Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.28 08:48

AUD/USD Intra-Day Fundamentals: RBA Assist Gov Edey Speaks and 13 pips price movement

2016-09-28 00:20 GMT | [AUD - RBA Assist Gov Edey Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[AUD - RBA Assist Gov Edey Speaks] = The Speech at the Australian Financial Review Retail Summit, in Melbourne.

=========="This is a conference about the retail industry, not the payments industry. However, a retail business is not a business if the retailer cannot get paid. And a retailer won't be at their most competitive if their payment costs are higher than they should be. This is an issue staff at the Reserve Bank think about every day, and one that I hope retailers are taking a close interest in as well.

Today I'll talk about how the way we pay is changing, and what it means for retail businesses. I'll also talk about the Reserve Bank's role as a payments regulator and about some of the things that are just around the corner in payments."

==========

AUD/USD M5: 13 pips price movement by RBA Assist Gov Edey Speaks news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.28 15:02

Intra-Day Fundamentals - EUR/USD and USD/CAD: Durable Goods Orders

2016-09-28 12:30 GMT | [USD - Durable Goods Orders]

- past data is 3.6%

- forecast data is -1.0%

- actual data is 0.0% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods.

==========

From Market Watch article: Durable-goods orders lose steam in August

"Orders

for durable or long-lasting goods flattened out in August after a

sizable gain in the prior month, pointing to ongoing difficulties for

American manufacturers. Orders fell 22% for large commercial aircraft, a

volatile category

that’s exhibited large swings during the summer. Bookings for new autos

rose 0.7%, however. Stripping out transportation, orders sagged 0.4%,

the Commerce Department said Wednesday. Demand declined for heavy

machinery, computers and electrical equipment. What’s

more, shipments of core capital goods, a category used to help

determine gross domestic product, fell 0.4% to mark the fourth straight

decline."

==========

EUR/USD M5: 16 pips price movement by Durable Goods Orders news events

==========

AUD/USD M5: 15 pips range price movement by Durable Goods Orders news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.01 11:58

Weekly Outlook: 2016, October 02 - October 09 (based on the article)

The third quarter ended with mixed moves in currencies. A full buildup to the US Non-Farm Payrolls, a rate decision in Australia and other figures fill the first week of the last quarter. These are the main events on forex calendar.

- US ISM Manufacturing PMI: Monday, 14:00. Manufacturing PMI is expected to reach 52.1 in September.

- Australian rate decision: Tuesday, 3:30. No change in rates is expected this time. This is the first rate decision made by the new governor Philip Lowe.

- US ADP Non-Farm Employment Change: Wednesday, 12:15. The ADP report is expected to show a 166,000 jobs gain in September.

- US ISM Non-Manufacturing PMI: Wednesday, 14:00. Non-manufacturing activity is expected to reach 53.1 in September.

- US Crude Oil Inventories: Wednesday, 14:30.

- US Unemployment Claims: Thursday, 12:30. The number of new claims is expected to register 255,000 jobs gain this week.

- Canadian employment data: Friday, 12:30. Economists expected a smaller gain of 16,000 jobs and the unemployment rate to remain steady at 6.9%.

- US Non-Farm Payrolls: Friday, 12:30. The number of new jobs in September is expected to be 171,000 while the unemployment rate is forecasted to remain at 4.9%. Wages are projected to rise by 0.2% m/m.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.04 06:06

AUD/USD Intra-Day Fundamentals: RBA Cash Rate and 15 pips price movement

2016-10-04 03:30 GMT | [AUD - Cash Rate]

- past data is 1.50%

- forecast data is 1.50%

- actual data is 1.50% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Cash Rate] = Interest rate charged on overnight loans between financial intermediaries.

==========From Australian Broker article:

- "The Reserve Bank of Australia (RBA) has made it two consecutive months of inaction for Australia’s official cash rate."

- "In what was a widely predicted outcome, today’s RBA board meeting ended with the cash rate remaining at 1.5%, the same outcome that occurred after September’s board meeting."

==========

AUD/USD M5: 15 pips range price movement by RBA Cash Rate news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.06 07:55

AUD/USD Intra-Day Fundamentals: Australian Trade Balance and 7 pips price movement

2016-10-06 00:30 GMT | [AUD - Trade Balance]

- past data is -2.12B

- forecast data is -2.32B

- actual data is -2.01B according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month.

==========

==========

AUD/USD M5: 7 pips price movement by Australian Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.11 06:37

AUD/USD Intra-Day Fundamentals: Australia Home Loans and 50 pips price movement

2016-10-11 00:30 GMT | [AUD - Home Loans]

- past data is -4.5%

- forecast data is -1.3%

- actual data is -3.0% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Home Loans] = Change in the number of new loans granted for owner-occupied homes.

==========From RTT News article:

- "The total number of home loans issued in Australia was down a seasonally adjusted 3.0 percent on month in August, the Australian Bureau of Statistics said on Tuesday - coming in at 53,109."

- "That missed forecasts for a fall of 1.5 percent following the 4.5 percent decline in July."

- "Investment lending added 0.1 percent to A$11.915 billion following the 0.5 percent gain in the previous month."

==========

AUD/USD M5: 50 pips range price movement by Australia Home Loans news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.18 10:38

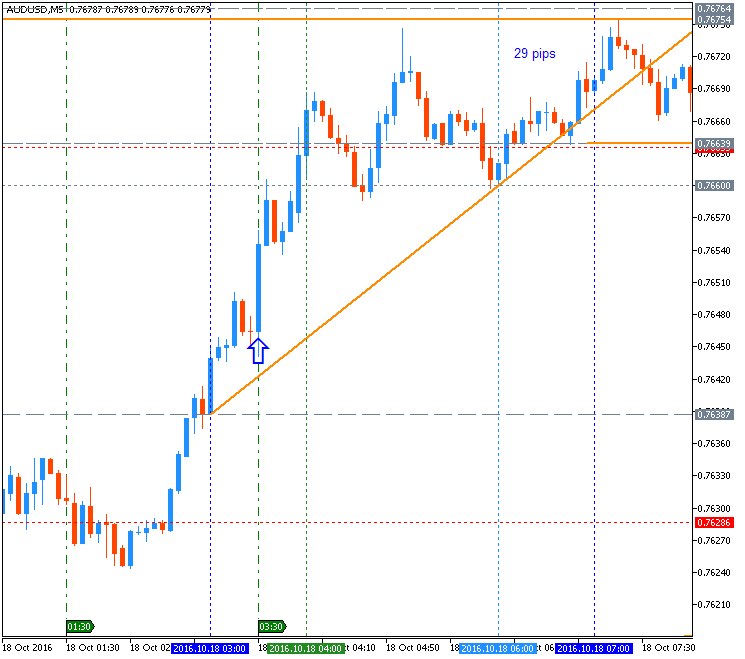

AUD/USD Intra-Day Fundamentals: RBA Monetary Policy Meeting Minutes and 29 pips price movement

2016-10-18 00:30 GMT | [AUD - RBA Monetary Policy Meeting Minutes]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[AUD - RBA Monetary Policy Meeting Minutes] = It's a detailed record of the RBA Reserve Bank Board's most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

==========From official report:

- "Over the past year, the Australian economy had continued its transition following the end of the mining investment boom. Over the year to the June quarter, GDP growth had been a little above estimates of potential, driven mainly by growth in resource exports that had been stronger than expected a year earlier. Growth in the June quarter had been more moderate than in the March quarter. Recent data were consistent with further moderate growth in the September quarter. This implied that, in year-ended terms, growth was expected to decline somewhat in the near term before rising gradually."

- "There remained a degree of uncertainty about the momentum in the labour market. While the unemployment rate had edged down a little further in previous months, broader measures of labour underutilisation had not declined. This was consistent with part-time work having accounted for all of the increase in employment over the year to date and the relative strength of the household services sector, which employs a higher-than-average share of part-time workers. National accounts data had provided some further tentative evidence that growth in employee earnings had stabilised. This was consistent with less downward pressure on earnings associated with the movement of labour from mining to the non-mining sectors of the economy."

==========

AUD/USD M5: 29 pips price movement by RBA Monetary Policy Meeting Minutes news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.20 08:23

AUD/USD Intra-Day Fundamentals: Australia Employment Change and 65 pips range price movement

2016-10-20 00:30 GMT | [AUD - Employment Change]

- past data is -8.6K

- forecast data is 15.0K

- actual data is -9.8K according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Employment Change] = Change in the number of employed people during the previous month.

==========- Employment decreased 9,800 to 11,947,200. Full-time employment decreased 53,000 to 8,105,300 and part-time employment increased 43,200 to 3,841,900.

- Unemployment decreased 12,500 to 705,100. The number of unemployed persons looking for full-time work decreased 7,400 to 492,300 and the number of unemployed persons only looking for part-time work decreased 5,100 to 212,800.

- Unemployment rate decreased 0.1 pts to 5.6%.

- Participation rate decreased 0.2 pts to 64.5%.

- Monthly hours worked in all jobs increased 4.0 million hours to 1,660.0 million hours.

==========

AUD/USD M5: 65 pips range price movement by Australia Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.26 05:52

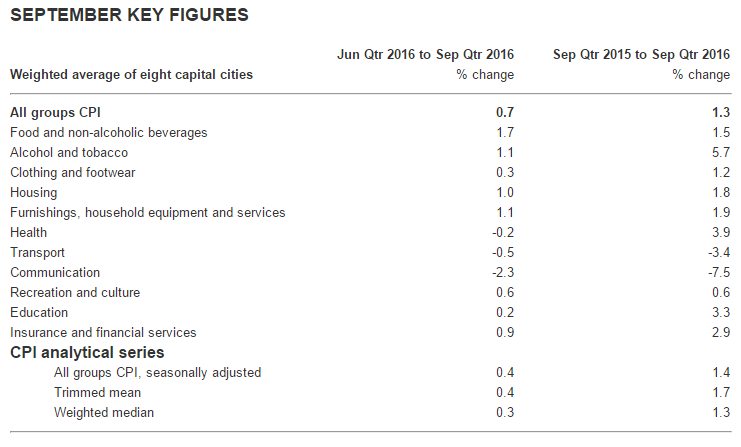

AUD/USD Intra-Day Fundamentals: Australia Consumer Price Index (CPI) and 20 pips range price movement

2016-10-26 00:30 GMT | [AUD - CPI]

- past data is 0.4%

- forecast data is 0.5%

- actual data is 0.7% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - CPI] = Change in the price of goods and services purchased by consumers. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate.

==========

From official report:

==========

AUD/USD M5: 20 pips range price movement by Australia Consumer Price Index (CPI) news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.01 07:19

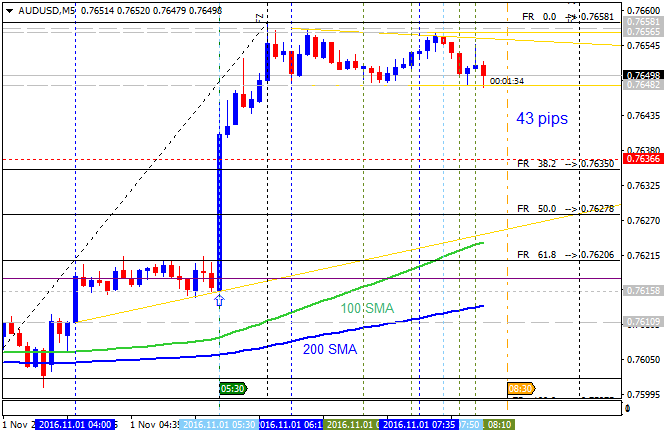

AUD/USD Intra-Day Fundamentals: RBA Cash Rate and 43 pips range price movement

2016-11-01 03:30 GMT | [AUD - Cash Rate]

- past data is 1.50%

- forecast data is 1.50%

- actual data is 1.50% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Cash Rate] = Interest rate charged on overnight loans between financial intermediaries.

==========

From official report:

==========

AUD/USD M5: 43 pips range price movement by RBA Cash Rate news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

AUD/USD October-December 2016 Forecast: ranging bullish waiting for breakout or breakdown

W1 price is on ranging market condition located to be above Ichimoku cloud in the bullish area of the chart. The price is located within 0.7755 resistance level for the bullish trend to be resumed and 0.7330 support level for the bearish reversal to be started. The key resistance level for the bullish trend continuation is 0.7834, and key support for the bearish market condition is 0.7200 psy level with 0.7144 weekly bearish target. Symmetric triangle pattern was formed by the price to be crossed for direction, and descending triangle pattern was formed by the price to be crossed to below for the possible bearish reversal.

Chinkou Span line is located near and above the price indicating the ranging condition and ready for breakout or breakdown in the near future, and Absolute Strength indicator is estimating the trend to be ranging bullish. Tenkan-sen line is above Kijun-sen line for the bullish trend to be resumed.

Trend:

W1 - ranging bullish