You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

GBP/USD Intra-Day Fundamentals - BOE Governor Mark Carney speaks and 25 pips price movement

2016-01-12 14:15 GMT | [GBP - BOE Governor Mark Carney speaks]

[GBP - BOE Governor Mark Carney speaks] = Discussion titled "Legacy for Business Models and Financial Stability" at the Farewell Symposium for Christian Noyer, in Paris. As head of the central bank, which controls short term interest rates, he has more influence over the nation's currency value than any other person. Traders scrutinize his public engagements as they are often used to drop subtle clues regarding future monetary policy.

==========

GBPUSD M5: 25 pips price movement by GBP - BOE Governor Mark Carney speaks :

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

Sergey Golubev, 2014.12.20 08:14

What is an Inside bar? (based on dailyfx article)

Inside bars are easily identified pricing patterns that can be found on virtually any chart. The pattern itself requires some simple technical analysis, which includes identifying a series of highs and lows on a daily chart. The idea is that the current candle on the graph will not exceed the previous candles high or low, thus leaving it “inside”.

Weekly bearish ranging below 50.0% Fibo resistance level (adapted from the article)

Weekly price is located below 200 period SMA and 100 period SMA for the primary bearish market condition:

If the price will break Fibo support level at 1046.23 so the primary bearish trend will be continuing.

If the price will break 50.0% Fibo resistance level at 1119.33 from below to above so the local uptrend as the bear market rally will be started.

If the price will break Fibo resistance level at 1191.26 from below to above so the reversal of the price movement from the primary bearish to the primary bullish trend will be started.

If not so the price will be ranging within the levels.

- Recommendation for long: watch close W1 price to break 1119.33 for possible buy trade with 1191.26 target to re-enter

- Recommendation

to go short: watch W1 price to break 1046.23 support level for possible sell trade

- Trading Summary: ranging

Trend:W1 - ranging bearish

Intra-Day Fundamentals - China CGAC Trade Balance and 67 pips price movement for majors

2016-01-13 02:00 GMT | [CNY - CGAC Trade Balance]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - CGAC Trade Balance] = Difference in value between imported and exported goods during the previous month. Export demand/currency demand are directly linked with each other: foreigners buy the domestic currency to pay for the exports.

==========

EURUSD M5: 14 pips price movement by CNY - CGAC Trade Balance news event :

==========

GBPUSD M5: 11 pips price movement by CNY - CGAC Trade Balance news event :

==========

USDJPY M5: 31 pips price movement by CNY - CGAC Trade Balance news event :

==========

USDCHF M5: 11 pips price movement by CNY - CGAC Trade Balance news event :

AUD/USD Intra-Day Fundamentals - Employment Change and 37 pips range price movement

2016-01-14 00:30 GMT | [AUD - Employment Change]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Employment Change] = Change in the number of employed people during the previous month.

==========

==========

AUDUSD M5: 37 pips range price movement by AUD - Employment Change news event :

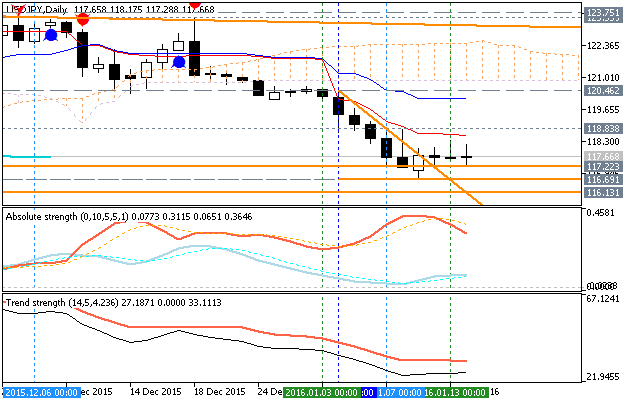

D1 price is on primary bearish market condition:

If the price will break 117.22 support level so the primary bearish will be continuing with 116.13 target to re-enter.If the price will break 118.83 resistance level so the local uptrend as the bear market rally will be started.

If the price will break 123.75 resistance level so the price will be fully reversed to the bullish market condition with good breakout possibility.

If not so the price will be ranging within the levels.

SUMMARY : bearish

TREND : breakdown of support levels

GBP/USD Intra-Day Fundamentals - Official Bank Rate and 54 pips price movement

2016-01-14 12:00 GMT | [GBP - Official Bank Rate]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Official Bank Rate] = Interest rate at which the BOE lends to financial institutions overnight.

==========

"The Bank of England’s Monetary Policy Committee (MPC) sets monetary policy in order to meet the 2% inflation target and in a way that helps to sustain growth and employment. At its meeting ending on 13 January 2016, the MPC voted by a majority of 8-1 to maintain Bank Rate at 0.5%. The Committee voted unanimously to maintain the stock of purchased assets financed by the issuance of central bank reserves at £375 billion, and so to re-invest the £8.4 billion of cash flows associated with the redemption of the January 2016 gilt held in the Asset Purchase Facility."==========

GBPUSD M5: 54 pips price movement by GBP - Official Bank Rate news event :

AUDIO - Gas, Oil and Gold… Oh My! (based on the article)

Solo on the show, Merlin welcomes a small live studio audience, who asks questions pertaining to the decline to oil. Merlin also focuses on listener questions and how to apply risk management techniques to current markets.

EUR/USD Intra-Day Fundamentals - Core Retail Sales and 64 pips price movement

2016-01-15 13:30 GMT | [USD - Core Retail Sales]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Core Retail Sales] = Change in the total value of sales at the retail level, excluding automobiles.

==========

EURUSD M5: 64 pips price movement by USD - Core Retail Sales news event :

What we’re watching (based on the article)