You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.05.09 11:22

Dollar Index - Daily Ranging Bearish (based on the article)

Daily price is below ichimoku cloud for the bearish ranging wthin the narrow s/r levels:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.05.13 08:00

Weekly Outlook: 2017, May 14 - May 21 (based on the article)

The second week of May saw the dollar gaining ground against many currencies despite a political controversy. A mix of events awaits us now: GDP from Japan, jobs from Australia, and housing data from the US.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.05.29 06:27

Weekly Outlook: 2017, May 28 - June 04 (based on the article)

The US dollar managed to recover in the last full week of May. As the page turns into June, we have a buildup to the Non-Farm Payrolls, consumer confidence, and the Fed’s favorite inflation figure. Here are the highlights for the upcoming week.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.06.01 14:50

Intra-Day Fundamentals - GBP/USD, Dollar Index and GOLD (XAU/USD): ADP Non-Farm Employment Change

2017-06-01 13:15 GMT | [USD - ADP Non-Farm Employment Change]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ADP Non-Farm Employment Change] = The indicator characterizes the labor market and industrial sector activity to assess the economic development in the country. Employment growth exceeding the predicted value is seen as positive for the US dollar.

==========

From official report:

==========

GBP/USD M5: range price movement by ADP Non-Farm Employment Change news events

==========

Dollar Index M5: range price movement by ADP Non-Farm Employment Change news events

==========

XAU/USD M5: range price movement by ADP Non-Farm Employment Change news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.06.03 07:59

Weekly Outlook: 2017, June 04 - June 11 (based on the article)

The US dollar was on the back foot throughout most of the week as data remained mixed and speculation about the Fed decision mounts. A rate decision in Australia, the ECB’s critical decision and the UK elections stand out in the first full week of June. Here are the highlights for the upcoming week.

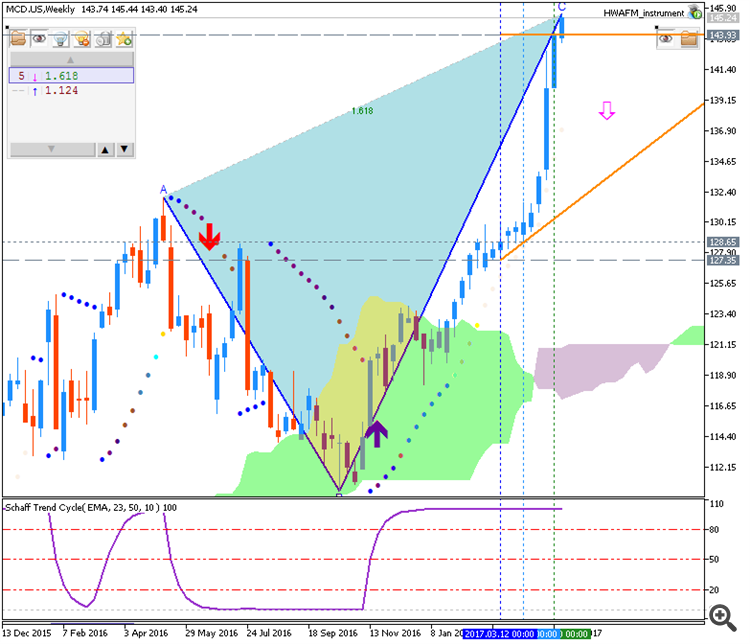

Road map (quarterly candles)

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.06.10 13:57

Weekly Outlook: 2017, June 11 - June 18 (based on the article)

The US dollar advanced against its major peers amid the testimony from Comey. The focus now shifts to the highly anticipated Fed decision. We also have three additional rate decisions as well as other figures.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.06.14 14:57

Intra-Day Fundamentals - Dollar Index and GOLD (XAU/USD): U.S. Consumer Price Index

2017-06-14 13:30 GMT | [USD - CPI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CPI] = The Consumer Price Index m/m measures changes in prices of a basket of consumer goods and services in the given month compared to the previous one. The index shows price changes from the perspective of the consumer.

==========

From official report:

==========

Dollar Index M5: range price movement by Consumer Price Index news events

==========

XAU/USD M5: range price movement by Consumer Price Index news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.06.17 09:36

Weekly Outlook: 2017, June 18 - June 25 (based on the article)

The US dollar enjoyed some strength thanks to the Fed’s hawkish hike. Can it continue advancing? The Fed can continue influencing currencies thanks to speeches from top Fed officials. In addition, we have housing data from the US and other events. Here are the highlights for the upcoming week.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.06.24 08:57

Weekly Outlook: 2017, June 25 - July 02 (based on the article)

The US dollar enjoyed some strength thanks to the Fed’s hawkish hike, but this did not last too long. What’s next? The Fed can continue influencing currencies thanks to speeches from top Fed officials, including Yellen. In addition, we have many other central bankers speaking and also some GDP figures.