Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.01 11:58

Weekly Outlook: 2016, October 02 - October 09 (based on the article)

The third quarter ended with mixed moves in currencies. A full buildup to the US Non-Farm Payrolls, a rate decision in Australia and other figures fill the first week of the last quarter. These are the main events on forex calendar.

- US ISM Manufacturing PMI: Monday, 14:00. Manufacturing PMI is expected to reach 52.1 in September.

- Australian rate decision: Tuesday, 3:30. No change in rates is expected this time. This is the first rate decision made by the new governor Philip Lowe.

- US ADP Non-Farm Employment Change: Wednesday, 12:15. The ADP report is expected to show a 166,000 jobs gain in September.

- US ISM Non-Manufacturing PMI: Wednesday, 14:00. Non-manufacturing activity is expected to reach 53.1 in September.

- US Crude Oil Inventories: Wednesday, 14:30.

- US Unemployment Claims: Thursday, 12:30. The number of new claims is expected to register 255,000 jobs gain this week.

- Canadian employment data: Friday, 12:30. Economists expected a smaller gain of 16,000 jobs and the unemployment rate to remain steady at 6.9%.

- US Non-Farm Payrolls: Friday, 12:30. The number of new jobs in September is expected to be 171,000 while the unemployment rate is forecasted to remain at 4.9%. Wages are projected to rise by 0.2% m/m.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.14 15:27

Intra-Day Fundamentals - EUR/USD, USD/CAD and NZD/USD: U.S. Advance Retail Sales

2016-10-14 12:30 GMT | [USD - Retail Sales]

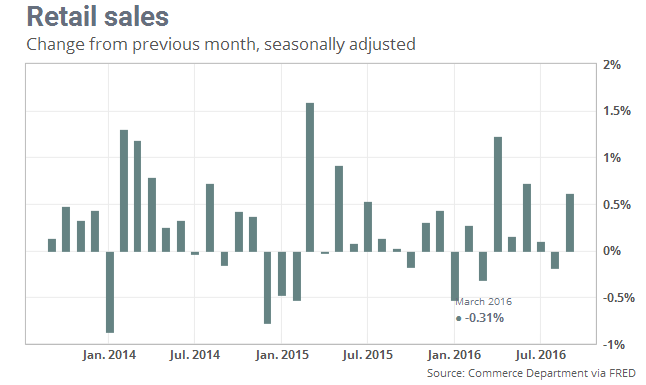

- past data is -0.2%

- forecast data is 0.7%

- actual data is 0.6% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

From MarketWatch article: U.S. retail sales snap back in September

"Sales at U.S. retail stores rebounded in September, with auto dealers

and gas stations racking up the biggest gains, in a sign consumers are

still spending fast enough to keep the economy on solid ground. Retail

sales rose 0.6% last month to snap back from a small decline in August

that was the first in five months. Economists surveyed by MarketWatch

had forecast a 0.7% increase."

==========

EUR/USD M5: 25 pips range price movement by U.S. Advance Retail Sales news events

==========

USD/CAD M5: 23 pips range price movement by U.S. Advance Retail Sales news events

==========

NZD/USD M5: 24 pips price movement by U.S. Advance Retail Sales news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.23 12:29

Weekly Outlook: 2016, October 23 - October 30 (based on the article)

- German Ifo Business Climate: Tuesday, 8:00. Economists expect a further rise to 109.6.

- US CB Consumer Confidence: Tuesday, 14:00. U.S. consumer confidence is expected to decline to 101.5 this time.

- Mark Carney speaks: Tuesday, 14:35. BOE Governor Mark Carney will speak in London before the House of Lords Economic Affairs Committee about the economic consequences of the Brexit Vote.

- Mario Draghi speaks: Tuesday, 15:30. ECB President Mario Draghi will make a speech in Berlin. Market volatility is expected.

- US Crude Oil Inventories: Wednesday, 14:30.

- UK GDP data: Thursday, 8:30. The third quarter growth rate is expected to reach 0.3%.

- US Durable Goods Orders: Thursday, 12:30. Orders for durable goods are expected to increase be 0.1% in September, while core orders are predicted to gain 0.2%.

- US Unemployment Claims: Thursday, 12:30. The number of new unemployment claims is expected to reach 261,000 this week.

- US GDP data: Friday, 12:30. The estimates for GDP growth in the third quarter are around 2.5%.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.27 08:05

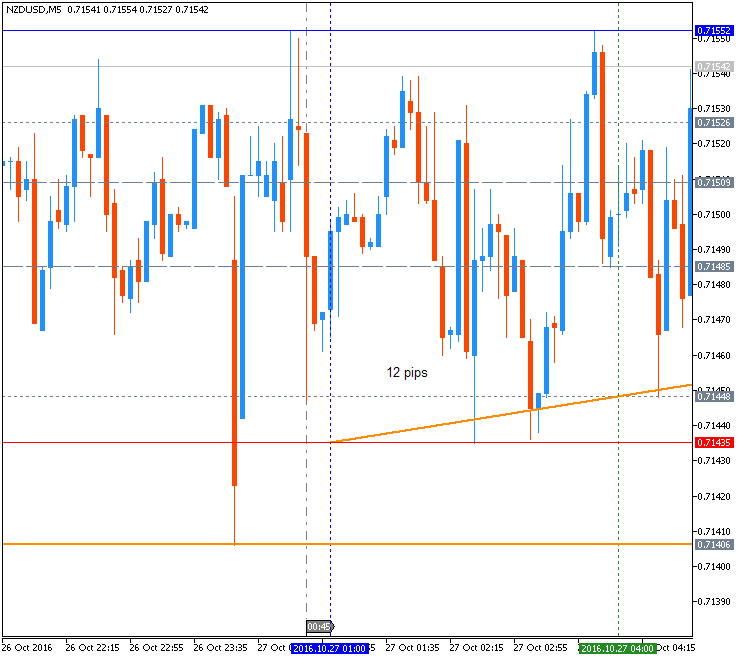

NZD/USD Intra-Day Fundamentals: NZ Overseas Merchandise Trade and 12 pips range price movement

2016-10-26 21:45 GMT | [NZD - Trade Balance]

- past data is -1243M

- forecast data is -1123M

- actual data is -1436M according to the latest press release

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - Trade Balance] = Difference in value between imported and exported goods during the reported month.

==========

From official report:

==========

NZD/USD M5: 12 pips range price movement by New Zealand Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.02 19:35

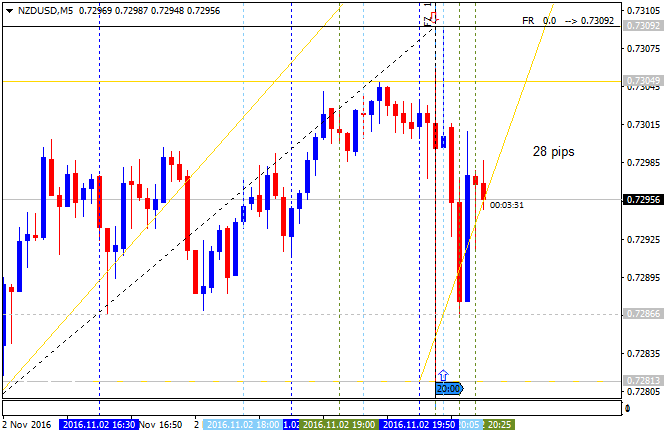

Intra-Day Fundamentals - EUR/USD, USD/CAD and NZD/USD : Federal Funds Rate and Federal Open Market Committee Statement

2016-11-02 18:00 GMT | [USD - Federal Funds Rate]

- past data is 0.50%

- forecast data is 0.50%

- actual data is 0.50% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight.

==========

From official report:

- "Inflation has increased somewhat since earlier this year but is still

below the Committee's 2 percent longer-run objective, partly reflecting

earlier declines in energy prices and in prices of non-energy imports.

Market-based measures of inflation compensation have moved up but remain

low; most survey-based measures of longer-term inflation expectations

are little changed, on balance, in recent months."

- "Against this backdrop, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The Committee judges that the case for an increase in the federal funds rate has continued to strengthen but decided, for the time being, to wait for some further evidence of continued progress toward its objectives. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation."

==========

EUR/USD M5: 29 pips range price movement by Federal Funds Rate news events

==========

USD/CAD M5: 19 pips range price movement by Federal Funds Rate news events

==========

NZD/USD M5: 28 pips range price movement by Federal Funds Rate news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.07 13:31

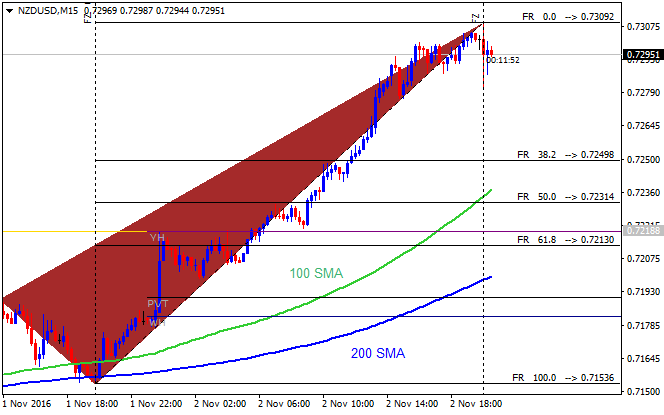

Weekly Fundamental Forecast for NZD/USD (based on the article)

NZD/USD - "Key speeches by Chicago Fed President Charles Evans, Minneapolis Fed President Neel Kashkari, San Francisco Fed President John Williams, St Louis Fed President James Bullard and Fed Vice-Chair Stanley Fischer may impact the FX market and boost the appeal of the greenback as central bank officials appear to be making a more collective approach to prepare U.S. households and businesses for a December rate-hike. It seems as though the Federal Open Market Committee (FOMC) will stay on course to further normalize monetary policy in 2017 as ‘the Committee judges that the case for an increase in the federal funds rate has continued to strengthen,’ but the 8 to 2 split suggests the permanent voting-members are in no rush to implement higher borrowing-costs as ‘market-based measures of inflation compensation have moved up but remain low; most survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.’ As a result, Chair Janet Yellen and Co. may largely advocate a wait-and-see approach going into 2017, and the permanent-voting members may continue to favor a ‘gradual’ path in normalizing monetary policy as the central bank remains ‘data-dependent.’"

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.10 08:02

NZD/USD Intra-Day Fundamentals: RBNZ Official Cash Rate and 121 pips range price movement

2016-11-09 20:00 GMT | [NZD - Official Cash Rate]

- past data is 2.00%

- forecast data is 1.75%

- actual data is 1.75% according to the latest press release

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - Official Cash Rate] = Interest rate at which banks lend balances held at the RBNZ to other banks overnight.

==========

From official report:

- "The Reserve Bank today reduced the Official Cash Rate (OCR) by 25 basis points to 1.75 percent."

- "Significant surplus capacity exists across the global economy despite improved economic indicators in some countries. Global inflation remains weak even though commodity prices have come off their lows. Political uncertainty remains heightened and market volatility is elevated."

- "Weak global conditions and low interest rates relative to New Zealand are keeping upward pressure on the New Zealand dollar exchange rate. The exchange rate remains higher than is sustainable for balanced economic growth and, together with low global inflation, continues to generate negative inflation in the tradables sector. A decline in the exchange rate is needed."

==========

NZD/USD M5: 121 pips range price movement by RBNZ Official Cash Rate news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.16 14:59

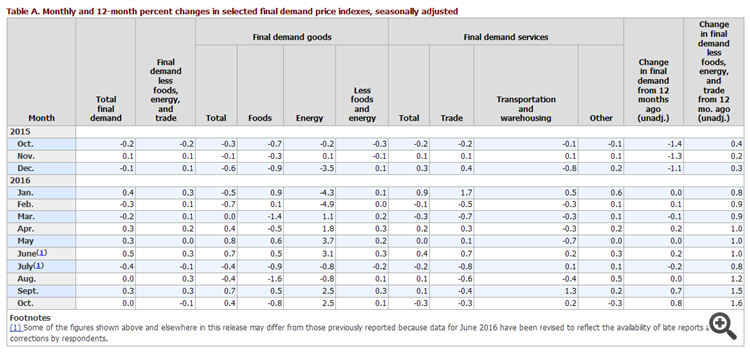

Intra-Day Fundamentals - EUR/USD, USD/CNH and NZD/USD: Producer Price Index (PPI)2016-11-16 13:30 GMT | [USD - PPI]

- past data is 0.3%

- forecast data is 0.3%

- actual data is 0.0% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - PPI] = Change in the price of finished goods and services sold by producers.

==========

From official report:

"The Producer Price Index for final demand was unchanged in October, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices rose 0.3 percent in September and were unchanged in August. On an unadjusted basis, the final demand index increased 0.8 percent for the 12 months ended in October, the largest 12-month rise since advancing 0.9 percent in December 2014."

==========

EUR/USD M5: 14 pips range price movement by Producer Price Index news events

==========

USD/CNH M5: 46 pips price movement by Producer Price Index news events

==========

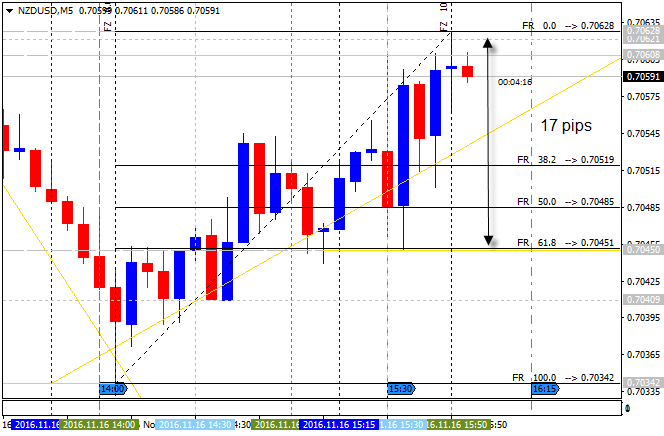

NZD/USD M5: 17 pips range price movement by Producer Price Index news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.19 07:40

Weekly Outlook: 2016, November 20 - November 27 (based on the article)

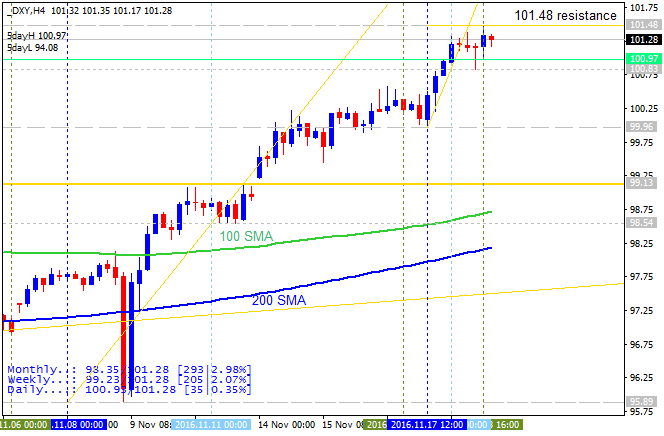

The US dollar continued marching forward, accompanied by clear hints of a rate hike. US Durable Goods Orders, UK GDP and the all-important FOMC Meeting Minutes stand out in the week of Thanksgiving. These are the major events on forex calendar.

- Mario Draghi speaks: Monday, 16:00. ECB President Mario Draghi will testify before the European Parliament, in Strasbourg.

- US Durable Goods Orders: Wednesday, 13:30. Economists expect durable goods to rise 1.2% in September, while core goods to rise 0.2%.

- US Unemployment Claims: Wednesday, 13:30. The number of jobless claims is expected to reach 241,000 this time.

- US Crude Oil Inventories: Wednesday, 15:30.

- US FOMC Meeting Minutes: Wednesday, 19:00. These are the minutes from the November meeting, in which the Fed left rates unchanged but argued that the case for raising rates has “continued to strengthen”.

- German Ifo Business Climate: Thursday, 9:00. German business climate is expected to register 110.6 in November.

- UK GDP data: Friday, 9:30. The second estimate is expected to confirm the first one, but changes are not uncommon.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.19 11:33

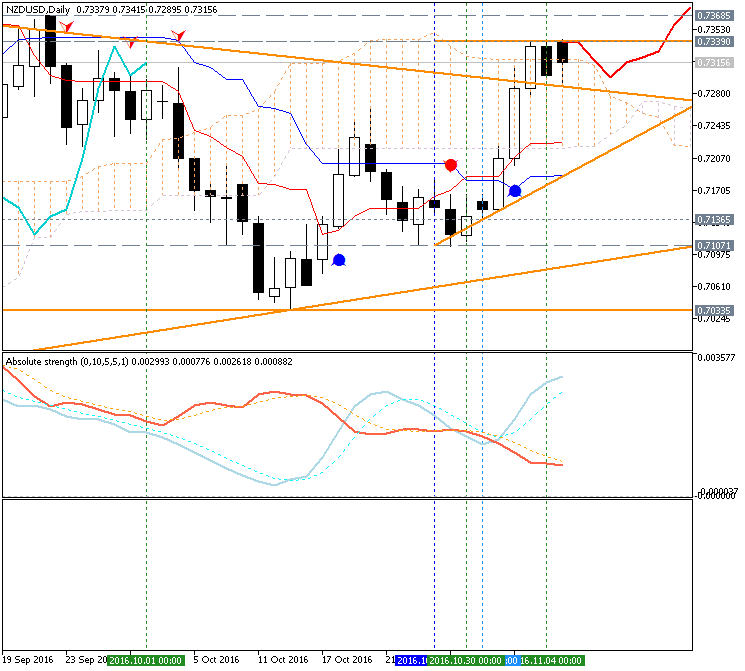

Weekly Fundamental Forecast for NZD/USD (based on the article)

NZD/USD - "The New Zealand Dollar has continued to show steady appreciation on the crosses as economic data is supportive, yet the kiwi remains susceptible to weakness continuing against the USD and possible the JPY should a risk shock take place."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

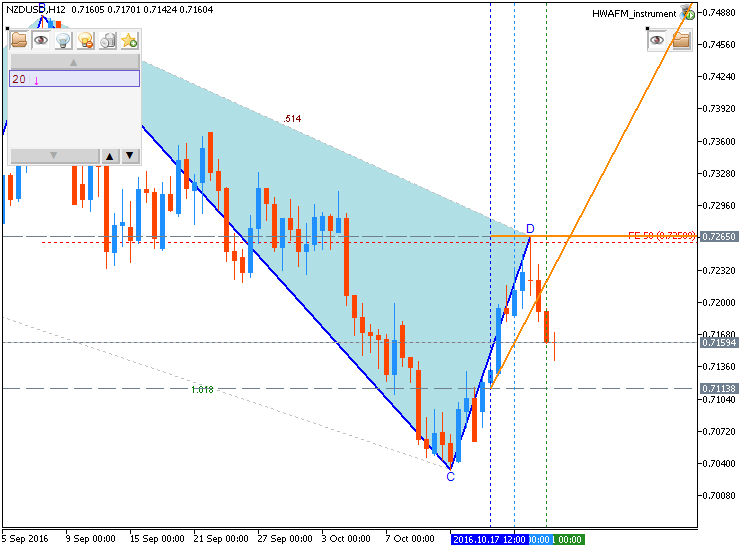

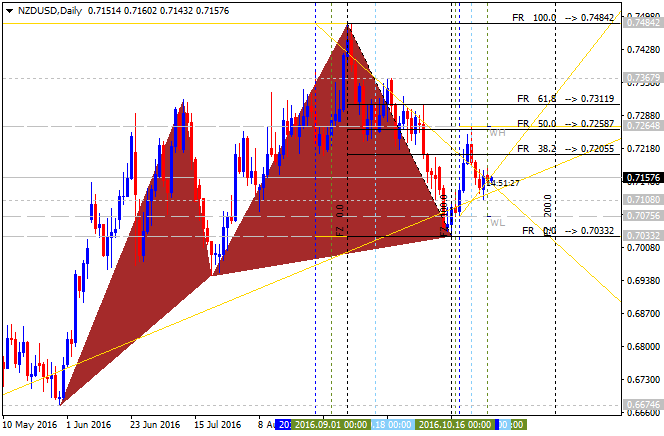

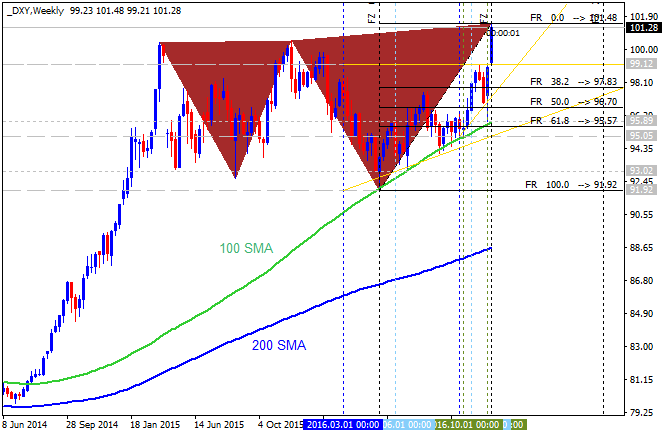

NZD/USD October-December 2016 Forecast: ranging within narrow s/r levels for the bullish trend to be continuing

W1 price is located above Ichimoku cloud in the primary bullish area of the chart: the price was on the bullish reversal based on breakout started from the February this year by the crossing Ichimoku cloud to above and breaking strong resistance levels on the way to the bullish market condition. For now, the price is on bullish ranging within narrow support/resistance levels: 0.7379/0.7484 resistance for the bullish trend to be resumed and 0.7085 support level for the secondary correction to be started. The bearish reversal levels for this pair on weekly timeframe are 0.6793/0.6630 support, and if the price breaks those levels to below on close weekly bar so the global bearish reversal will be started.

Chinkou Span line is located above the price indicating the bullish market condition, Tenkan-sen line is above Kijun-sen line for the bullish trend as well, and Absolute Strength indicator is estimating the trend to be ranging bullish in the future.

Trend:

W1 - ranging bullish