You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Hello, Mr.Sergey! I'm a newbie. Now I'm trading at Teletrade.

After Macron's election, the market fluctuates. Hope that the price will continue to increase as your analysis article. I set a buying limit order. Thank you for your article!

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.05.09 17:51

EUR/USD - daily correction to be started; 1.0741 is the key (based on the article)

Daily price is on bullish trend with the seondary correction to be started yesterday by bounced from 1.1017 resistance level to below. The price is testing 1.0874 and 1.0851 support levels for the correction to be continuing with Fibo bearish reversal level at 1.0741 as a nearest target to re-enter.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.05.10 17:08

EUR/USD Intra-Day Fundamentals: ECB President Draghi Speech and range price movement

2017-05-09 12:00 GMT | [EUR - ECB President Draghi Speaks]

[EUR - ECB President Draghi Speaks] = Speech about the impact of monetary policy at the Dutch House of Representatives, in Netherlands.

==========

From official report:

==========

EUR/USD M5: range price movement by ECB President Draghi Speech news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.05.12 15:26

Intra-Day Fundamentals - EUR/USD, AUD/USD and Bitcoin (BTC/USD): U.S. Retail Sales and Consumer Price Index (CPI)

2017-05-12 13:30 GMT | [USD - Retail Sales]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

2017-05-12 13:30 GMT | [USD - CPI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers.

==========

From marketwatch article:

==========

EUR/USD M5: range price movement by Retail Sales and CPI news events

==========

AUD/USD M5: range price movement by Retail Sales and CPI news events

==========

BTC/USD M5: range price movement by Retail Sales and CPI news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.05.13 08:06

Weekly EUR/USD Outlook: 2017, May 14 - May 21 (based on the article)

EUR/USD took Macron’s victory with a stride, having priced in the election from the outset. GDP and inflation data stand out in the third week of May.

Here's my latest prediction for EUR/USD

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.05.16 06:03

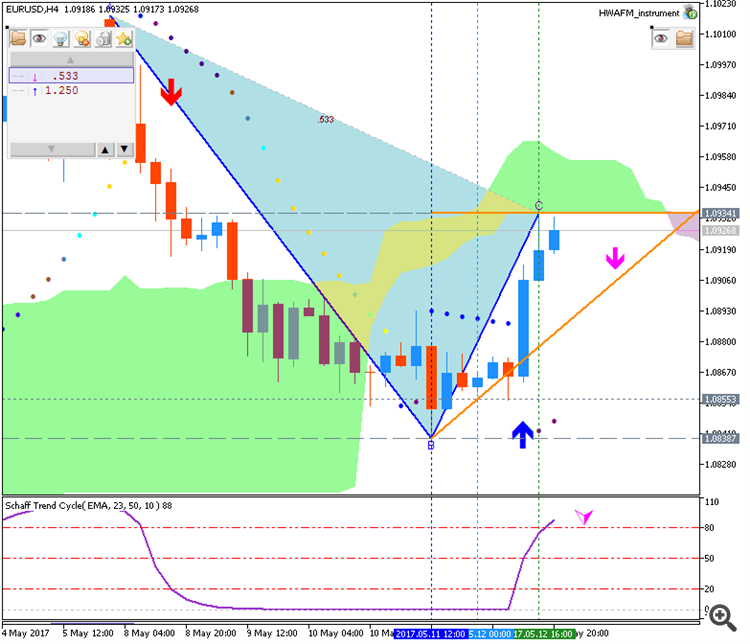

EUR/USD - Bullish ranging within narrow s/r channel (based on the article)

Daily price is above Ichimoku cloud for the bullish market condition with the ranging within 1.1017 resistance level and 1.0838 support level.

If the price breaks 1.1017 resistance on close daily bar so the bullish trend will be resumed.

If the daily price breaks 1.0838 support on close bar so the secondary correction will be started.

If not so the price will be on bullish ranging within the levels.

Trading Positions and Forecat Poll

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.05.17 07:10

EUR/USD - bullish breakout (based on the article)

Daily price is on bullish breakout which was started in the end of the previous week: the price is testing 1.1097 resistance to above for the bullish trend to be continuing.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.05.18 19:47

EUR/USD Intra-Day Fundamentals: ECB President Draghi Speaks and range price movement

2017-05-18 18:00 GMT | [EUR - ECB President Draghi Speaks]

[EUR - ECB President Draghi Speaks] = Speech at the University of Tel Aviv.

==========

From official report:

==========

EUR/USD M5: range price movement by ECB President Draghi Speaks news event