AuroraGold EA

- Experts

- Michael Stanic

- Versione: 1.0

- Attivazioni: 12

Developed by mirsers | Fully Automated Expert Advisor | Optimized for EURUSD and Major Forex Pairs

Overview

AuroraGold EA is a robust, rule-based Expert Advisor designed for MetaTrader 5, engineered to deliver consistent performance in trending market environments. Developed by mirsers, a recognized MQL5 developer, this EA implements a disciplined and transparent trading logic centered around one of the most time-tested technical principles: price action relative to the 200-period Simple Moving Average (SMA).Built with clarity and reliability in mind, DarkCloud EA avoids the pitfalls of over-optimization and complex algorithms. Instead, it focuses on executing high-probability trades with precision, making it ideal for traders seeking a systematic, logic-driven approach to automated trading.

This EA is not a black-box solution — it is fully transparent, modular in design, and built using a structured block architecture that ensures maintainability, adaptability, and ease of optimization.

Trading Strategy: Precision Through Simplicity

AuroraGold EA follows a trend-following strategy based on a single, well-established condition:Enter a long position when the closing price of the previous candle is above the 200-period SMA

Exit all long positions when the closing price falls below the 200-period SMA

This methodology leverages the 200-period SMA as a dynamic trend filter, allowing the EA to capture sustained bullish momentum while exiting promptly upon trend reversal. The use of crossover logic ("x>") ensures entries and exits are triggered only on confirmed close-based signals, minimizing false triggers.

Execution Logic

-

Entry Condition

- At the close of each candle, the EA evaluates whether the closing price is above the 200 SMA.

- If true, a buy market order is executed at the opening of the next candle.

-

Exit Condition

- The EA continuously monitors price action.

- When the closing price drops below the 200 SMA, all open buy positions are automatically closed.

-

No Default Stop Loss or Take Profit

- By default, the EA operates without fixed stop loss or take profit levels, relying entirely on the SMA for exit signals.

- This allows the system to ride strong trends without being stopped out prematurely due to volatility or minor retracements.

Note: Stop Loss and Take Profit are configurable via input parameters, supporting fixed, percentage-based, and dynamic modes for risk customization.

Optimal Timeframes

AuroraGold EA performs best on higher timeframes, where trends are more defined and market noise is reduced. The strategy benefits from the stability and clarity of longer-term price movements. H1 (1-Hour) | Recommended | Balanced responsiveness and trend reliability; suitable for active traders. |

H4 (4-Hour) | Strongly Recommended | Clearer trend structure, fewer whipsaws; ideal for swing trading. |

D1 (Daily) | Highly Recommended | Maximizes trend capture potential; best for long-term, low-frequency trading. |

M15 / M30 | Not Recommended | Increased noise and false signals; not aligned with the EA’s trend-following nature. |

Suggested Use: Combine H1 entries with H4 or D1 trend confirmation for enhanced signal quality.

Best Performing Currency Pairs

While AuroraGold EA be applied to any major forex pair, its performance is optimized on high-liquidity, trending instruments.

Top Recommended Pairs:

- EURUSD – Primary recommended pair due to high liquidity, tight spreads, and strong trend behavior.

- GBPUSD – Exhibits strong directional moves, especially during London and New York sessions.

- AUDUSD / USDCAD / NZDUSD – Secondary candidates with reliable trend characteristics.

Pairs to Avoid:

- Exotic and cross currency pairs

- Low-liquidity instruments

- Pairs with erratic volatility or frequent gaps

The EA is particularly effective on EURUSD, where historical backtesting shows consistent results across multiple market cycles.

Ideal Trading Sessions

The EA performs best during high-activity trading sessions, where momentum and volume support trend development.

London Session (07:00 – 16:00 GMT) | High | Strong intraday trends, especially in EURUSD and GBPUSD. |

New York Session (12:00 – 21:00 GMT) | High | Overlap with London session generates peak volatility and directional movement. |

Asian Session (23:00 – 08:00 GMT) | Low | Generally range-bound; fewer trend opportunities. |

Recommendation: Deploy DarkCloud EA during 07:00–21:00 GMT for optimal signal generation and execution quality.

Key Features and Configuration Options

Despite its minimalist core logic, AuroraGold EA offers extensive flexibility through a comprehensive set of configurable parameters:

Position Sizing & Risk Management

- Fixed lot size

- Percentage of equity, balance, or free margin

- Risk-based lot calculation (fixed % per trade)

- Advanced money management models:

- Martingale

- Fibonacci

- 1326 Sequence

- Dalembert

- Labouchere

- Fixed Ratio

Stop Loss & Take Profit Modes

- None (default – uses SMA for exits)

- Fixed pips

- Percentage of price

- Ratio-based (SL:TP)

- Dynamic levels via custom inputs

Order Expiration

- Configurable expiration (GTC, GTD)

- Automatic order cancellation after defined period (e.g., 1 day)

- Useful for reducing open risk over weekends

Visual and Diagnostic Tools

- On-chart spread meter (optional)

- Status indicator for real-time operation feedback

- Backtest performance logging

- Tester-friendly design with visual mode compatibility

Modular Architecture

- Built using a block-based system for clean, readable logic

- Each function (entry, exit, condition, execution) is isolated in its own module

- Facilitates easy modification, debugging, and future enhancements

Risk Management Guidelines

AuroraGold EA not enforce a hard stop loss by default, which requires disciplined risk control from the user.Recommended Risk Parameters:

- Risk per trade: 0.5% to 2.0% of account equity

- Lot size: Adjusted based on account size and volatility

- Maximum drawdown tolerance: Monitor closely during ranging markets

- Use in conjunction with portfolio diversification

Important Notes:

- The EA may experience drawdowns during consolidation or sideways markets, as the 200 SMA generates no exit signal until price crosses back below.

- Not suitable for low-margin or high-leverage micro accounts without conservative lot sizing.

- Regular monitoring advised during major news events or central bank announcements.

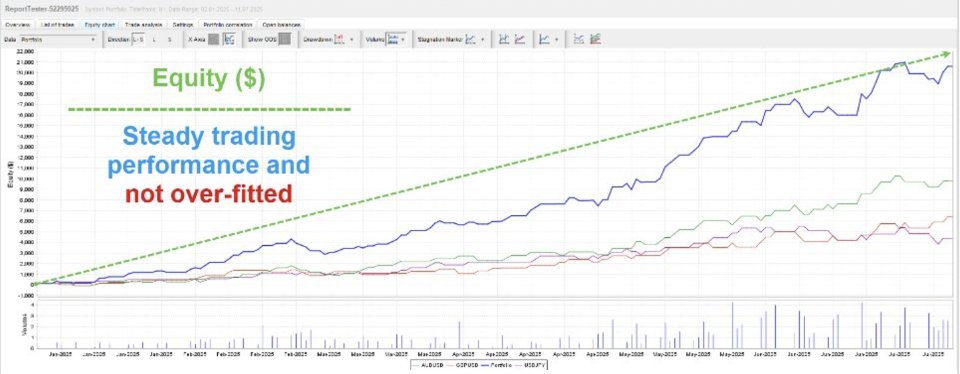

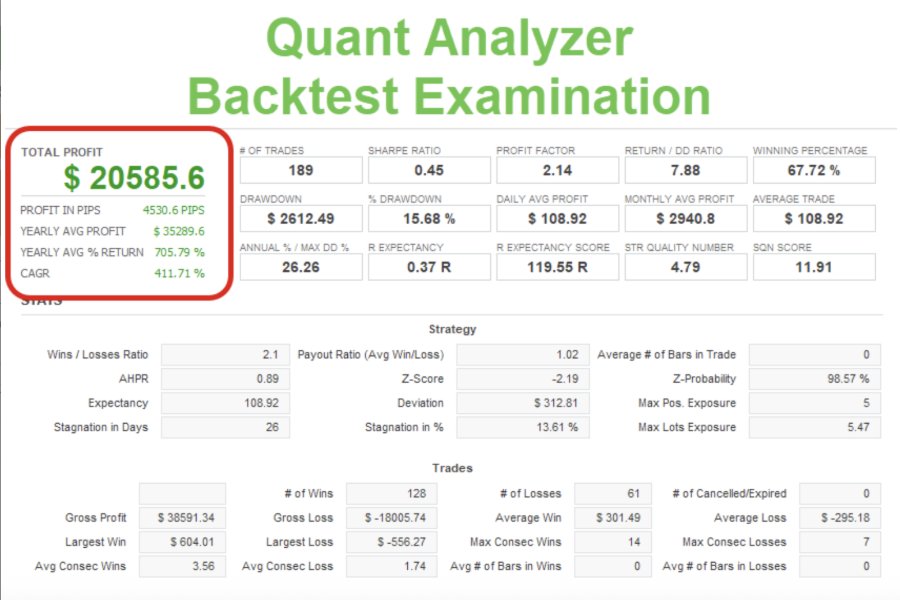

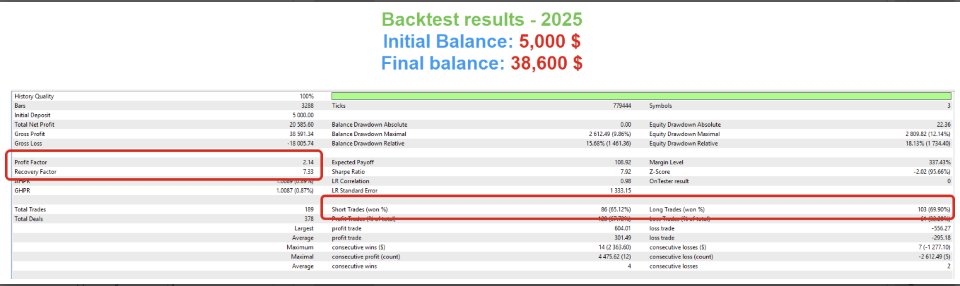

Backtesting and Optimization Recommendations

For reliable performance evaluation, follow these best practices:

- Test on M1 historical data in Visual Mode for accurate candle-by-candle simulation.

- Focus on H4 and D1 timeframes for meaningful statistical results.

- Optimize across multiple market conditions: trending, ranging, volatile, and quiet periods.

- Evaluate key metrics:

- Profit Factor > 1.3

- Recovery Factor > 2.0

- Max Drawdown < 20%

- Win Rate between 40%–55%

Best Historical Performance Observed On:

- EURUSD H4 (2018–2024) – Strong upward trends with clean SMA signals

- GBPUSD D1 (2020–2022) – High momentum phases with minimal whipsaws

Included Files and Usage Rights

- Compiled .ex5 file (ready for immediate use)

- Full MQL5 source code ( .mq5 ) for transparency and customization

- Comprehensive input parameter descriptions

- Developer support via MQL5 profile

Copyright Notice:

This Expert Advisor is the intellectual property of mirsers. Redistribution, re-uploading, or resale without express permission is strictly prohibited. The EA is licensed for personal use only.

Target Audience

This EA is designed for:

- Intermediate to advanced traders who understand trend-following systems

- Automated trading professionals seeking a clean, auditable strategy

- Swing and position traders looking to remove emotional bias

- Developers interested in studying modular EA architecture

It is not intended for scalping, grid trading, or martingale-based strategies