You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Credit Agricole: Get Ready For Volatile Week (based on the article)

Short GBPUSD An Attractive Relative Value Trade by BNPP (based on the article)

Weekly price is located below Ichimoku cloud for the ranging condition within the narrow support/resistance levels:

Absolute Strength indicator is estimating the ranging trend to be continuing for the following few months for example.

Most likely scenario for the weekly price in the medium term situation is the following: bearish ranging within the narrow levels waiting for the direction of the trend to be started.DAX Index: Levels to watch - intra-day bearish breakdown (based on the article)

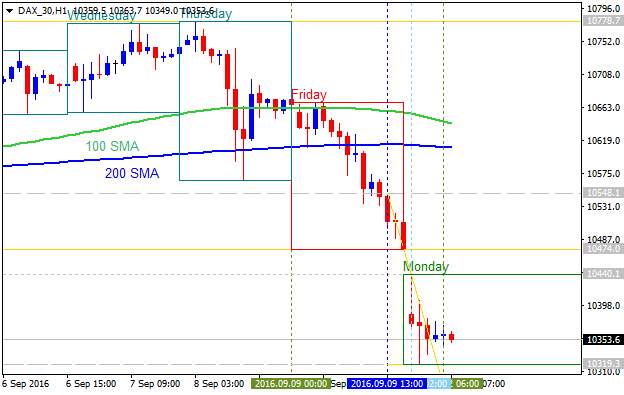

Hi price broke 100 SMA/200 SMA reversal area to berlow for the bearish market condition. The price is on ranging within 10,440 resistance and 10,319 support level for this morning.

If H1 price breaks 10,440 resistance to above on close bar so the secondary rally within the primary bearish trend will be started with 10,474 level as a nearest target to re-enter.If H1 price breaks 10,319 support level to below on close bar so the primary bearish trend will be resumed.

If not so the price will be on bearish ranging within the levels

USD/CNH Intra-Day Fundamentals: China Industrial Production and 24 pips price movement

2016-09-13 02:00 GMT | [CNY - Industrial Production]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Industrial Production] = Change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

==========

From News Dog article:

==========

USD/CNH M5: 24 pips price movement by China Industrial Production news event

GBP/USD Intra-Day Fundamentals: U.K. Consumer Price Index and 31 pips range price movement

2016-09-13 08:30 GMT | [GBP - CPI]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - CPI] = Change in the price of goods and services purchased by consumers.

==========

CPI 12-month inflation rate for the last 10 years: August 2006 to August 2016:

==========

GBP/USD M5: 31 pips range price movement by U.K. Consumer Price Index news event

AUD/USD Technical Analysis: Aussie Rejected at 0.77 Figure (based on the article)

H4 price is on bearish condition located below 100 SMA/200 SMA: price was bounced from 0.7731 resistance level to below for the breakdown with the bearish reversal. Fow now, the price is on bearish ranging within narrow support/resistance levels: 0.7567 resistance and 0.7493 support.

If H4 price breaks 0.7567 resistance level to above on close bar so the local uptrend as the bear market rally will be started.

If H4 price breaks 0.7493 support level to below so the primary bearish trend will be resumed.

If not so the price will be on bearish ranging within the levels.

SUMMARY : bearish

TREND : rangingNZD/USD Intra-Day Fundamentals: NZ Current Account and 11 pips range price movement

2016-09-13 22:45 GMT | [NZD - Current Account]

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - Current Account] = Difference in value between imported and exported goods, services, income flows, and unilateral transfers during the previous quarter.

==========

==========

NZD/USD M5: 11 pips range price movement by NZ Current Account news event

AUD/USD Intra-Day Fundamentals: Westpac-Melbourne Institute Consumer Sentiment and 12 pips range price movement

2016-09-14 00:30 GMT | [AUD - Westpac Consumer Sentiment]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Westpac Consumer Sentiment] = Change in the level of a diffusion index based on surveyed consumers.

==========

From thebull.com.au article:

"Wisest place for savings: Banks (chosen by 29.9 per cent of respondents) were regarded as the wisest place for new savings from “Pay Debt” (21.0 per cent) and Real Estate (15.4 per cent)."

"Less certain: Over 5 per cent of respondents don’t know the best place to put new savings."

"These are uncertain times. And that is shown by the views of Aussie consumers regarding the best place to put new savings. Before 2015, Aussie consumers had firm views about where to put new savings. But over the past year, the proportion of people unsure about the best place to put new savings has lifted to the highest levels on record. In March this year 7 per cent of people said that they didn’t know the wisest place for savings. The latest survey result showed that the proportion of undecided consumers was still high at 5.3 per cent."

==========

AUD/USD M5: 12 pips range price movement by Westpac-Melbourne Institute Consumer Sentiment news event

GBP/USD Intra-Day Fundamentals: U.K. Jobless Claims and 27 pips range price movement

2016-09-14 08:30 GMT | [GBP - Claimant Count Change]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Claimant Count Change] = Change in the number of people claiming unemployment-related benefits during the previous month.

==========

UK Claimant Count (people), seasonally adjustedAugust 2011 to August 2016

For August 2016 there were 771,000 people claiming unemployment related benefits. This was:

==========

GBP/USD M5: 27 pips range price movement by U.K. Jobless Claims news event

AUD/USD Intra-Day Fundamentals: Australia Employment Change and 29 pips price movement

2016-09-15 01:30 GMT | [AUD - Employment Change]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Employment Change] = Change in the number of employed people during the previous month.

==========

==========

AUD/USD M5: 29 pips price movement by Australia Employment Change news event