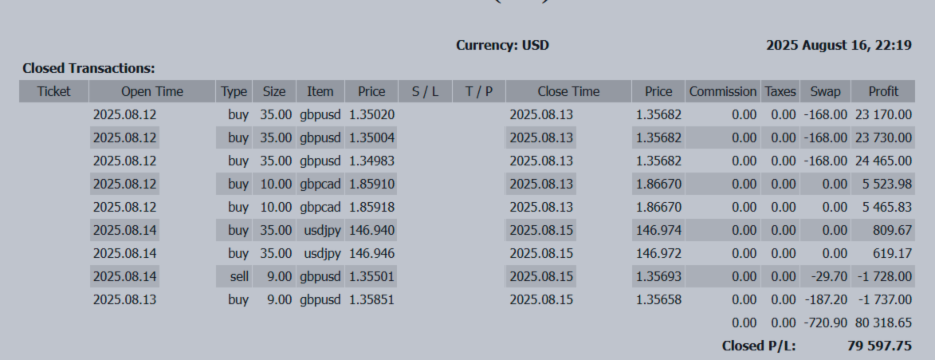

Period: August 11–15, 2025

📈 Trading Results

- Weekly Total: +79,597 USD

- Main Profit Drivers: Gains from GBP pairs (GBP/USD, GBP/CAD)

- Loss/Profit Factors:

USD/JPY surged on strong US PPI → Dollar buying spike → Then plunged after Japan GDP beat expectations.

Missed locking in large unrealized gains, but still ended the week with a solid profit.

🌍 Key Market Events to Watch (Week of Aug 18)

- Top Event: Aug 22 – Jackson Hole Symposium (Powell, Fed Chair, speech)

- US: Aug 20 – FOMC July Meeting Minutes

- Eurozone: Aug 19 – Final CPI; Aug 22 – Flash PMIs

- UK: Aug 21 – CPI; Aug 22 – Retail Sales

- Australia: Aug 20 – RBA Meeting Minutes; Aug 21 – Inflation Expectations

- Canada: Aug 20 – CPI

- Other: Keep close watch on crude oil and China’s economic trends

💱 Tactical Guide by Currency Pair (Week of Aug 18)

| Pair | Strategy Overview | Short-Term Range |

|---|---|---|

| USD/JPY | Buy on dips near 147.50; reduce lot size before major events. If US yields keep rising, a test of 150.00 possible. | 146.50–149.50 |

| EUR/USD | Sell on rallies toward 1.1650–70; if PMIs worsen, aim for break below 1.16. Buy dips only below 1.1550. | 1.1550–1.1700 |

| GBP/JPY | Buy dips in low 197s; take profit near 200.00. Direction hinges on CPI outcome. | 196.50–200.50 |

| CAD/JPY | Bearish bias below 107.00; sell rallies into 108s. Oil rebound could offer support. | 106.00–108.50 |

| AUD/JPY | Sell rallies in high 96s; break below 95.50 could accelerate selling. Mid-term upside likely limited. | 94.50–97.00 |

📝 Strategy Summary

- USD/JPY: Keep positions light before key events; if US data disappoints, 145s come into play.

- EUR/USD: Sell on strength; short-term rebounds possible depending on data.

- GBP/JPY: UK CPI & Retail Sales will set tone; 200.00 remains a cap.

- CAD/JPY: Watch CPI and oil; lean toward selling rallies.

- AUD/JPY: Selling rallies remains the base case; sensitive to external factors.

📌 Afterword

This week brought significant market moves. When tracking charts and news for hours, it’s easy to stay glued to the desk — but remember, it’s your eyes taking the constant strain.

While FX prices can change in seconds, eye health is preserved only through consistent daily care. Research suggests that foods rich in lutein, zeaxanthin, omega-3 fatty acids, vitamins A, C & E, and zinc can protect the retina and lens from oxidative stress, helping slow age-related vision decline.

Among the most accessible options: fish, eggs, almonds, dairy, carrots, kale, and oranges — all easy “eye allies.” For traders spending long hours in front of monitors, this nutritional “portfolio” is as important as a trading strategy.

In both markets and health, preparation is everything. Let’s chase numbers and charts next week, but also keep our bodies — and our vision — in top shape.