You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

it's perfect, thanks a lot!

Rsx 3 indicator

It allows specifying speed (in range from 0.1 to 1.5 - 1.5 is the fastest), depth (up to depth 10 - the greater the depth the greater the lag is but it will filter more false signals out and the lag is not too significant regarding everything), price filtering (in order to additionally filter out false signals ...

Here is an example with a modest depth 3 and a rather aggressive filter set to 10

Rsx 4

Upgraded Rsx 3 version : Rsx 4 - added 14 types of additional price pre-filtering averages types (so it is a more complete version of price pre-filtering with 18 types of averages available). Added multi time frame (with the usual choice of interpolation or non interpolated representation)

HI guys, I'm looking for a coder ( ZZ and donchian ) indi. Regards amoras.chirita@gmail.com

HI guys, I'm looking for a coder ( ZZ and donchian ) indi. Regards amoras.chirita@gmail.com

Ammoo

Why don't you explain the idea you have about the indicator (if you do not want to keep it private, of course)?

Thank to invite me to post here,

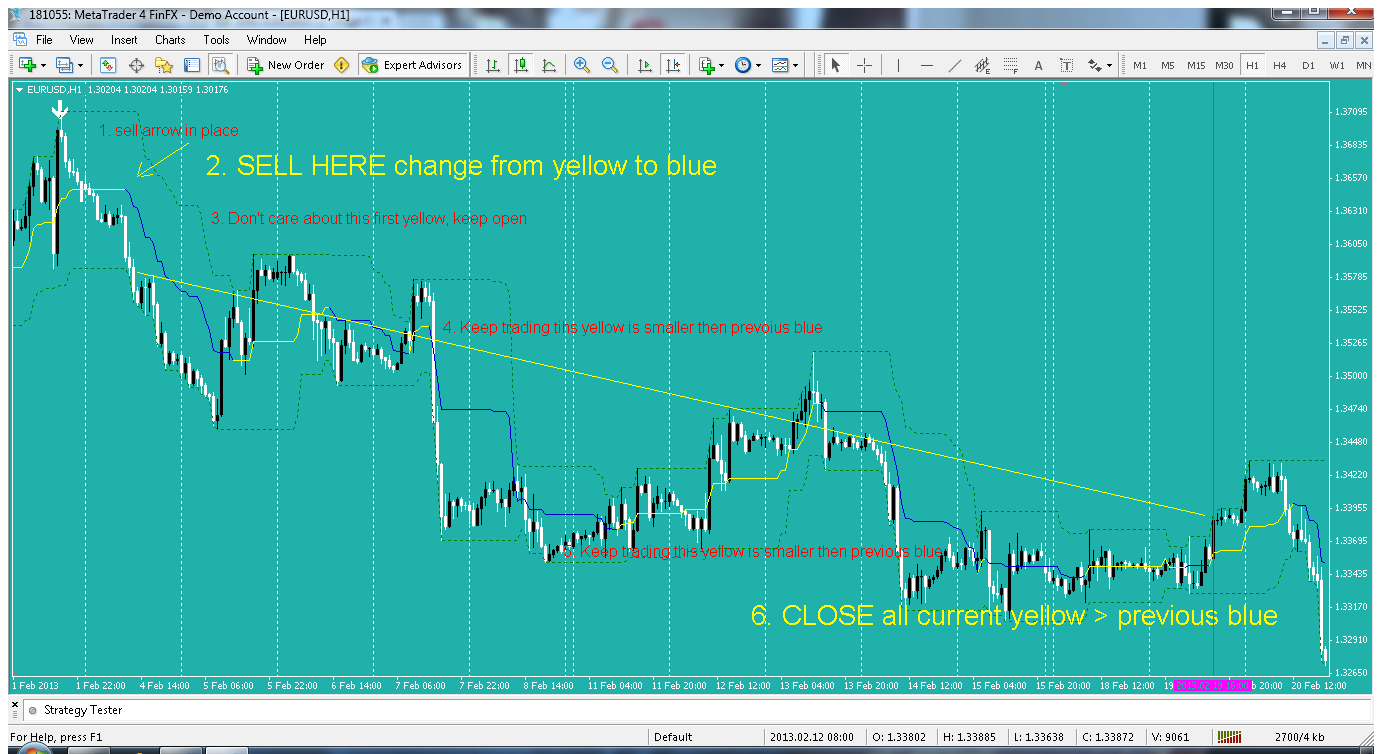

Ok, then two indi ZZ and donchian channel ( ZZ is used only when open a trade, then ignore when a trade is open )

buy when ZZ red arrow down and price open above second ( middle ) donchian line

sl set at green line ( few levels 0...5 ) with different values will select the risk which we will take

first yellow which will pass do not consider ( keep open trade )

close all buy when current LL < previous LL ... means current middle/yellow line price is lower then previous middle/blue line

for each new yellow line which is smaller then previous blue do not close any except if partial close is in place

partial close option true/false

increase lot size ( there is a formula here )

)

break even when price goes positive and turn back (made potential profit once or twice ) the existing SL

I also attached a image with this move.

So, waiting for a coder

Buy is Sell in this case of course

Ammo

Any EA that uses ZigZag us very hard to code (since ZigZag values can change and move the last leg entry all over the chart). How do you solve situations when last ZigZag leg changes (and it will change almost constantly in a case of a new trend forming) and you already have entered an order?

Hi Mladen, ZZ is is important only new open trade starts. To answer your question yes in this case a loss is also possible. But have a look and ZZ is not 100% open trade factor it only be there, donchian take this decision. Why not to do together this and see what is the outcome. I trade this manually but is hard to follow all rules. BR Ammoo