You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

US Dollar Fundamentals (based on dailyfx article)

Fundamental Forecast for Dollar: Neutral

The US Dollar finished the week near decade-plus highs versus the Euro as it rallied against nearly all G10 counterparts. A noteworthy gain in US Treasury Yields helped explain much of the Dollar’s rally, but heavily stretched positioning and price momentum makes further gains relatively unlikely.

Global interest rate differentials remain the main driver of major currency moves, and expectations of US Federal Reserve interest rate hikes have pushed the US Dollar to impressive peaks. The US Federal Reserve is in fact the only G10 central bank expected to raise interest rates in the coming 12 months, and as long as this remains the case we expect the US currency to hold its gains against lower-yielding counterparts. Yet there remains clear uncertainty surrounding the Fed’s moves. Further Dollar strength is far from guaranteed.

Traders will look to the coming week’s US Retail Sales and Consumer Price Index inflation data for the next clues on the Federal Reserve’s interest rate policy, and major surprises could force important US Dollar volatility. Analysts predict the Advance Retail Sales report will show that consumer spending grew by 1.0 percent March—the first month-over-month gain in three months and the fastest pace of expansion in exactly a year. Lofty expectations leave ample room for disappointment and the odds seem stacked against the US Dollar ahead of the event.

Late-week CPI inflation figures represent the biggest risk to the Greenback given their clear implications for the future of US Federal Reserve monetary policy. Headline CPI data is expected to show prices remained exactly unchanged in the 12 months through March, while CPI excluding food and energy will likely match February’s pace at 1.7 percent. Topside surprises could increase the Fed’s sense of urgency in raising interest rates and normalizing monetary policy.

Recent FOMC minutes showed a surprising level of support for raising interest rates at the highly-anticipated June meeting, and the jump in yields helped drive renewed Dollar strength. Yet rhetoric is one thing and actions an entirely different matter. Interest rate futures show a miniscule 7 percent chance that the Fed will hike in June—hardly encouraging for US Dollar bulls.

Patience may wear thin for those holding USD-long positions rather quickly; recent CFTC Commitment of Traders data showed large speculators were their most net-long US Dollar versus the Euro (short EUR/USD) on record. And though this in itself does not signal that the currency is likely to reverse, it does imply that there may be relatively few traders left to sell. The key question is simple: will interest rate expectations be enough to fuel further Dollar gains? It’s entirely possible, but we’ll keep a close eye on upcoming data given clear risks of an important USD reversal.

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: Neutral

The Australian Dollar snapped a two-week losing streak after the RBA opted against another interest rate cut at April’s monetary policy meeting. The central bank was unmistakably clear about its bias however, saying “further easing…may be appropriate over the period ahead” and pledging to “assess the case for such action at forthcoming meetings”.

This makes for a data-sensitive environment going forward as traders weigh up news flow to see when RBA Governor Glenn Stevens and company might pull the trigger. In the week ahead, the March set of employment figures will be in the spotlight. The economy is expected to have added 15,000 jobs last month while the unemployment rate is tipped to have remained at 6.3 percent.

Leading survey data points to a significant slowdown in service-sector hiring in March while employment in manufacturing continued to contract (albeit at a slower pace). With close to three quarters of those working doing so on the services side, this is an ominous sign. Furthermore, Australian data outcomes have increasingly underperformed relative to consensus forecasts recently, hinting analysts’ models are overestimating the economy’s vigor and raising the threat of a downside surprise.

A disappointing jobs report may help stoke bets on an RBA interest rate cut when policymakers reconvene in May. As it stands, the markets’ priced-in expectations assign a 70 percent probability to a 25 basis point reduction. A similar degree of conviction prevailed ahead of April’s meeting, only to be proven wrong. This means a set of employment figures that builds investors’ certitude is likely to have market-moving potential despite already elevated easing speculation, weighing on the Aussie.

Chinese news-flow may amplify any dovish shift in the markets’ RBA outlook. The East Asian giant is expected to report that year-on-year GDP growth slowed to 7 percent in the first quarter of 2015, marking the weakest reading since the post-crisis trough in the first three months of 2009. This bodes ill for Australia, whose economic resilience in recent years has largely relied on Chinese demand for the output of its mining sector.

The Australian Dollar’s down move since April 2013 has tracked deteriorating expectations for 2015-16 Chinese GDP growth (as tracked by a survey of economists polled by Bloomberg). A parallel drop in Australia’s front-end bond yields bolsters the narrative, suggesting traders are betting that deteriorating export prospects will undermine overall growth. This will push the RBA into action, denting the Aussie’s yield appeal. A soft Chinese growth print will probably feed such speculation.

EUR/USD Weekly Fundamental Analysis, April 13-17, 2015 – Forecast (based on fxempire article)

The EUR/USD tumbled 54 points to trade at 1.0603 on Friday to close the week at a recent bottom. Greece, Europe’s most-indebted state, is negotiating with euro-area countries and the International Monetary Fund on the terms of its 240 billion-euro ($259 billion) rescue. The standoff, which has left Greece dependent upon European Central Bank loans, risks leading to a default within weeks and its potential exit from the euro area.

German Chancellor Angela Merkel has repeatedly said that she wants Greece to stay in the euro and along with French President Francois Hollande last week expressed concern that time is running short.

“There’s no time to lose,” Merkel said at a news conference with Hollande after they met in Berlin March 31. Hollande said too much time has been lost already, adding that he would like an agreement and “the sooner, the better.”

Greece made another plea to the euro zone for cash to avert bankruptcy but was told to present an improved list of economic reforms within six working days for finance ministers to pave the way for any more lending, EU officials said on Thursday.

Greece told the same forum last week that it would have difficulty paying back an installment to the IMF due on Thursday and covering its expenses for wages and pensions. But it subsequently said it would make the IMF payment on time.

Officials said euro zone experts were not convinced the liquidity position was a dire as portrayed by Athens, and some suspected an attempt to scare creditors into releasing funds. Once Athens agrees on a set of measures with its creditors — euro zone governments and the International Monetary Fund — and passes laws through parliament to implement them, it could get 7.2 billion euros that remain to be disbursed from its existing 240 billion euro international bailout.

But after 10 weeks in office the Tsipras government has been unable to agree with lenders, mainly because many of the measures run counter to his election promises to put an end to austerity and refuse “recessionary” measures.

The U.S. dollar hit a near-three-week peak on Thursday, driven higher by sentiment that U.S. interest rates inevitably will rise, with the prospect of a June increase still in the mix despite spotty economic data. Interest rate differentials between benchmark U.S. and German 10-year government bonds widened to 1.771 percent on Thursday, their biggest spread since March 26.

EUR/USD weekly outlook: April 13 - 17 (based on investing.com article)

The euro was down against the dollar for the fifth straight session on Friday, falling to one-month lows as the contrasting monetary policy stance of the European Central Bank with the Federal Reserve acted as a drag.

EUR/USD was at 1.0603 in late trade, down 0.51%. For the week the pair lost 3.57%, the worst weekly performance since September 2011.

The single currency has already weakened broadly this year after the ECB unveiled a trillion-euro quantitative easing program in January. The bank started asset purchases last month, pushing euro area bond yields to new lows.

Demand for the dollar was underpinned by expectations for higher interest rates, as investors regained confidence that the U.S. economy would continue to recover after recent economic reports pointed to a slowdown at the start of the year.

The greenback received a boost earlier in the week after comments by the presidents of the New York and Richmond Federal Reserve banks made the case for the Fed to begin policy tightening as early as the summer.

Some investors had pushed back the timing of a rate hike until late 2015 after a surprisingly weak U.S. employment report for March.

The euro was also weaker against the yen, with EUR/JPY down 0.81% to 127.48 at the close, the weakest since March 16.

In the week ahead, Wednesday’s monetary policy announcement and press conference by the ECB will be in focus. U.S. data on retail sales, inflation and consumer sentiment will be closely watched for further indications on the strength of the recovery.

Tuesday, April 14

Wednesday, April 15

Thursday, April 16

Friday, April 17

EUR/USD forecast for the week of April 13, 2015

The EUR/USD pair fell hard during the course of the week as the 1.10 level continues to be resistive. The 1.05 level below has been supportive, but it would be only a matter of time before we fall below there in our opinion. We would head to the parity level at that point in time, and believe that bounces continue to be nice selling opportunities as the European Central Bank continues to offer significant liquidity measures that of course can work against the value of the Euro. We have no interest in buying.

EUR/USD technical analysis from Goldman Sachs - Elliot Wave (based on forexlive article)

Goldman Sachs technical analyst says 'EUR/USD seems to be resuming its trend':This 1.0286-1.0103 pivot includes 76.4% retrace of theentire '00/'08 rise as well as an equality target taken from the Jul. '08 peak. Reaching it would satisfy a multi-year ABC which began in '08. It would consequently be an ideal place to take on a more neutral outlook.

EUR/USD Technical Analysis: March Bottom Threatened (based on dailyfx article)

The Euro continues to push lower against the US Dollar, with prices on pace to retest monthly lows below the 1.05 figure. A daily close below the 1.0456-1.0513 area (March 16 low, 50% Fibonacci expansion) exposes the 61.8% level at 1.0386. Alternatively, a move back above the 38.2% expansion at 1.0640 opens the door for a challenge of the 38.2% Fib retracement at 1.0868.

AUDIO - Weekend Edition with John O'Donnell

Financial illiteracy is a major factor in America’s significant shortfall with retirement savings and much more. John and Merlin talk about how this illiteracy is spreading, and what we should do to help improve financial understanding. The duo also take a look at paper profits most investors hold, and how they should protect those gains in the face of a potential market correction.

EUR/USD: Towards 1.15 Or Below 1.00 - JP Morgan (based on efxnews article)

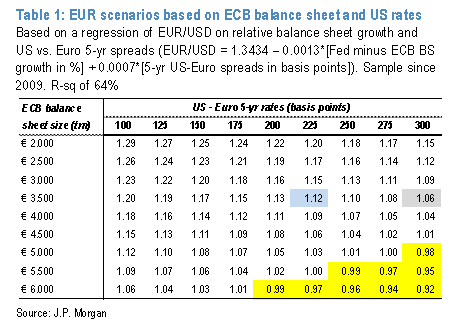

JP Morgan's EUR/USD forecast profile is unchanged this month and continues to show a slower decline for the rest of the year, after an unprecedented -11% drop in Q1. JPM's Quarter-end targets are 1.07 in Q2, 1.06 in Q3 and 1.05 in Q4.

"Downside targets would be more aggressive were it not for the US dollar’s valuation problem and the Fed’s gradual pushback on a strong currency," JPM argues.

"Based on JPM’s expectations that the ECB balance sheet expands to €3.5trn by end 2016 and that 5-yr spreads might move about 50bp in the US’s favour, EUR/USD’s fair value is about 1.12 (blue cell in table 1). The euro's current level near 1.06 would be justified if the ECB balance sheet were heading to €5trn (unlikely given how Euro area growth is improving) or the USEuro 5-yr spread would widen to over 300bp over the cycle (unlikely as the Fed dots fall towards the money market curve due to mediocre US growth)," JPM adds.

"So while we know that currencies can undershoot for some time until a macroeconomic or policy catalyst emerges, we are reluctant to forecast trend extensions that have little empirical basis," JPM argues.

The Next Big Levels In EUR/USD, GBP/USD, USD/CAD - Goldman Sachs (based on efxnews article)

Starting with EUR/USD, GS notes that it peaked least week right underneath an important resistance area at 1.1052-1.1099, a region included the interim high (bearish key day reversal) from Mar. 26th , the interim low from Jan. 26th and the 55-dma.

"It’s since broken lower from a triangle type pattern (ABCDE). Triangles tend to be characteristic of wave 4s which in this case suits the underlying wave count and implies that there is further downside potential. The next near-term support stands down at 1.0487- 1.0458 (1.618 extension from Mar. 26th and the low from Mar. 15th)," GS projects.

Bigger picture, GS targets f EURUSD at 1.0286-1.0103 pivot which includes 76.4% retrace of the entire ‘00/’08 rise as well as an equality target taken from the Jul. ’08 peak.

Moving to GBP/USD, GS notes that it has broken trendline support and this should in theory be a strong signal opening up potential to accelerate lower.

"The next big level lower is 1.4372-1.420. This includes two long-term Fibonacci retracements and the low from May ’10...Put simply, it appears that GBPUSD is gradually making its way down to the bottom of its multi-decade range," GS projects.

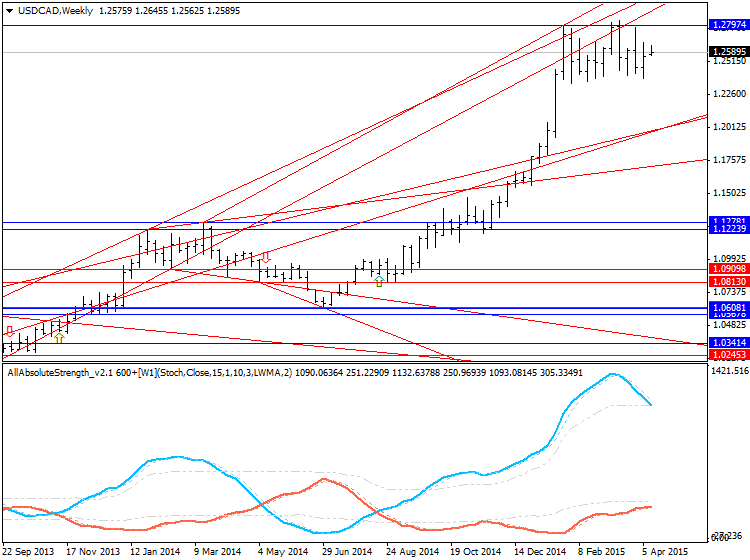

Finally in USD/CAD, GS thinks that the focus should be back on the range highs; 1.2799-1.2835.

"Would however need a clean break above 1.2799-1.2835 to cancel out the risk of a double top and to diminish the bearish implications of the bearish key day reversal which formed on Mar. 18th . Ideally want to play the range until a break in either direction is finally attain," GS advises.