You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

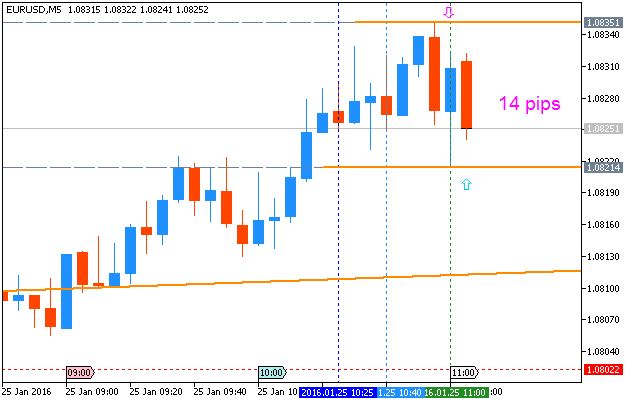

EUR/USD Intra-Day Fundamentals: German Ifo Business Climate and 14 pips range price movement

2016-01-25 09:00 GMT | [EUR - German Ifo Business Climate]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - German Ifo Business Climate] = Level of a composite index based on surveyed manufacturers, builders, wholesalers, and retailers.

==========

EURUSD M5: 14 pips range price movement by German Ifo Business Climate news event :

Danske Bank: buy EUR and sell GBP (based on the article)

-------------

EURUSD.

H4 price is located below 200 period SMA (200 SMA) and below 100 period SMA (100 SMA) for the primary bearish market condition with secondary ranging within the following key reversal support resistance levels:

If the price will break Fibo support level at 1.0777 to below so the primary bearish trend will be continuing.

If the price will break 61.8% Fibo resistance level at 1.0899 to above so the reversal of the price movement from the primary ebarish to the primary bullish trend will be started.

If not so the price will be ranging within the levels.

-------------

GBPUSD.

H4 price is far below 200 period SMA (200 SMA) and below 100 period SMA (100 SMA) for the primary bearish market condition/ The price is ranging within the following key reversal support resistance levels:

There are 3 simple scenarios for the price movement for the week:

AUDIO - Nailing Levels with Roger Best (based on the article)

"On his last visit with us on Power Trading Radio, Roger was talking about trade setups, and how he plans out trades with his students live in class. This time, Roger shares 3 of the setups that his class worked on from December 11th, all of which worked out very well! The duo looks at probability and risk management as a function of planning as well."

EUR/USD Intra-Day Fundamentals: CB Consumer Confidence and 10 pips range price movement

2016-01-26 15:00 GMT | [USD - CB Consumer Confidence]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CB Consumer Confidence] = Level of a composite index based on surveyed households.

==========

"The Conference Board Consumer Confidence Index®, which had increased in December, improved moderately in January. The Index now stands at 98.1 (1985=100), up from 96.3 in December. The Present Situation Index was unchanged at 116.4, while the Expectations Index increased from 83.0 to 85.9 in January."

“Consumer confidence improved slightly in January, following an increase in December,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers’ assessment of current conditions held steady, while their expectations for the next six months improved moderately. For now, consumers do not foresee the volatility in financial markets as having a negative impact on the economy.”

==========

EURUSD M5: 10 pips range price movement by CB Consumer Confidence news event :

AUD/USD Intra-Day Fundamentals: AUD Consumer Price Index and 39 pips price movement

2016-01-27 00:30 GMT | [AUD - CPI]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - CPI] = Change in the price of goods and services purchased by consumers.

==========

"THE ALL GROUPS CPI

==========

AUDUSD M5: 39 pips price movement by AUD - Consumer Price Index news event :

Technical Targets for EUR/USD - United Overseas Bank (based on the article)

EUR/USD: Bearish with target of 1.0710.

If daily price will break 1.0777 support level on close bar so the primary bearish will be continuing with 1.0710 target to re-enter.

If the price will break 1.0992 resistance level so the reversal of the daily price movement from the porimary bearish to the primary bullish market condition will be started with 1.1059 target.

If not so the price will be ranging within the levels.

SUMMARY : bearish

TREND : bearish ranging on reversalEUR/USD Intra-Day Fundamentals: New Home Sales and 20 pips price movement

2016-01-27 15:00 GMT | [USD - New Home Sales]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - New Home Sales] = Annualized number of new single-family homes that were sold during the previous month.

==========

EURUSD M5: 20 pips price movement by New Home Sales news event :

EUR/USD Intra-Day Fundamentals: Federal Funds Rate and 44 pips price movement

2016-01-27 19:00 GMT | [USD - Federal Funds Rate]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight.

==========

"Committee is closely monitoring global economic and financial developments and is assessing their implications for the labor market and inflation, and for the balance of risks to the outlook.

Given the economic outlook, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation."

==========

EURUSD M5: 44 pips price movement by Federal Funds Rate news event :

USD/JPY Intra-Day Fundamentals: Federal Funds Rate and 35 pips price movement

2016-01-27 19:00 GMT | [USD - Federal Funds Rate]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight.

==========

"Committee is closely monitoring global economic and financial developments and is assessing their implications for the labor market and inflation, and for the balance of risks to the outlook."

==========

USDJPY M5: 35 pips price movement by Federal Funds Rate news event :

NZD/USD Intra-Day Fundamentals: RBNZ Official Cash Rate and 59 pips price movement

2016-01-27 20:00 GMT | [NZD - RBNZ Official Cash Rate]

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - RBNZ Official Cash Rate] = Interest rate at which banks lend balances held at the RBNZ to other banks overnight.

==========

"The Reserve Bank today left the Official Cash Rate unchanged at 2.5 percent.

Uncertainty about the strength of the global economy has increased due to weaker growth in the developing world and concerns about China and other emerging markets. Prices for a range of commodities, particularly oil, remain weak. Financial market volatility has increased, and global inflation remains low."

==========

NZDUSD M5: 59 pips price movement by RBNZ Official Cash Rate news event :