Market Condition Evaluation based on standard indicators in Metatrader 5 - page 104

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.13 06:21

EUR/USD technical analysis from Goldman Sachs - Elliot Wave (based on forexlive article)

Goldman Sachs technical analyst says 'EUR/USD seems to be resuming its trend':This 1.0286-1.0103 pivot includes 76.4% retrace of theentire '00/'08 rise as well as an equality target taken from the Jul. '08 peak. Reaching it would satisfy a multi-year ABC which began in '08. It would consequently be an ideal place to take on a more neutral outlook.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.13 16:43

AUDIO - Weekend Edition with John O'Donnell

Financial illiteracy is a major factor in America’s significant shortfall with retirement savings and much more. John and Merlin talk about how this illiteracy is spreading, and what we should do to help improve financial understanding. The duo also take a look at paper profits most investors hold, and how they should protect those gains in the face of a potential market correction.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video April 2015

newdigital, 2015.04.14 05:56

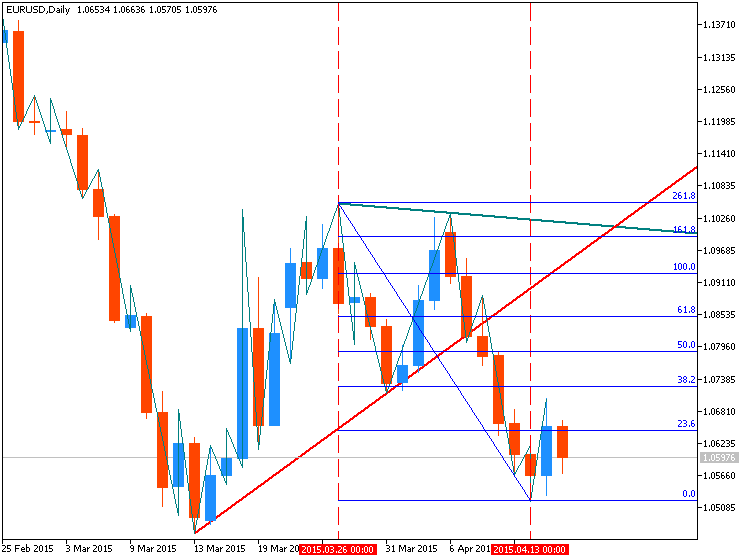

EUR/USD Forex Analysis- April 14, 2015

The EUR/USD pair fell during the bulk of the session on Monday, testing the 1.05 handle. This is an area that has been supportive in the past, so therefore it does not surprise me at all that we bounced. That bounce of course forming a hammer is a very bullish sign but I have no interest in buying this pair. I recognize that the Euro is a massive ball of trouble waiting to happen, and as a result I have no interest in being long of this pair. On top of that, the US dollar of course has strengthened exponentially for some time, so as a result I have no interest in shorting the Dollar.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.14 06:05

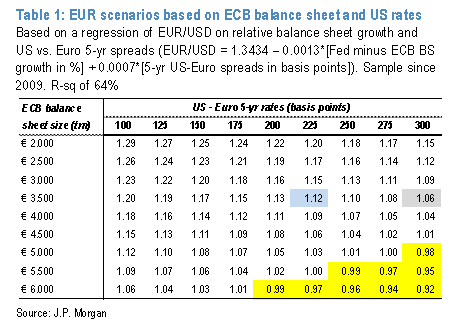

EUR/USD: Towards 1.15 Or Below 1.00 - JP Morgan (based on efxnews article)

JP Morgan's EUR/USD forecast profile is unchanged this month and continues to show a slower decline for the rest of the year, after an unprecedented -11% drop in Q1. JPM's Quarter-end targets are 1.07 in Q2, 1.06 in Q3 and 1.05 in Q4.

"Downside targets would be more aggressive were it not for the US dollar’s valuation problem and the Fed’s gradual pushback on a strong currency," JPM argues.

"Based on JPM’s expectations that the ECB balance sheet expands to €3.5trn by end 2016 and that 5-yr spreads might move about 50bp in the US’s favour, EUR/USD’s fair value is about 1.12 (blue cell in table 1). The euro's current level near 1.06 would be justified if the ECB balance sheet were heading to €5trn (unlikely given how Euro area growth is improving) or the USEuro 5-yr spread would widen to over 300bp over the cycle (unlikely as the Fed dots fall towards the money market curve due to mediocre US growth)," JPM adds.

"So while we know that currencies can undershoot for some time until a macroeconomic or policy catalyst emerges, we are reluctant to forecast trend extensions that have little empirical basis," JPM argues.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.14 11:51

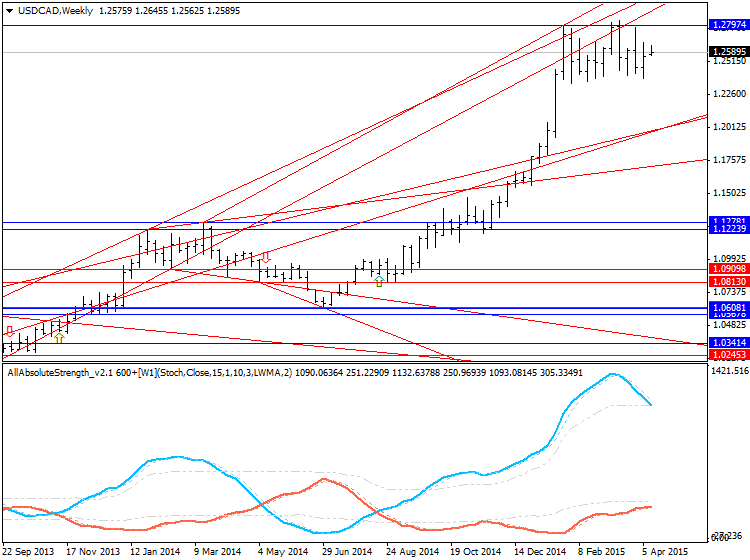

The Next Big Levels In EUR/USD, GBP/USD, USD/CAD - Goldman Sachs (based on efxnews article)

Starting with EUR/USD, GS notes that it peaked least week right underneath an important resistance area at 1.1052-1.1099, a region included the interim high (bearish key day reversal) from Mar. 26th , the interim low from Jan. 26th and the 55-dma.

"It’s since broken lower from a triangle type pattern (ABCDE). Triangles tend to be characteristic of wave 4s which in this case suits the underlying wave count and implies that there is further downside potential. The next near-term support stands down at 1.0487- 1.0458 (1.618 extension from Mar. 26th and the low from Mar. 15th)," GS projects.

Bigger picture, GS targets f EURUSD at 1.0286-1.0103 pivot which includes 76.4% retrace of the entire ‘00/’08 rise as well as an equality target taken from the Jul. ’08 peak.

Moving to GBP/USD, GS notes that it has broken trendline support and this should in theory be a strong signal opening up potential to accelerate lower.

"The next big level lower is 1.4372-1.420. This includes two long-term Fibonacci retracements and the low from May ’10...Put simply, it appears that GBPUSD is gradually making its way down to the bottom of its multi-decade range," GS projects.

Finally in USD/CAD, GS thinks that the focus should be back on the range highs; 1.2799-1.2835.

"Would however need a clean break above 1.2799-1.2835 to cancel out the risk of a double top and to diminish the bearish implications of the bearish key day reversal which formed on Mar. 18th . Ideally want to play the range until a break in either direction is finally attain," GS advises.

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

newdigital, 2015.02.03 18:48

Market condition setup (indicators and template) is hereForum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.15 08:34

2015-04-15 03:00 GMT (or 05:00 MQ MT5 time) | [CNY - GDP]if actual > forecast (or previous data) = good for currency (for CNY in our case)

[CNY - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy. It's the broadest measure of economic activity and the primary gauge of the economy's health.

==========

China GDP Rises 7.0% On Year In Q1

China's gross domestic product expanded 7.0 percent on year in the first quarter of 2015, the National Bureau of Statistics said on Wednesday, coming in at 14,066.7 billion yuan.

The headline figure was in line with expectations while slowing from 7.3 percent in the previous three months.

On an annualized quarterly basis, GDP gained 1.3 percent - below expectations for 1.4 percent and down from 1.5 percent in the fourth quarter.

The value added of the primary industry was 777.0 billion yuan, up by 3.2 percent year-on-year; that of the secondary industry was 6,029.2 billion yuan, up 6.4 percent; and that of the tertiary industry was 7,260.5 billion yuan, up 7.9 percent.

The bureau added that industrial production gained just 5.6 percent on year in March - shy of forecasts for an increase of 7.0 percent and down from 7.9 percent in February. Output was up 0.25 percent on month.

MetaTrader Trading Platform Screenshots

AUDUSD, M5, 2015.04.15

MetaQuotes Software Corp., MetaTrader 5

AUDUSD M5: 29 pips price movement by CNY - GDP news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.15 13:35

Dovish ECB to Fuel Bearish EUR/USD Outlook- 1.0500 in Focus (based on dailyfx article)

Trading the News: European Central Bank (ECB) Interest Rate Decision

The fresh batch of rhetoric coming out of the European Central Bank (ECB) may heighten the bearish sentiment surrounding the EUR/USD should President Mario Draghi endorse a dovish outlook for monetary policy

However, we may see growing speculation for a ‘taper tantrum’ in the euro-area should Mr. Draghi adopt a more upbeat tone for the region and talk down expectations for more non-standard measures as the recent developments coming out of the monetary union beat market forecasts.

Nevertheless, we may get more of the same from the ECB amid the series of positive data prints coming out of the euro-area, and the single-currency may face a more meaningful correction over the near-term should the central bank implement a more hawkish twist to the forward-guidance for monetary policy.

Bearish EUR Trade: ECB Stays on Course & Talks Down ‘Taper Tantrum’

Bullish EUR Trade: Governing Council Adopts Improved Outlook

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.15 16:42

2015-04-15 03:00 GMT (or 05:00 MQ MT5 time) | [CAD - Overnight Rate]if actual > forecast (or previous data) = good for currency (for CAD in our case)

[CAD - Overnight Rate] = Interest rate at which major financial institutions borrow and lend overnight funds between themselves. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future.

==========

"The Bank of Canada today announced that it is maintaining its target for the overnight rate at 3/4 per cent. The Bank Rate is correspondingly 1 per cent and the deposit rate is 1/2 per cent.

Total CPI inflation is at 1 per cent, reflecting the drop in consumer energy prices. Core inflation has remained close to 2 per cent in recent months, as the temporary effects of sector-specific factors and pass-through of the lower Canadian dollar have offset the disinflationary forces from slack in the economy.

The Bank expects global growth to strengthen and average 3 1/2 per cent per year over 2015-17, in line with the projection in the January Monetary Policy Report (MPR). This is in part because many central banks have eased monetary policies in recent months to counter persistent slack and low inflation, as well as the effect of lower commodity prices in some cases. At the same time, economies continue to adjust to lower oil prices, which have fluctuated at or below levels assumed in the January MPR. Strong growth in the United States is expected to resume in the second quarter of 2015 after a weak first quarter".

MetaTrader Trading Platform Screenshots

USDCAD, M5, 2015.04.15

MetaQuotes Software Corp., MetaTrader 5

USDCAD M5: 97 pips price movement by CAD - Overnight Rate news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.16 09:00

2015-04-16 02:30 GMT (or 04:30 MQ MT5 time) | [AUD - Unemployment Rate]if actual < forecast (or previous data) = good for currency (for AUD in our case)

[AUD - Unemployment Rate] = Percentage of the total work force that is unemployed and actively seeking employment during the previous month. Although it's generally viewed as a lagging indicator, the number of unemployed people is an important signal of overall economic health because consumer spending is highly correlated with labor-market conditions.

==========

Australia March Jobless Rate Falls To 6.1%

"The unemployment rate in Australia came in at a seasonally adjusted 6.1 percent in March, the Australian Bureau of Statistics said on Thursday.

That beat forecasts for 6.3 percent, which would have been unchanged from the February reading.

The Australia economy added 37,700 jobs in March to 11,720,300 - also beating expectations for adding 15,000 following the gain of 15,600 jobs in the previous month."

MetaTrader Trading Platform Screenshots

AUDUSD, M5, 2015.04.16

MetaQuotes Software Corp., MetaTrader 5

AUDUSD M5: 70 pips price movement by AUD - Unemployment Rate news event