EURUSD Technical Analysis 2015, 12.04 - 19.04: Bearish Breakdown with 1.0461 Next Key Support Level - page 2

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.14 17:24

EUR/USD falls to lowest level in three weeks (based on dailyfx article)

EUR/USD Strategy: Square

Big move...what are your predictions for EURUSD now? Still in down trend? If watching at H1,H4 and Daily chart?

Why bearish (downtrend) for EURUSD D1 timeframe? Well ... do you see Sinkou Span A line?

This is primary trend. It means that we may see the secondary trend within this primary. Secondary trend is market rally (local uptrend during the primary bearish), and correction (local downtrend during the primary bullish), flat, ranging etc

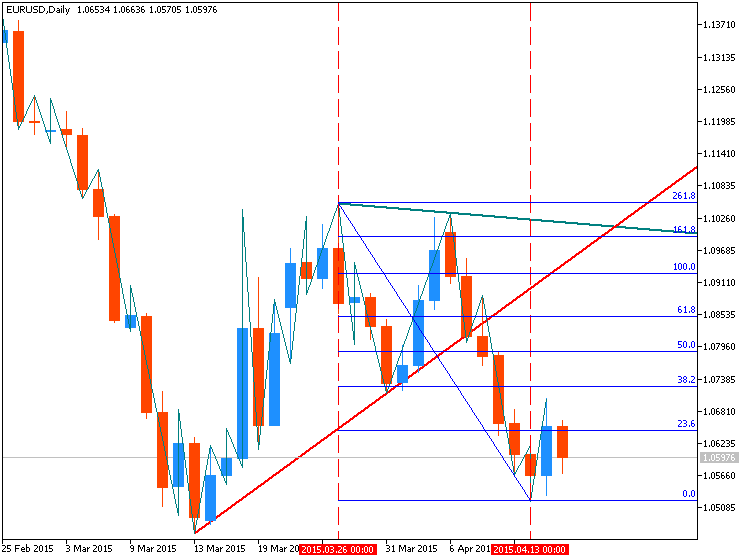

As we see from the image above we are having the following (for D1 timeframe):

Thus, we may have the following scenarios:

- If D1 price will break 1.0520 support level so the primary bearish breakdown will be continuing up to the new low forming

- If D1 price will break 1.0954 and especially 1.1034 resistance level together with Chinkou Span crossing the price from below to above so we may see good breakout with the reversal of the price from primary bearish to the primary bullish with secondary ranging (it will be ranging because the price will be inside Ichimoku cloud in this case)

- If not so the price will be moved between 1.0520 support and 1.0954 resistance

Please note that those support/resistance levels are dynamic ones (it means that we may see the other levels next days as a next high or next low for example).

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.15 09:10

Trading The ECB: Possible EUR/USD Reactions (based on efxnews article)

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.15 13:35

Dovish ECB to Fuel Bearish EUR/USD Outlook- 1.0500 in Focus (based on dailyfx article)

Trading the News: European Central Bank (ECB) Interest Rate Decision

The fresh batch of rhetoric coming out of the European Central Bank (ECB) may heighten the bearish sentiment surrounding the EUR/USD should President Mario Draghi endorse a dovish outlook for monetary policy

However, we may see growing speculation for a ‘taper tantrum’ in the euro-area should Mr. Draghi adopt a more upbeat tone for the region and talk down expectations for more non-standard measures as the recent developments coming out of the monetary union beat market forecasts.

Nevertheless, we may get more of the same from the ECB amid the series of positive data prints coming out of the euro-area, and the single-currency may face a more meaningful correction over the near-term should the central bank implement a more hawkish twist to the forward-guidance for monetary policy.

Bearish EUR Trade: ECB Stays on Course & Talks Down ‘Taper Tantrum’

Bullish EUR Trade: Governing Council Adopts Improved Outlook

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.15 17:13

EURUSD ECB Support and Resistance Update (based on dailyfx article)

The EURUSD has opened the day moving towards support in early London trading. However, despite the ECB holding its banking rate announcement today, the pair has yet to breakout. Currently price is found near range support at the S3 Camarilla pivot near 1.0606. In the event that price remains supported, traders will begin to look for a bounce in price towards levels of resistance, including the R3 pivot found today at a price of 1.0702.

Despite price opening inside of a 96 pip range, statements from the ECB still have the ability to progress price to a breakout point. A EURUSD decline below the S4 pivot at 1.0557 would suggest a return to USD strength and raise the possibility of the creation of future lower lows. Conversely, if price moves back through its trading range, and breaches the R4 pivot at 1.0751, this would open the market for a potentially broader bullish move.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.16 06:28

EUR/USD: Temp Bounce; Parity Call Still Intact For Q3 (based on efxnews article)

President Draghi continued to distance himself from verbally jawboning the EUR, continued to rule out another rate cut, continued to say the ECB is rule-based when asked how long they can support Greece, said he saw no signs of a bond bubble, and continued to avoid saying anything to suggest tapering is a concept they have even thought about at this stage, notes TD.

"So overall, the ECB continues to be optimistic on the impact of its measures and likes the improvement it is seeing in the data and lending surveys, but not enough to significantly shift their overall message. There was no mention of a review to broaden the assets eligible for SSA purchases, but this may still follow in the non-policy meeting later this month," TD adds.

"Overall, this provided minor support to both fixed income (no bubble means buy bonds) and EURUSD (uncertain passthrough of weaker currency to inflation means maybe weaker EURUSD doesn’t help), TD argues.

"Nothing here changes our view that bunds should continue to trade in a range capped at around 30bps for the next 3-6 months and EURUSD should trade below parity by 2015Q3," TD projects.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.16 06:42

AUDIO - Traveling The World with Brandon Wendell

The Road Warrior, Brandon Wendell joins Merlin for a look at his recent classes, travels, and more importantly. Trading! Merlin and Brandon answer several questions that relating to the Euro and specific trade setups on the Euro, Swiss Franc, and US Dollar. Brandon also talks about his All Asset Class Mastery XLT as well.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.16 18:06

EURUSD Attempts Post News Breakout (based on dailyfx article)

The EURUSD has opened the trading day range bound, with the pair moving between its R3 and S3 Camarilla pivot points. Price has traversed this 73 pip range twice thus far, with price currently trading above its R3 pivot which is found today at 1.0720. Despite being range bound for most of the session, traders should continue to watch the R4 pivot found at 1.0755. Price has already attempted to break this value once this morning on worse than expected initial jobless claims data. A breakout above this value would suggest the potential for higher highs for the EURUSD.

In the event that price trades back below its R3 pivot, it opens the possibility of another move back towards values of support. Currently range support sits at a price of 1.0647 at the S3 pivot. A continued decline below the S4 pivot at a price of 1.0611 would suggest a larger reversal on the creation of a lower low.