SuperTrend Explorer

- Indicatori

- Quang Huy Quach

- Versione: 1.20

1. Overview

Thank you for choosing the SuperTrend Suite for MT5. This package provides a set of powerful tools for trend analysis, designed to integrate seamlessly into your MetaTrader 5 platform.

This suite includes two components:

- SuperTrend Indicator: A robust trend-following indicator that displays the current market trend directly on your chart, complete with entry signals and alerts.

- SuperTrend Screener EA: A multi-symbol dashboard that scans a user-defined list of instruments in the background, alerting you to potential and confirmed trend reversals across the market.

Disclaimer: This tool is designed for market analysis and decision support. It does not provide financial advice or guaranteed trading signals. All trading decisions are the sole responsibility of the user. Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors.

2. The SuperTrend Indicator

The SuperTrend indicator is the core of the suite. It helps to identify the primary trend direction and provides clear visual cues for potential trend shifts.

How to Interpret the Indicator

-

The Trend Line:

- A green line drawn below the price bars suggests the market is in an uptrend.

- A red line drawn above the price bars suggests the market is in a downtrend.

-

Trend Reversals: A potential change in trend is indicated when the price closes across the SuperTrend line. The line will then change its color and position relative to the price.

-

Signal Arrows:

- A green up-arrow (Buy Signal) appears below a candle when the trend potentially shifts from bearish to bullish.

- A red down-arrow (Sell Signal) appears above a candle when the trend potentially shifts from bullish to bearish.

-

Alerts: The indicator can generate a pop-up alert in your terminal when a new buy or sell signal appears on the close of a bar.

Application in Trading Strategies

The SuperTrend indicator can be a valuable component of various trading systems.

-

Trend Following: A trader might use the indicator to confirm the prevailing trend. For example, when the line is green (uptrend), they may focus on looking for buying opportunities. Conversely, when the line is red (downtrend), they may focus on selling opportunities.

-

Confirmation Tool: You can use the SuperTrend signal to add confluence to signals from other indicators or analysis techniques. For instance, if your primary system generates a buy signal, you could check if the SuperTrend indicator is also in an uptrend for additional confirmation.

-

Guideline for Risk Management: The SuperTrend line can serve as a dynamic level for risk management. For example, in a long position, a trader might consider placing a stop-loss below the green SuperTrend line. In a short position, a stop-loss could be placed above the red line. This is an example, not a rule. Your stop-loss strategy should be based on your own risk tolerance and analysis.

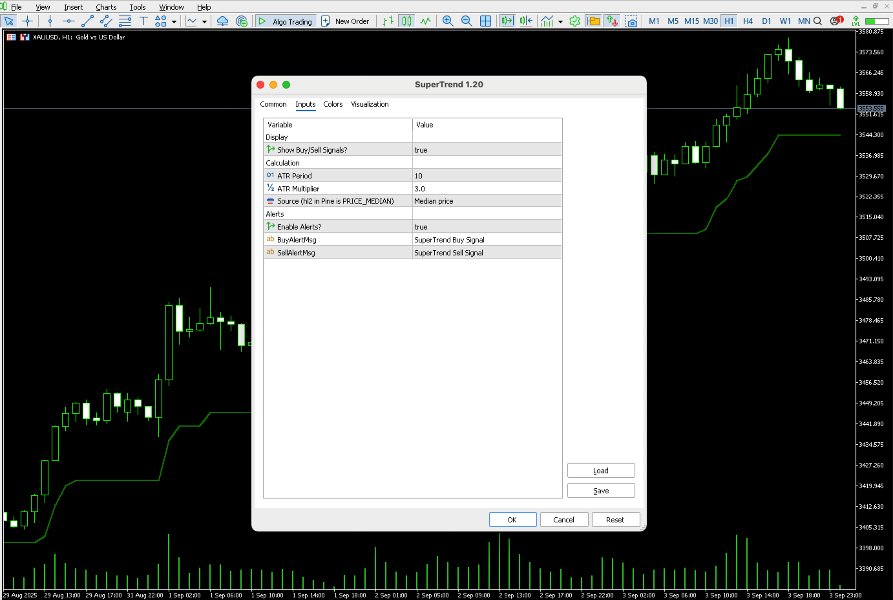

Indicator Input Parameters

- ShowSignals : (true/false) Toggles the visibility of the buy and sell arrows on the chart.

- AtrPeriod : The lookback period for the Average True Range (ATR) calculation. A higher value results in a smoother trend line that is less sensitive to minor price fluctuations. A lower value makes the indicator more responsive.

- AtrMultiplier : The multiplier for the ATR value. A higher multiplier creates a wider channel, resulting in fewer and later trend signals. A lower multiplier makes the channel tighter and produces more frequent signals.

- Src : The price data used for the calculation (e.g., Median, Close, Open).

- UseAlerts : (true/false) Enables or disables the pop-up alerts for new signals.

- BuyAlertMsg / SellAlertMsg : Allows you to customize the text for the buy and sell alert messages.