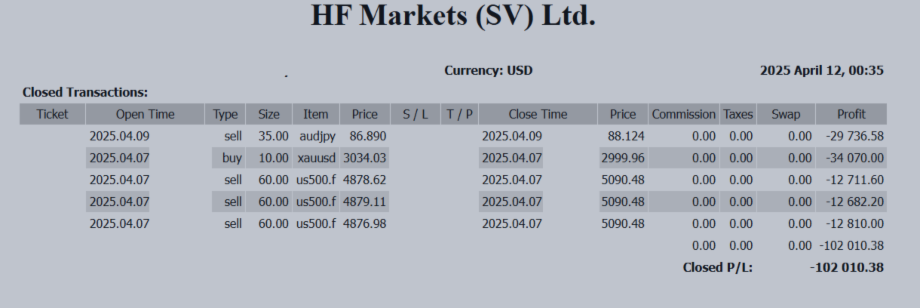

- $102,010 – “Entering the Trade Regime Phase” — US-Japan Negotiations Set to Shape FX Trends -

📈 Weekly Forex Outlook (Week of April 14, 2025)

- $102,010 – “Entering the Trade Regime Phase” — US-Japan Negotiations Set to Shape FX Trends -

📆 Key Economic Events (JST)

| Date | Indicator / Event | Impacted Currency |

|---|---|---|

| Tue, Apr 15 | RBA Meeting Minutes, Canada CPI | AUD, CAD |

| Wed, Apr 16 | UK CPI, BoC Rate Decision, South Africa Retail Sales, NZ Trade Balance | GBP, CAD, ZAR, NZD |

| Thu, Apr 17 | Japan Trade Balance, US-Japan Trade Talks, Australia Jobs Report, ECB Meeting | JPY, AUD, EUR |

| Fri, Apr 18 | Japan CPI, NZ Q1 CPI | JPY, NZD |

🔍 Currency Outlooks & Key Drivers

USD/JPY (Dollar / Yen)

Outlook: U.S.-Japan trade negotiations are the primary focus.

Key Drivers: Japan’s trade surplus, CPI data, and Trump’s dollar-weakening stance.

EUR/USD (Euro / Dollar)

Outlook: Upward pressure led by dollar weakness, though capped by ECB rate cut expectations.

Key Drivers: ECB meeting, German ZEW Sentiment Index, Eurozone inflation outlook.

GBP/JPY (Pound / Yen)

Outlook: Sensitive to inflation and jobs data. Seasonally strong in April.

Key Drivers: UK CPI, unemployment rate, and IMF’s growth downgrade.

CAD/JPY (Canadian Dollar / Yen)

Outlook: BoC meeting in focus. Watch for risks tied to U.S.-Canada trade tensions and the April 28 elections.

Key Drivers: Canada CPI, BoC policy statement, election-related headlines.

AUD/JPY (Australian Dollar / Yen)

Outlook: RBA policy and U.S.-China relations remain pivotal. Market remains unstable.

Key Drivers: RBA minutes, Australian jobs data, Chinese economic indicators.

ZAR/JPY (South African Rand / Yen)

Outlook: Political instability and worsening U.S. ties are weighing on sentiment. Rebound potential is limited.

Key Drivers: Retail sales, ruling party split risks, U.S.-South Africa tension coverage.

✅ Weekly Summary: Strategy Guidelines

📌 1. Risk-Averse Mode Still in Play

→ Tariff tensions and trade negotiations continue to drive volatility risk.

📌 2. Watch Central Bank Actions Closely

→ ECB, BoC, RBA meetings in focus. Surprise policy shifts could drive sharp moves in cross currencies.

📌 3. Short-Term Trades Preferred Amid Data Gaps

→ Fundamentals remain too weak for sustainable breakouts. Favor short-term range trading and event-driven strategies.

📝 Afterword:

"In both markets and nutrition, what’s inside matters more than how it looks."

This past week, the FX market was heavily influenced by the headlines — economic data, policy remarks, and geopolitical tensions. But as we’ve seen, a seemingly positive announcement often hides risks beneath the surface.

This reminded me of a different world where appearances can be deceiving: eggs.

🐔 Are Free-Range Eggs Really Healthier?

When we see "free-range" on an egg carton, we’re naturally inclined to think they’re healthier. However, studies show nutritional value depends more on the hen’s feed than the farming method.

For example, eggs rich in omega-3 or vitamin D often come from hens fed with nutrient-enhanced diets — not necessarily from being free-range.

💰 Expensive Doesn’t Mean Nutritious

Price isn’t a reliable indicator either. Higher prices often reflect the cost of production and labeling, like “organic” or “free-range,” rather than actual nutritional content.

Consumers are also swayed by appearance — yolk color, egg size, and packaging often drive buying decisions more than actual health benefits.

🧘♂️ The Market, Like Eggs, Requires Depth of Understanding

This egg analogy really mirrors the FX market. Just like with eggs, traders must look beyond the surface — flashy chart patterns or dramatic headlines — and dig into fundamentals and context to make smart decisions.

It’s not about “expensive = good” or “label = safe.” It’s about what’s inside, the drivers behind the move, and how it was formed.

Whether trading or grocery shopping, the ability to assess the true quality beneath the surface leads to wiser choices.

Let’s keep that in mind and approach next week’s trades without being swayed by appearances. Stay focused on the essentials and trade with clarity.

Wishing you a restful weekend! 🐣