- Signals of the Indicator Accelerator Oscillator

- Signals of the Indicator Adaptive Moving Average

- Signals of the Indicator Awesome Oscillator

- Signals of the Oscillator Bears Power

- Signals of the Oscillator Bulls Power

- Signals of the Oscillator Commodity Channel Index

- Signals of the Oscillator DeMarker

- Signals of the Indicator Double Exponential Moving Average

- Signals of the Indicator Envelopes

- Signals of the Indicator Fractal Adaptive Moving Average

- Signals of the Intraday Time Filter

- Signals of the Oscillator MACD

- Signals of the Indicator Moving Average

- Signals of the Indicator Parabolic SAR

- Signals of the Oscillator Relative Strength Index

- Signals of the Oscillator Relative Vigor Index

- Signals of the Oscillator Stochastic

- Signals of the Oscillator Triple Exponential Average

- Signals of the Indicator Triple Exponential Moving Average

- Signals of the Oscillator Williams Percent Range

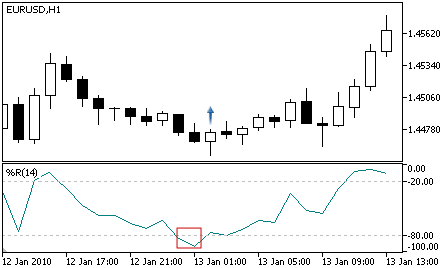

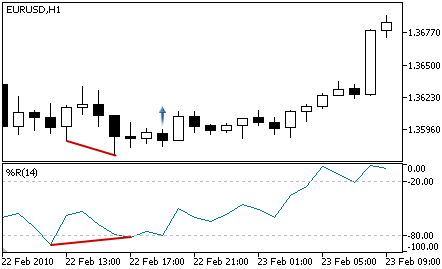

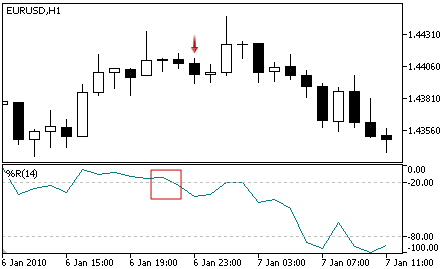

Signals of the Oscillator Williams Percent Range

This module of signals is based on the market models of the oscillator Williams Percent Range. The mechanism of making trade decisions based on signals obtained from the modules is described in a separate section.

Conditions of Generation of Signals

Below you can find the description of conditions when the module passes a signal to an Expert Advisor.

Signal Type |

Description of Conditions |

|---|---|

For buying |

|

For selling |

|

No objections to buying |

Value of the oscillator grows at the analyzed bar. |

No objections to selling |

Value of the oscillator falls at the analyzed bar. |

Note

Depending on the mode of operation of an Expert Advisor ("Every tick" or "Open prices only") an analyzed bar is either the current bar (with index 0), or the last formed bar (with index 1).

Remember that the oscillator Williams Percent Range has a reversed scale. Its maximum value is -100, and minimum is 0.

Adjustable Parameters

This module has the following adjustable parameters:

Parameter |

Description |

|---|---|

Weight |

Weight of signal of the module in the interval 0 to 1. |

PeriodWPR |

Period of calculation of the oscillator. |