You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

"Despite forecasts for an uptick in the jobless rate, a 1.8K rebound in Canada Employment may heighten the appeal of the loonie and spur a near-term decline in USD/CAD as the data highlights an improved outlook for growth and inflation."

What’s Expected:

Why Is This Event Important:

"Even though the Bank of Canada (BoC) retains a cautious outlook for the real economy, Governor Stephen Poloz and Co. may stick to the sidelines throughout 2016 and show a greater willingness to gradually move away from its easing cycle especially as Prime Minister Justin Trudeau implements fiscal support to encourage a stronger recovery."

====

USD/CAD Technical Analysis: bearish ranging near bullish reversal within narrow s/r levels waiting for direction

Daily price was on breakout with the bearish reversal: price broke Ichimoku cloud to below to be reversed to the primary bearish market condition. For now, the price is moved along one of the Senkou Span line for the bullish trend to be resumed or for the bearish trend to be continuing.

Absolute Strength indicator is estimating the ranging condition, and Trend Strength indicator is evaluating the trend as the primary bearish in the near future.

If D1 price will break 1.2654 support level on close bar so the primary bearish trend will be continuing with 1.2460 level as a possible bearish target.

If D1 price will break 1.3187 resistance level on close bar so the price will be reversed back to the bullish market condition.

If not so the price will be on ranging within the levels.

SUMMARY : bearish

TREND : waiting to break the levels for direction

Forum on trading, automated trading systems and testing trading strategies

Forecast for Q2'16 - levels for USD/CAD

Sergey Golubev, 2016.06.10 12:03

==========

USD/CAD M5: 85 pips price movement by Canada's Employment Change news event

SILVER (XAG/USD) Technical Analysis: weekly ranging bearish, daily ranging bullish, 17.99 is the key level (adapted from the article)

Weekly price is located within 100 SMA/200 SMA and below 200 SMA for the ranging bearish market condition. The price is on ranging within 17.99 resistance and 15.80 support levels waiting for the primary bearish trend to be continuing or for the bullish reversal to be started.

Silver is finding good resistance around the 17.31 level we had penciled in, so we will work with that as the first hurdle to overcome. Around 17.55 is the next top-side level to worry about, and then if things get really out of hand in the short-term we have the April peak at 18 (17.99 if you are counting pennies)."

Fundamental Weekly Forecasts for Dollar Index, NZD/USD, GBP/USD, USD/CAD, USD/CNH, USD/JPY, AUD/USD and GOLD (based on the article)

Dollar Index - "Aside from monetary policy, however, the general conditions of the market are increasingly important. The Dollar hasn’t resorted to its ultimate safe haven status in some time as the market’s complacency has afforded an unsteady peace in the markets. However the degree of concern beneath the surface is increasingly clear to the market rank. If confidence falters, the Dollar may (begrudgingly) return to its haven roots."

NZD/USD - "Despite the macro-prudential measures designed to offset continued gains in New Zealand real estate, it’s becoming increasingly unlikely that we’ll see a near-term rate cut out of the RBNZ until the situation changes. The short-term issue is global inflation continuing to lag and that’s surely continuing to effect the lack of inflation in the New Zealand economy, but the systemic concerns around a housing bubble can have far more grave consequences; and given the RBNZ’s recent stance, it appears unlikely that they’ll further that long-term risk of a deepening a housing bubble by molding policy to shorter-term needs."

GBP/USD - "What happens to the Sterling if the UK votes for “Brexit”? The short answer seems obvious—the GBP will fall. By how much? This question is substantially more complicated, but current FX Options prices suggest anywhere between 4-7 percent in one fell swoop. The ensuing uncertainty would almost certainly produce shockwaves beyond Britain’s shores and onto broader global financial markets, and modeling every possibility seems nearly impossible."

USD/CAD - "A minor data point compared to the inflation reading on Friday will be the Manufacturing Sales on Wednesday. The prior print of -0.9% MoM and 3.1% annualized will be a basis to compare Wednesday print. However, the print will be discounted given the large macro even south of the border when the Federal Reserve releases their June rate decision at 2:00 pm EST."

USD/CNH - "The Federal Reserve’s next policy meeting will be held next week. As the Chinese currency become more market-driven, China’s most important counterpart, the US, has contributed to some of the largest moves to the Yuan pairs, such as the recent bout of Dollar weakness being driven by a disappointing non-farm payrolls print. Although the June rate hike is less likely, any clue that hints a July rate hike could largely affect the Dollar pairs, including the Dollar-Yuan. Other key US data, such as the May Industrial Production and the Jobless Claims, could affect the Dollar-Yuan pairs as well. China’s domestic Industrial Production and Retail Sales gauges may have limited impact on Yuan pairs unless we see a significant miss, as it has already been well-known that China’s manufacturing industries would have to take a quite long time (at least two years) to recover."

USD/JPY - "The BoJ may largely endorse a wait-and-see approach especially as Prime Minster Shinzo Abe delays the sale-tax hike and pledges to take ‘bold’ measures to encourage a stronger recovery, and more of the same from Governor Haruhiko Kuroda and Co. may boost the appeal of the Japanese Yen as market participants scale back bets for more non-standard measures. Moreover, a further deterioration in risk sentiment may also heighten the appeal of the low-yielding currency, and the weakening outlook for global growth may prop up the Yen as Japan returns to its historical role as a net-lender to the world economy."

AUD/USD - "May’s labor-market figures will be in the spotlight on the domestic front. A net 16.5k jobs gain is expected while the unemployment rate holds unchanged at 5.7 percent. Australian economic news-flow has increasingly improved relative to consensus forecasts since late April, opening the door for an upside surprise. Such an outcome may reinforce an image of the RBA that is in no hurry to resume the rate cut cycle, a presumably supportive proposition for the currency."

GOLD (XAU/USD) - "On the back of last month’s dismal Non-Farm Payroll report, expectations for the timing of Fed normalization have been pushed out with markets now pricing in the first rate hike to be in February of 2017. If the Fed projections are adjusted to reflect market expectations, look for the repricing to remain supportive of gold prices as concerns about domestic growth, a material slowdown in China and the upcoming UK referendum continue to set a high bar for the possibility off Fed tightening."

Weekly Outlook: 2016, June 12 - June 19 (based on the article)

The US dollar was on the back foot, but the managed to recover some of the losses. Inflation data in the UK and the US, Employment data from the UK and Australia, US retail sales and no less than 4 rate decisions,with the Federal Reserve standing out from the crowd. These are the main events for this busy week.

Fed-BOE-BOJ Rates, Apple Meeting, Brexit: Week Ahead June 13-18 (based on the article)

USD/CNH Intra-Day Fundamentals: China Industrial Production and 54 pips price movement

2016-06-13 02:00 GMT | [CNY - Industrial Production]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Industrial Production] = Change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

==========

"Industrial output in China was up 6.0 percent on year in May, the National Bureau of Statistics said on Monday - in line with expectations and unchanged from the previous month."

==========

USD/CNH M5: 54 pips price movement by China Industrial Production news event

EUR/USD Price Action Analysis - bullish ranging near 50.0% Fibo level for the secondary daily correction to the possible bearish reversal

Daily price is above 200 SMA and near-and-above 100 SMA for the bullish market condition with the ranging within Fibo resistance level at 1.1415 and Fibo bearish reversal level at 1.1070.

If the price will break Fibo support level at 1.1070 so the reversal of the price movement from the primary bullish to the primary bearish market condition will be started.

If the price will break Fibo resistance level at 1.1415 from below to above so the primary bullish trend will be continuing with good possible breakout of the price movement up to 1.1615 as a possible bullish target.

If not so the price will be ranging within the levels.

Trend:

D1 - ranging bullish near bearish reversal areaFitch Rating - the outlook was lowered to "Negative" from "Stable" (from the article)

-

"A pickup in the headline & core U.K. Consumer Price Index (CPI) may

spark a near-term rebound in GBP/USD as it puts pressure on the Bank of

England (BoE) to normalize monetary policy sooner rather than later."

- "Even though the economic outlook remains clouded by the U.K. Referendum

on June 23, signs of heightening price pressures may encourage the BoE

to adopt a more hawkish tone for monetary policy as Governor Mark Carney

and Co. see a risk of overshooting the 2% inflation-target over the

policy horizon."

What’s Expected:===

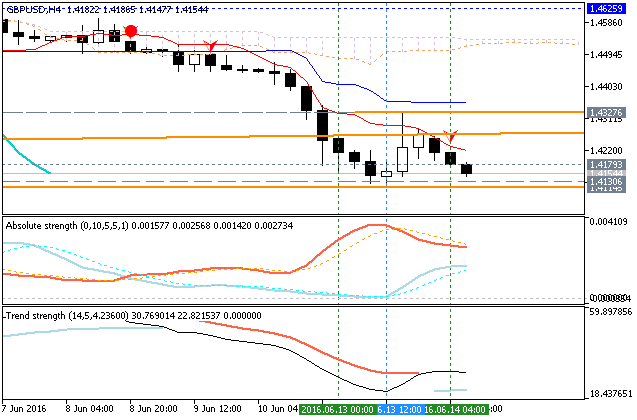

GBP/USD Technical Analysis: daily bearish breakdown, intra-day ranging bearish

GBPUSD D1: bearish breakdown. The daily price is on bearish market condition: price broke Ichimoku cloud to below for good breakdown with 1.4130 support level. Absolute Strength indicator and Trend Strength indicator are estimating the bearish trend to be continuing.

If the price breaks 1.4130 support to below on close D1 bar so the bearish breakdown will be continuing.

If the price breaks Senkou Span line at 1.4480 to above so the reversal of the price movement to the primary bullish condition will be started.

If not so the price will be on ranging bearish within the levels.

GBPUSD H4: bearish ranging within narrow levels. The price is on bearish condition for the ranging within narrow support/resistance levels: 1.4130 support and 1.4327 resistance.

If the price breaks 1.4130 support to below on close H4 bar so the bearish trend will be continuing.If the price breaks 1.4327 resistance to above so the local uptrend as the bear market rally will be started.

If not so the price will be on ranging bearish within the levels.

Forum on trading, automated trading systems and testing trading strategies

Forecast for Q2'16 - levels for GBP/USD

Sergey Golubev, 2016.06.14 08:53

GBP/USD M5: 36 pips range price movement by U.K. CPI news event

EUR/USD Intra-Day Fundamentals: U.S. Retail Sales and 10 pips price movement

2016-06-14 12:30 GMT | [USD - Retail Sales]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

CNBC reported:

==========

EUR/USD M5: 10 pips price movement by U.S. Retail Sales news event