Any great idea about HEDGING positions welcome here - page 20

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

That apart, I am so pleased to see someone who does understand what hedging actually means instead of thinking that it is simply opening orders in different directions with the same instrument.

Well ... he kind of copy/pasted it from wikipedia, so it remains to be seen if he truely understands it!

it doesn't say that a hedge shrub is double size the one before it, so by definition i call this wikipedia definition wrong!!

What on earth are you talking about???

There are several systems out there, depending on what your needs are... some as mentioned to be integrated into an existing trading system in order to minimize frequency and/or severity of losses & others are effectively standalone trading systems in their own right. I know there are at least 2 EAs in the Market that are pure hedging EAs.

Yet you try to force your ideas on to others

I will not get out of here as I will continue to make comments about a topic that I disagree with. That is the beauty of a discussion, we are allowed to challenge something that we disagree with. I am here as a person, not a moderator.

I think that you might find that Marco still believes in "hedging" so he is not disagreeing with the principle of "hedging" but your repeated claims that it is the only way to make profit. Also you have not actually added anything useful to your own topic. You want other people's ideas, but contributed none of your own. Just rhetoric.

I have looked at your presentation a few weeks ago and i could only agree on the matter, Hedging does not add anything useful, in fact it proved to be slightly more expensive.

Only on a very few of the occurrences where the movement does not cover both of the targets will there be a slight difference in performance.

This involves two opposite positions on the same instrument, not the 'real' multi instrument hedge, that is a different mater completely.

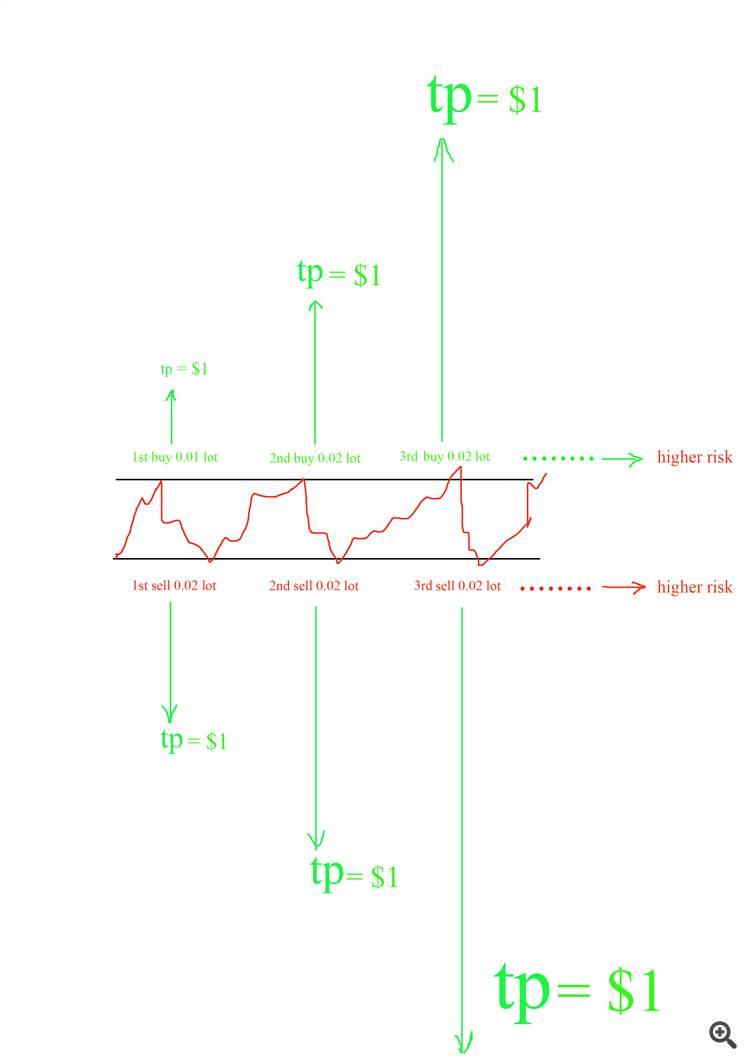

see the picture please.

this is a sure fire hedging strategy ...

the 1st problem is 1.this system only works on trending markets and in middle term or long term choppy market it will fail if will not blow up your trading account.

question: which strategy is better for that to don't fail in choppy markets and even make money in such conditions .?

the 2nd problem is by opening each new position you have to bring your tp point further to make the same amount of profit as initial trade.

question: what to do to decrease trade opening number in long term choppy market.?

the 3rd problem is spread and its widening by broker.

question: what to do if broker widened its spread so recovery zone will be wider . so some opposite trades in both directions will be closer to each other

here is the image

and some of them will be further from each other.

the 4th problem is fast market movement and price gaps that causes opposite orders open further that trader wanted.

question:what to do if between 1st buy and 1st sell or 2nd buy and 2nd sell or any other consecutive trades market will make a huge price gap ?because this causes 2 consecutive orders placing far from each other while another orders are close to each other.

how to manage such situations?

these are not all problems that we must resolve them but an important part of them i will add further question later...

don't forget using trailing stops can improve you success by increasing your winners and decreasing your risks.

please answer each question on its place.

come here and give your opinions only about this post.

What an interesting thread and a very important topic of hedging in forex by Seyedmajid. What a great post by Emmanuel with the golden words "knowledge and inspiration is never too late to acquire"... Both of them are traders... Then we have three excellent programmers Marco, Fernando and Keith... Traders and Programmers... Traders v Programmers....

-----

Marco - any tiny bit of info could lead to huge consequences, doesn't matter what the source was... in trading, in programming, in life.... surely it's not a secret for you :) there are thousands of thoughtful traders & programmers on the MQL5 site. They can not be ignored. They are a huge knowledge asset.

Fernando - "hedging" on a single instruments (partly or fully) is done by big/institutional traders all the time especially in the ranging markets and large time frames (you can also earn a good swap which also acts like a hedge). You r possibly influenced by the US regulatory rules for fx-brokers only allowing FIFO. A few years ago, just before these rules came to power, it was lots of posts everywhere peddling how it was bad for a retail trader to cover a loss with the same instrument... Now, here in Europe, we have another thing: the ESMA rules for retail trader limiting leverage to just 1/30. Again for our own good, again lots of peddling posts... What's next? perhaps, rules to stop retail traders trading :(

Keith - respect, excellent programming jobs

-----

Any hedging is legitimate, true or full as soon as one remembers the most important thing in trading: Risk Management is Paramount. Thus if you have a good enough Sharpe, then for me it doesn't mater what type of hedging you used to achieve it and how you called it:)

see the picture please.

this is a sure fire hedging strategy ...

the 1st problem is 1.this system only works on trending markets and in middle term or long term choppy market it will fail if will not blow up your trading account.

question: which strategy is better for that to don't fail in choppy markets and even make money in such conditions .?

the 2nd problem is by opening each new position you have to bring your tp point further to make the same amount of profit as initial trade.

question: what to do to decrease trade opening number in long term choppy market.?

the 3rd problem is spread and its widening by broker.

question: what to do if broker widened its spread so recovery zone will be wider . so some opposite trades in both directions will be closer to each other

here is the image

and some of them will be further from each other.

the 4th problem is fast market movement and price gaps that causes opposite orders open further that trader wanted.

question:what to do if between 1st buy and 1st sell or 2nd buy and 2nd sell or any other consecutive trades market will make a huge price gap ?because this causes 2 consecutive orders placing far from each other while another orders are close to each other.

how to manage such situations?

these are not all problems that we must resolve them but an important part of them i will add further question later...

don't forget using trailing stops can improve you success by increasing your winners and decreasing your risks.

please answer each question on its place.

come here and give your opinions only about this post.

Hi Seyedmajid,

you need to specify who's your broker, your account leverage, your chosen instrument, average spread, time frame, preferable market (US, Europe etc.), day/night trading, news trading... Apart of all this this scheme is unlikely to perform well on a long run especially if the Buy level (Green) and Sell level (Red) r too close (there is also a Zero in this scheme - widening spreads hitting your SL/TSs). This is due to the nature of retail broker setup... The scheme will chock in no time even if you have a huge account and trading nano-lots... then commissions and negative swaps will start "eating" your account unfortunately... :(

Hi Seyedmajid,

you need to specify who's your broker, your account leverage, your chosen instrument, average spread, time frame, preferable market (US, Europe etc.)... Apart of all this this scheme is unlikely to perform well on a long run especially if the Buy level (Green) and Sell level (Red) r too close (there is also a Zero in this scheme - widening spreads hitting your SL/TSs). This is due to the nature of retail broker setup... The scheme will chock in no time even if you have a huge account and trading nano-lots... then commissions and negative swaps will start "eating" your account unfortunately... :(