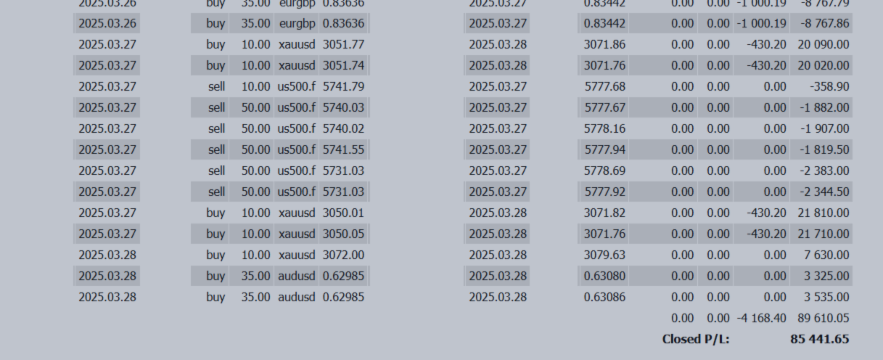

+$85,441 | March 24–28 Weekly Recap "Warning: Explosive Volatility in USD/JPY Driven by Auto Tariff Risk"

こちらが英訳です:

+$85,441 | March 24–28 Weekly Recap

"Warning: Explosive Volatility in USD/JPY Driven by Auto Tariff Risk"

🔭 [FX Outlook: Week of March 31, 2025]

■ USD/JPY

Trend: Rally Pauses – High Volatility Expected Amid Tariffs & Key U.S. Data

-

April 2: Expected imposition of U.S. auto tariffs on China → Retaliation risk may trigger yen buying

-

April 4: U.S. Non-Farm Payrolls and ISM Services → Surprise results may lead to one-directional moves

-

Technical note: Resistance remains in the high 150s. Sustained move into the 151s possible on data-driven momentum

📌 Key Events:

-

ISM Manufacturing (Apr 1)

-

ADP Employment Report (Apr 2)

-

ISM Services (Apr 3)

-

Non-Farm Payrolls (Apr 4)

-

Auto Tariff Activation (Apr 2)

■ EUR/USD

Trend: Capped Range as ECB Rate Cut Expectations Grow

-

Disagreements emerging within the ECB between dovish and cautious members

-

If Eurozone PMI revisions in early April disappoint, break below 1.07 may come into view

📌 Key Events:

-

Finalized Eurozone PMIs (Apr 1 & Apr 3)

-

ECB commentary

-

German and French economic indicators

■ GBP/JPY

Trend: Growth Downgrades Weigh on Pound; Uncertainty Remains

-

UK OBR spring outlook highlighted slower growth & sticky inflation

-

While May rate cut expectations weigh, CPI rebounds or strong PMIs could trigger short-covering

📌 Key Events:

-

UK Final PMIs

-

OBR Economic Outlook

-

BOE’s monetary policy tone

■ CAD/JPY

Trend: Pressured by U.S. Tariffs & Stalling Oil Prices

-

Focus on impact to Canadian auto exports

-

Retaliation from Canada and political risks ahead of the April 28 general election are in view

📌 Key Events:

-

U.S. auto tariffs and implications for Canadian economy

-

Retaliation risk and trade stance

-

Canadian election developments (Apr 28)

■ AUD/JPY

Trend: RBA Decision Looms – Policy Clarity May Spark Volatility

-

RBA expected to hold rates due to easing inflation, but a hawkish tone may fuel AUD buying

-

Early budget announcements or U.S. tariffs could act as additional catalysts

📌 Key Events:

-

RBA Meeting (Mar 31–Apr 1)

-

Inflation forecasts and tone

-

U.S. tariff effects on sentiment

■ ZAR/JPY

Trend: Downside Risk Persists Due to Tariff Concerns and U.S.-South Africa Tensions

-

U.S.-South Africa relations deteriorating; aid suspension & land policy disputes weigh on sentiment

-

U.S. retaliation tariffs may activate on Apr 2, adding to pressure on risk assets like ZAR

📌 Key Events:

-

South Africa Feb Trade Balance

-

U.S.-South Africa diplomatic updates

-

Retaliatory tariff decisions (Apr 2)

📌 Summary:

The first week of April is packed with market-moving events: tariffs, ISM releases, and U.S. jobs data.

Expect heightened short-term volatility. Proper position sizing and stop-loss management are key.

📘 [Afterword] As a Trader – and as a Parent: Don't Ignore Subtle "Warnings" From Your Child

This week brought plenty of market volatility again – rate hike speculations for the dollar, Eurozone recession fears, and ongoing geopolitical risks in the Middle East.

Yet, no matter how wild the market gets, the most important thing remains: the health of those closest to us. Especially for parents, noticing the small signs children give when something isn’t quite right is an irreplaceable judgment call.

👧 A Mother’s Instinct: It Wasn’t Just “Growing Pains”…

It started on a cold winter day when a 4-year-old girl began saying her neck and knees hurt. Since she was otherwise cheerful and active, her parents initially thought it might be a strained muscle or simply growing pains.

But the pain worsened. One day, she couldn’t even climb stairs.

After multiple tests, doctors began suspecting juvenile idiopathic arthritis (JIA).

It took MRIs, bloodwork, and consultations with rheumatology specialists. Throughout it all, one thing remained clear: the mother trusted her intuition.

🧠 Whether Markets or Children – It’s the Unseen Signs That Matter Most

Trading is similar in many ways. Even when everything looks fine on the surface, hidden shifts can be brewing. Spotting those subtle signs is key.

On a chart, they appear as “distorted prices” or “unusual volume.” For a child, it may be minor pain or subtle changes in behavior.

📌 See a Doctor Immediately If These Symptoms Appear

-

Morning stiffness or joint swelling

-

Pain without injury / refusal to walk

-

Redness, fever, or stiffness in joints

-

Pain that lasts or frequently shifts

These may not be “just growing pains,” but signs of immune or inflammatory conditions.

A parent’s intuition is a vital fundamental.

🌿 If You Sense Something’s Off – Take Action

Even with advanced medicine, early detection often lies in the hands of family.

If your child or someone close to you seems "off" or is moving differently, don’t hesitate – get a professional opinion early.

💬 In Closing…

As traders, we analyze risk and time our moves every day. But beyond the charts, it’s even more vital to recognize the subtle signs that matter most in life.

In this week’s afterword, we focused on unseen risks — both in the market and at home.

Let’s stay sharp, both with our trades and with our loved ones’ well-being.

Wishing you a healthy and fulfilling week ahead.