Boom Crash Divergence Tool

- Indicatori

- Stephen Muriithi Muraguri

- Versione: 1.0

An MT5 divergence scanner that automatically finds divergence / hidden divergence between price and a chosen oscillator, then draws the matching trendlines/channels in the indicator window and can alert you when the line is crossed.

Key features (simple)

-

Auto Divergence Detection

-

Bullish divergence: price makes a lower low while oscillator makes a higher low (possible reversal up).

-

Bearish divergence: price makes a higher high while oscillator makes a lower high (possible reversal down).

-

-

Hidden divergence (called “convergence” in settings)

-

Finds continuation-style setups (useful for trend trading).

-

-

Works with many oscillators

-

RSI (default), MACD, Stochastic, CCI, Momentum, ADX, ATR, AO/AC, OBV, etc.

-

-

Clear visuals

-

Draws trendlines and optional channels (parallel / regression / std-dev channel).

-

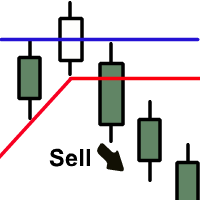

Shows buy/sell arrows on detected swing points.

-

-

Noise reduction

-

Uses T3 smoothing on the oscillator line to reduce false pivots on volatile markets (handy for Boom/Crash).

-

-

Alerts

-

Popup, push notification, email, sound, optional external program launch, plus optional advanced alerts (Telegram/Discord/etc via DLL).

-

-

Performance controls

-

Limits bars processed to keep the indicator fast.

-

How it works (logic overview)

-

Calculates the selected oscillator (or selected price source).

-

Applies T3 smoothing to produce a cleaner oscillator curve.

-

Detects swing highs/lows using “left/right strength” (how many bars on each side must be lower/higher).

-

Compares recent swings:

-

For regular divergence and hidden divergence

-

-

Draws trendlines/channels for the detected setups and optionally triggers alerts when the line is crossed.

Note: swing points are confirmed only after the “right-side” bars are complete, which helps reduce noise.

Oscillator selector (Osc)

Use Osc to choose what the tool compares against price:

1 AC, 2 AD, 3 ADX, 4 ATR, 5 AO, 6 BearsPower, 7 BullsPower, 8 CCI, 9 DeMarker, 10 Force, 11 Momentum, 12 MFI, 13 MACD, 14 MAO, 15 OBV, 16 RVI, 17 StdDev, 18 Stochastic, 19 Volume, 20 Close, 21 Open, 22 High, 23 Low, 24 (H+L)/2, 25 (H+L+C)/3, 26 (H+L+2C)/4, 27 (O+C+H+L)/4, 28 (O+C)/2, 29 RSI, 30 RBCI, 31 FTLM, 32 STLM, 33 JRSX, 34 RSI, 35 Williams %R.

Inputs (parameters) — with plain-English descriptions

A) Core detection

-

Osc (int, default: 29) — Which oscillator/source to use for divergence (see list above).

-

TH (bool, default: true) — Enable high-side (bearish) divergence checks.

-

TL (bool, default: true) — Enable low-side (bullish) divergence checks.

-

trend (bool, default: true) — Draw basic oscillator trendlines (not only divergence).

-

convergen (bool, default: true) — Enable hidden divergence detection.

-

Complect (int, default: 1) — Visual set/slot used in object names & styling (helps separate drawings).

-

_qSteps (int, default: 1) — How many “recent setups” to draw/scan (max 3).

-

_BackSteph (int, default: 0) — Skip this many swing points back before starting (highs).

-

_BackStepl (int, default: 0) — Skip this many swing points back before starting (lows).

-

BackStep (int, default: 0) — One value to override both back-step settings above.

B) Swing-point (pivot) sensitivity

-

LevDPl (int, default: 5) — Left-side strength: bars to the left that must confirm a swing point.

-

LevDPr (int, default: 1) — Right-side strength: bars to the right that must confirm a swing point.

-

LeftStrong (bool, default: false) — If true , equal-values on the left are treated as “strong” (fewer duplicate pivots).

-

RightStrong (bool, default: true) — If true , equal-values on the right are treated as “strong”.

C) Indicator calculation settings

-

period (int, default: 8) — Main period used by many oscillators (and RSI used for alerts).

-

applied_price (int, default: 4) — Price type used by some indicators (commonly Close).

-

mode (int, default: 0) — Buffer/line index for multi-line indicators (example: MACD line vs signal).

-

ma_method (ENUM_MA_METHOD, default: MODE_SMA) — MA method used by some calculations (e.g., StdDev).

-

ma_shift (int, default: 0) — MA shift used by some calculations.

MACD-only

-

fast_ema_period (int, default: 12) — MACD fast EMA.

-

slow_ema_period (int, default: 26) — MACD slow EMA.

-

signal_period (int, default: 9) — MACD signal SMA/EMA period.

Stochastic-only

-

Kperiod (int, default: 13) — %K period.

-

Dperiod (int, default: 5) — %D period.

-

slowing (int, default: 3) — Slowing factor.

-

price_field (ENUM_STO_PRICE, default: 0) — Price field for Stochastic.

Smoothing

-

T3_Period (int, default: 1) — T3 smoothing length (higher = smoother).

-

b (double, default: 0.7) — T3 smoothing factor (controls smoothness/lag).

D) Drawing options (look & behavior)

-

TrendLine (bool, default: true) — Master switch for drawing the lines.

-

Trend_Down (bool, default: true) — Show downtrend/bearish-side drawings.

-

Trend_Up (bool, default: true) — Show uptrend/bullish-side drawings.

-

HandyColour (bool, default: true) — Auto-color lines based on setup/step.

-

Highline (color, default: Red) — Manual color for high-side lines (if auto-color off).

-

Lowline (color, default: DeepSkyBlue) — Manual color for low-side lines (if auto-color off).

-

ChannelLine (bool, default: true) — Draw a parallel “channel” style line.

-

Trend (int, default: 0) — Direction filter: 1 only up, -1 only down, 0 both.

-

Channel (bool, default: false) — Use a classic channel object style.

-

Regression (bool, default: false) — Use regression channel mode.

-

RayH (bool, default: true) — Extend high-side channel/line to the right.

-

RayL (bool, default: true) — Extend low-side channel/line to the right.

-

ChannelH (color, default: Red) — High-side channel color.

-

ChannelL (color, default: DeepSkyBlue) — Low-side channel color.

-

STDwidthH (double, default: 1.0) — StdDev channel width (high-side).

-

STDwidthL (double, default: 1.0) — StdDev channel width (low-side).

-

Back (int, default: -1) — Reserved/legacy parameter (not essential for normal use).

-

code_buy (int, default: 159) — Wingdings code for the “buy” arrow symbol.

-

code_sell (int, default: 159) — Wingdings code for the “sell” arrow symbol.

E) Performance

-

_showBars (int, default: 1000) — Bars to visually work with.

-

bars_limit (int, default: 1000) — Bars to calculate per tick (speed control).

F) Alerts

-

SIGNAL_BAR (int, default: 1) — Which bar is used to confirm/trigger alerts ( 1 = closed bar).

-

popup_alert (bool, default: false) — MT5 popup alert.

-

notification_alert (bool, default: false) — Push notification.

-

email_alert (bool, default: false) — Email alert.

-

play_sound (bool, default: false) — Play a sound.

-

sound_file (string, default: "") — Sound file name.

-

start_program (bool, default: false) — Launch an external program on alert.

-

program_path (string, default: "") — Path to the program executable.

-

advanced_alert (bool, default: false) — Advanced alert via DLL (Telegram/Discord/etc).

-

advanced_key (string, default: "") — Key for advanced alert service.

-

AlertsSection / Comment2 / Comment3 / Comment4 (string) — UI separators/info text (no trading logic impact).

Practical advantages for Boom/Crash traders

-

Saves time: no manual divergence drawing.

-

Cleaner signals on fast, spiky markets thanks to pivot confirmation + smoothing.

-

Flexible: switch oscillator types without changing the workflow.

-

No alert spam: it tracks last alerted line/time to avoid duplicates.