You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

As for the supply demand zones and nesting or position of price on different time frames on the supply demand curve (%) I am experimenting with a supply and demand level radar.

The data are from today, from the Asian session. Some data I know is faulty, it is just for experimenting.

It is likely not as intelligent as the AI (human eye), but for a radar I think it is working quite well i.e. just for picking possibly the best candidates with a few minutes work, and updating the curve and coloring the imported data live as we go. Mainly for daytrading.

not as intelligent as the AI (human eye), but for a radar I think it is working quite well i.e. just for picking possibly the best candidates with a few minutes work, and updating the curve and coloring the imported data live as we go. Mainly for daytrading.

I thought I would share the thought.

Gyazo - 8ca83059e9938912815061338c68c974.png

and I am trying to match it up with my general weekend HP review (posted stuff earlier here):

Gyazo - 93be1615b12ae147288f556a6129ef11.png

Of course the biggest problem is me again, need to get more focused and organized .

.

And of course I still do not know if it is any better than astrology or astronomy in forex trading - there are supposedly no dry and rainy seasons in the forex market - though natural disaters there are happening and affecting currencies a great deal.

An other multi time frame radar I started to use for picking candidates is mainly ABCD/3 drive patterns (and others of course) on the MT5 platform.

Just tools, hoping to help me, and seeing those are helping me.

AudJpy M15 potential bull gartley

Chart AUDJPY, M15, 2014.04.24 09:02 UTC, HF Markets Ltd, MetaTrader 4, Demo - MetaTrader Trading Platform Screenshots

Depending on entry and entry style risk will be less than 20 pips or 10 pips, in an H1 demand zone close to DB, in a mild H4 DT.

would love to see this one reach the recent high and keep the supposedly "trend"

I am done for today,

G'night.half way to target 2

mind if I ask what's your criteria?

Simple, I don't trade hourly chart. If I did, I would definitely take the cypher on lower time frames.

AudJpy M15 potential bull gartley

Chart AUDJPY, M15, 2014.04.24 09:02 UTC, HF Markets Ltd, MetaTrader 4, Demo - MetaTrader Trading Platform Screenshots Depending on entry and entry style risk will be less than 20 pips or 10 pips, in an H1 demand zone close to DB, in a mild H4 DT.Ratio wise it is a gartley but it would not be valid structure wise. Did you take it?

Ratio wise it is a gartley but it would not be valid structure wise. Did you take it?

Yes did, ended up with a 14 pips loss, did not secure my gains.

So you are probably right about structure.

half way to target 2

Nice hammer bar level. People may urge me to say "demand" but whatever :P

Nice hammer bar level. People may urge me to say "demand" but whatever :P

that level almost got hammered, lucky I was asleep most of the time the DD took place.

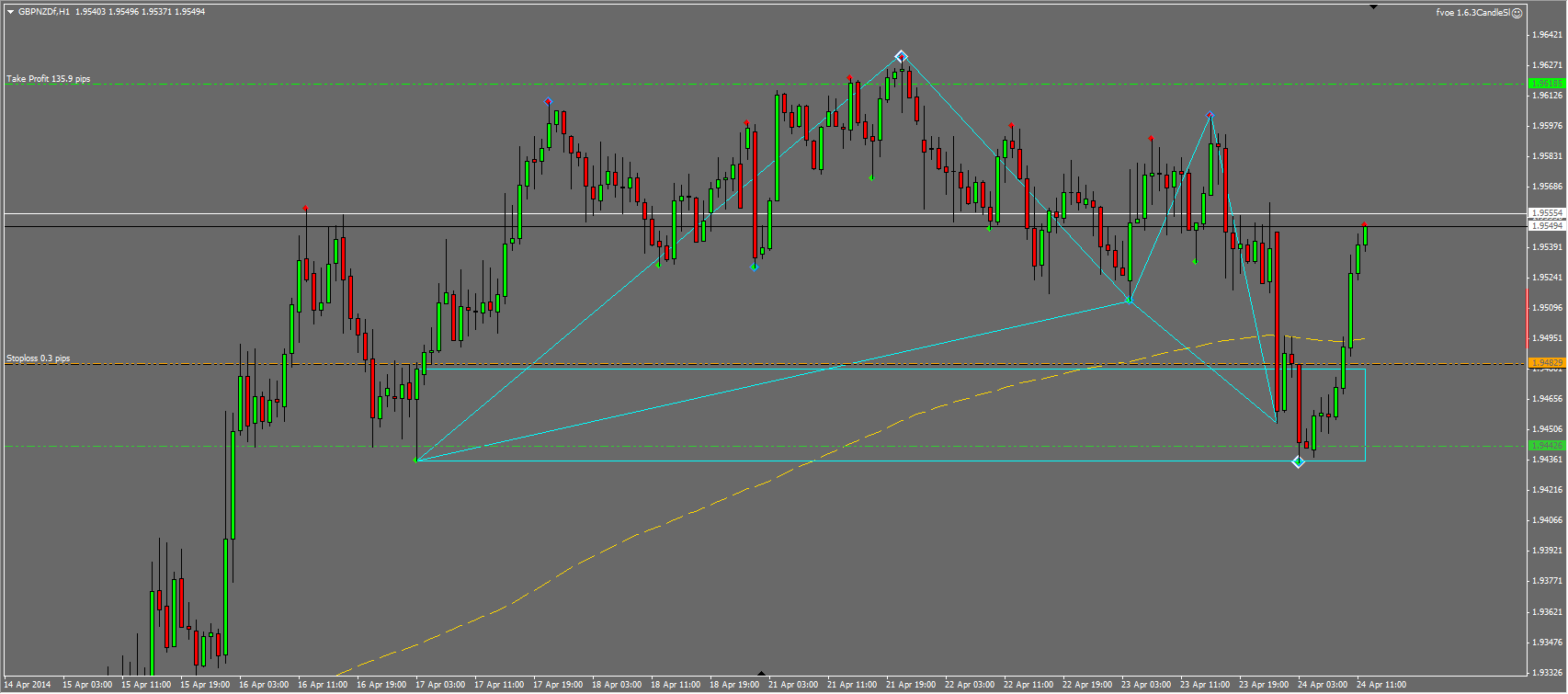

we don't see 135 pip move directly like that everyday.

love to catch those candies :P

Nice hammer bar level. People may urge me to say "demand" but whatever :P

Nice! Say Hammand, Demport or Suppand level... just add to the woodoo vocabulary, and differentiate it with different rules, which serves 2 purposes: is necessary for identifying different rules, as well as, be different from others if you use marketing, like others...

just add to the woodoo vocabulary, and differentiate it with different rules, which serves 2 purposes: is necessary for identifying different rules, as well as, be different from others if you use marketing, like others...

I must admit whatever it was called (HTF sup/res) in the T2T courses this was the faintest message for me that came through. First in your approach with the fibpivot levels I got some eye opening, then finally in supdem concepts now I see how much I was missing it.

Other than that, it does not matter, main thing is, if it is working for you, that is great! Internal dialogue will not rely on woodoo anyway.

The rules defining a level for each of us might be different, whather it is a "shelf" a "flip zone", "supply" "resistance" etc, and within that it is a candle "hammer", "doji" etc, or a candle pattern "engulfing" or "piercing" whatever included. We see and learn it all differently.

Furthermore, I find my internal dialogue struggling with support=demand kinda approach, but understand, different rules need to be distinguished somehow. For me a last HL support would be more processable, but well...the fairy tale story, marketing, and other stuff required me to learn an other word for defining other rules...maybe.

The 222 pattern is a great thing people gave it away that time, but nowadays we are exceeding even the 666 patterns series, it is becoming harder.

people gave it away that time, but nowadays we are exceeding even the 666 patterns series, it is becoming harder.

So I guess if you see differnece between a hammer level and a demand level would worth to look into it, and find out for us if there is any.

The options I see without paralisys:

Does timing play any role? There are some time sensitive patterns I read... ABCDs are one of those, I dunno what else there is out there.

Anybody has a list and and relations or proportions?Time will play role if you want it to play role,

it's your decision to keep stuff in the equation or out of it.

for me if price will touch the purple line, It would negate the trade. I'll reconsider to but limit down there again if I'll see price rejection and doesn't closing above X pivot.