💹 +81,702 USD Will the Dollar Hold Up? U.S. Jobs Data & Nuclear Submarine Tensions Stir the Market

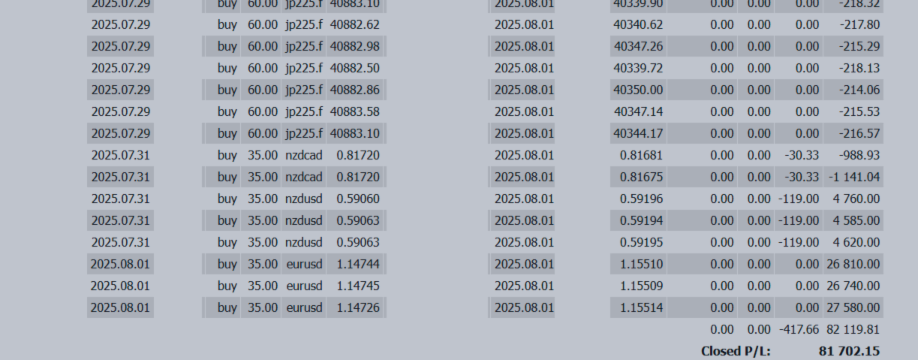

💹 +81,702 USD Profit

Weekly FX Review (Aug 1st week) & Market Outlook

Title: Will the Dollar Hold Up? U.S. Jobs Data & Nuclear Submarine Tensions Stir the Market

✅ Weekly Trading Summary

This week’s market was dominated by a dollar-driven trend fueled by easing trade-related risks and key U.S. economic indicators.

At the start of the week, risk-on sentiment prevailed as the U.S. and Europe reached a trade agreement, pushing equities and forex markets higher. Unfortunately, I couldn’t fully ride that early momentum and found myself slightly behind the curve.

However, the tide turned on Friday when the U.S. nonfarm payrolls came in below expectations, triggering a dollar selloff. I took advantage of this move by entering a dip-buying position in EUR/USD, which ended up securing the week's profits.

That said, geopolitical risk is still simmering under the surface—especially after the Trump administration’s decision to deploy nuclear submarines. Markets are not entirely in risk-on mode, and caution remains warranted.

🔍 Key FX Drivers to Watch (Week of August 4, 2025)

💵 USD/JPY

- FOMC and BoJ meetings behind us; policy stance now clearer

- Watch for U.S. ISM Non-Manufacturing (Aug 5) and Productivity Data (Aug 7)

- Japan’s political scene may heat up with LDP General Assembly (Aug 8) – possible leadership shift

▶ Range Outlook: 148.50–151.50

💶 EUR/USD

- Concerns linger over how the US-EU trade deal will impact Germany’s auto industry

- ECB rate cut expectations have eased, but economic sentiment remains weak

- U.S. long-term yields will continue to influence euro direction

▶ Range Outlook: 1.1350–1.1550

💷 GBP/JPY

- A 0.25% BOE rate cut is widely expected

- Focus on MPC minutes and voting split (esp. Pill’s stance)

- Overall macro uncertainty could keep GBP capped

▶ Range Outlook: 191.50–194.00

🇨🇦 CAD/JPY

- U.S.-Canada ties strained again over Palestine recognition

- Trade balance and jobs data will be key; oil volatility also a factor

- If rate cut bets rise, CAD may weaken

▶ Range Outlook: 109.00–111.80

🇦🇺 AUD/JPY

- CPI slowdown has led markets to price in an August RBA rate cut

- Highly sensitive to U.S. rates and Chinese data; favor selling rallies

▶ Range Outlook: 95.20–97.50

📝 Strategy Notes for the Week Ahead

USD/JPY remains supported by monetary divergence and domestic political risks. Still, any breach above 150 could trigger profit-taking.

EUR/USD and GBP/JPY remain vulnerable to rallies amid weak economic outlook and dovish central bank bias—fade the bounce.

Commodity currencies (AUD, CAD) face triple pressures from oil, China, and trade tensions. Approach with caution.

✅ Weekly FX Strategy Table (Aug 4 Week)

| Pair | Approx. Price | Support | Resistance | Technical Trend | Strategy Summary |

|---|---|---|---|---|---|

| USD/JPY | 149.80 | 148.50 | 150.00 | Bullish trend | Buy the dips; watch for breakout on strong U.S. data or geopolitics |

| EUR/USD | 1.1450 | 1.1400 | 1.1550 | Range-bound/weak | Sell rallies amid weak EU outlook and strong USD bias |

| GBP/JPY | 199.80 | 198.80 | 200.50 | Mildly bullish | Neutral to buy dips depending on BOE reaction and USD flows |

| CAD/JPY | 110.30 | 109.40 | 111.00 | Triangle pattern | Consider mean-reversion trades near edges of range |

| AUD/JPY | 98.90 | 98.30 | 99.50 | Bearish bias | Sell the bounce; watch for rate cut confirmation from RBA |

🧭 Market Takeaways

- USD/JPY remains firm: Watch for resistance at 150. A strong U.S. PCE or geopolitical tensions could fuel another rally.

- EUR & GBP capped: Economic concerns and dovish central banks weigh on upside potential.

- Commodity currencies volatile: Sensitive to oil, China, and U.S. trade moves.

🧠 Afterword: The Power of Monotasking – In Markets and Life

In the fast-paced world of trading, it's easy to slip into multitasking without realizing it—watching charts while checking social media, researching news while entering trades, even eating lunch while managing positions.

But recent research reminded me of this truth: “More distraction equals more mistakes.”

A 2023 randomized study showed that constant multitasking increases stress, impairs focus, and may reduce long-term well-being—even if short-term adaptation appears possible.

That’s why now, more than ever, we need to practice monotasking—the art of doing one thing at a time.

Whether it's “just watching the chart for 5 minutes” or “committing full attention to a single trade,” small habits matter. Even cooking, reading, walking, or cleaning can serve as monotasking drills.

Focus isn’t about time; it’s about the quality of attention.

In trading and in life, we must consciously choose where our attention goes. That one extra moment of awareness may prevent costly losses—and help us live and trade with greater clarity.

This week reminded me to refine not just my strategy, but the way I engage with the market.