TrendTracker EA

- Experts

- Anis Boughachiche

- Versione: 1.0

- Attivazioni: 5

Product: Trendtracker EA

Platform: MetaTrader 5 (MT5)

Optimized for: EURUSD, USDJPY, XAUUSD

Special Launch Offer: 40% OFF now! (Price will increase by 40% after the launch)

DESCRIPTION

Trendtracker is a professional, transparent, and long-term oriented Expert Advisor.

Designed for swing trading, it focuses exclusively on capturing real directional market phases.

The EA filters ranging and low-quality market conditions and enters trades only when probabilities are favorable.

Trendtracker integrates strict risk and money management, built to preserve capital and remain operational even during periods of strong market turbulence.

Developed over several years of market research and refinement, the strategy is focused on identifying and exploiting genuine market trends, rather than relying on artificial or high-risk trading techniques.

No martingale. No grid. No aggressive recovery techniques.

TRADING PHILOSOPHY

Trendtracker never forces the market.

When no genuine opportunity is detected, no trade is taken.

This deliberate behavior helps avoid ranging markets and low-volatility phases, where most traders and automated systems tend to lose money.

The absence of trades is a strategic decision, not a weakness.

MULTI-TIMEFRAME ANALYSIS

The EA relies on multiple timeframes to:

-

Identify the main market trend

-

Confirm market structure

-

Refine entry points

This multi-timeframe filtering significantly reduces false signals and improves trade quality.

STRICT MONEY MANAGEMENT

Each position is fully managed automatically:

-

Real and respected Stop Loss

-

Smart Break-even system

-

Dynamic Take Profit

-

Early exit when the trend weakens

Even if the final Take Profit is not reached, profits are actively protected.

TRADING FREQUENCY & CONFIGURATION

Trendtracker prioritizes quality over quantity.

-

Average trading frequency: approximately 2 trades per month

-

Certain periods may remain without trades while the EA waits for meaningful market conditions

Trading frequency can be adjusted via input parameters (Low / Medium / High) without altering the core strategy logic or risk discipline.

The EA provides clearly structured input parameters, including:

-

Recommended default settings for standard operation

-

Full control over position sizing (lot size or risk-based adjustment)

-

Configurable Stop Loss, break-even, and Take Profit behavior

-

Ability to enable or disable specific filters and frequency options

This flexibility allows the strategy to be adapted to individual risk profiles without compromising its conservative design.

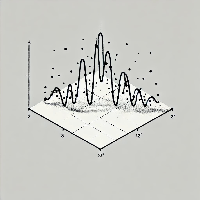

BACKTEST RESULTS – EURUSD (2020–2025)

-

Tested with a fixed lot size of 0.1 and a leverage of 1:30.

-

Net profit: +2,000 €

-

Profit Factor: > 2

-

Recovery Factor: > 10

-

Sharpe Ratio: > 4.5

-

Maximum Drawdown: ~1.9%

-

Total trades: 160

A stable and smooth equity curve.

COMPATIBLE MARKETS

- Optimized for EURUSD

- Fully compatible with USDJPY and XAUUSD.

DEMO VERSION

A free demo version is available :

-

EURUSD

-

Purpose: observe the real behavior of the EA

SAFE STRATEGY – NO RISKY METHODS

Trendtracker does not use any dangerous techniques:

-

No martingale

-

No grid

-

No averaging down

-

No aggressive recovery systems

Each trade is independent, with controlled risk from the start.

LICENSES & PRICING

-

Lifetime license: 499 € (MT5)

-

Annual subscription: 99 €/year

TARGET USERS

-

Conservative traders

-

Long-term investors

-

Users seeking stability and controlled risk

-

Traders wanting to avoid aggressive or over-optimized EAs