Join our fan page

- Views:

- 3406

- Rating:

- Published:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

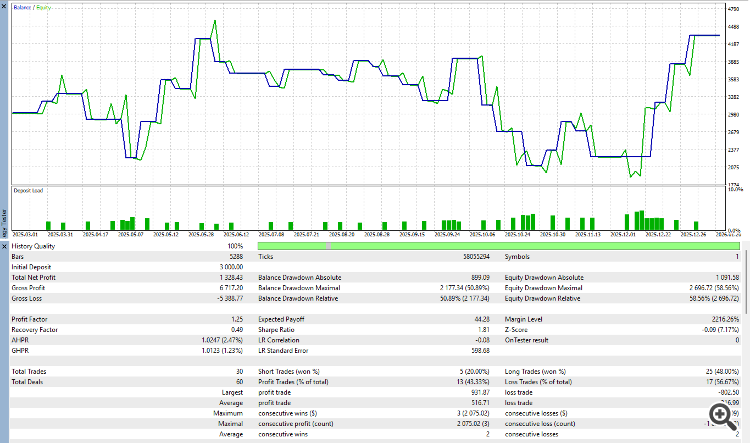

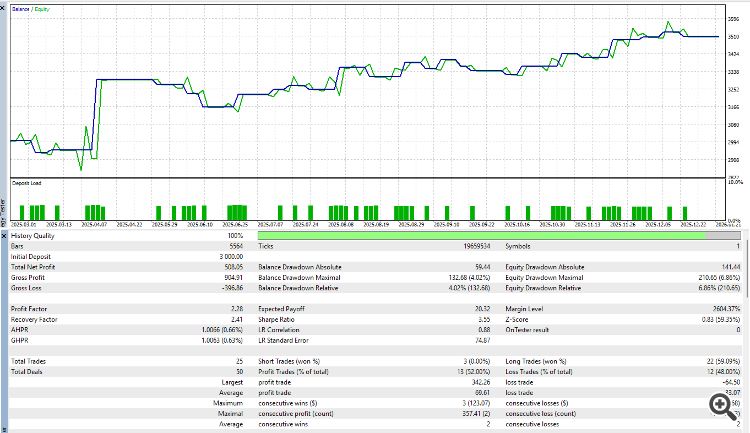

Backtest XAUUSD 01/03/2025 - 20/01/2026 Timeframe H1

1. Overall Concept

This strategy combines machine learning–based market structure classification with rule-based trade execution.

An ONNX model is used to classify the current market structure, while classical technical analysis (moving average trend filter, Fibonacci retracement, ATR, and risk–reward rules) is used to manage entries, exits, and risk.

The system is designed to:

-

Trade only at structurally meaningful pullback levels

-

Avoid overtrading by allowing only one active trade or pending order

-

Use probability confidence filtering from the AI model

-

Apply risk-reward–based trailing stop management

2. Market Structure Classification Using AI

An ONNX model ( market_structure.onnx ) is loaded during initialization.

On every new bar, the model predicts the current market structure state.

Input Features

The model receives six normalized features:

-

Momentum change

Price difference between the current close and the close 5 bars ago, normalized by ATR. -

Distance to recent swing high

Difference between the highest high in the last 50 bars and the current close, normalized by ATR. -

Distance to recent swing low

Difference between the current close and the lowest low in the last 50 bars, normalized by ATR. -

Relative tick volume

Current tick volume compared to the average tick volume of the last 20 bars. -

Candle body strength

Difference between close and open price, normalized by ATR. -

Time feature (hour of day)

Encodes intraday session behavior.

These features allow the model to infer trend strength, pullback depth, volatility, volume context, and session timing.

3. Model Output and Confidence Filtering

The ONNX model outputs:

-

A predicted label representing market structure state

(e.g., higher high, higher low, lower high, lower low) -

A probability score for the predicted class

A trade signal is considered valid only if:

-

The prediction confidence is above the defined threshold (default 0.65)

-

The signal aligns with the higher-timeframe trend filter

This ensures that low-confidence or noisy signals are ignored.

4. Trend Direction Filter

A 50-period Simple Moving Average (SMA) is used as a directional filter:

-

Bullish bias: price is above the SMA

-

Bearish bias: price is below the SMA

Trade directions are constrained as follows:

-

Bullish market structure signals are allowed only in bullish trend

-

Bearish market structure signals are allowed only in bearish trend

This prevents counter-trend entries.

5. Entry Logic Using Fibonacci Retracement

Instead of market orders, the strategy uses pending limit orders at Fibonacci retracement levels.

Pivot Detection

Recent swing high and swing low are detected using a pivot-based method that scans historical highs and lows.

Fibonacci Entry

-

Entry is placed at a predefined Fibonacci retracement level (default 61.8%)

-

This targets pullbacks within a valid market structure, not breakouts

Order Types

-

Buy Limit in bullish conditions

-

Sell Limit in bearish conditions

Each pending order has:

-

Fixed lot size

-

Stop Loss beyond the structure invalidation level

-

Take Profit based on a fixed Risk-Reward ratio (default 1:2)

-

Expiration time to avoid stale orders

6. Risk Management and Trade Limitation

The strategy enforces strict exposure control:

-

Only one open position or one pending order at a time

-

No stacking or martingale behavior

-

Stop Loss is always defined at entry

Risk is structurally bounded by:

-

Market structure invalidation

-

ATR-normalized distance

-

Fixed RR ratio

7. Trailing Stop Based on Risk-Reward Progress

Once a position is active, a Risk-Reward–based trailing stop is applied:

-

Trailing activates after price reaches a predefined fraction of the TP distance

-

Stop Loss is moved progressively toward breakeven and beyond

-

Trailing logic is symmetric for buy and sell positions

This approach:

-

Protects partial profits

-

Allows winners to extend

-

Avoids premature stop-outs caused by noise

8. Visual Feedback

When a trade setup is created:

-

A Fibonacci object is drawn on the chart

-

The object is automatically removed once all trades and pending orders are cleared

This helps visually confirm:

-

Market structure

-

Entry logic

-

Retracement validity

9. Summary of the Methodology

In summary, this strategy follows a hybrid AI + rule-based methodology:

-

AI classifies market structure using normalized, context-aware features

-

High-confidence predictions are filtered by trend direction

-

Trades are executed only at Fibonacci pullbacks within structure

-

Risk is controlled using fixed RR and structural stop placement

-

Profits are managed dynamically using RR-based trailing stops

The result is a disciplined, structure-driven trading system that uses AI for decision support rather than blind automation.

TrendMomentumEA

TrendMomentumEA

Automated trend-following EA using EMA, RSI, and Stochastic signals to open trades on the last closed candle with Stop Loss and Take Profit.

Position Size Pro Lite: Interactive Risk Calculator Panel

Position Size Pro Lite: Interactive Risk Calculator Panel

A professional on-chart panel for instant lot size and risk calculation. Essential for manual traders using strict risk management.

Sideways Martingale

Sideways Martingale

Martingale trend detector use onnx AI

Project Template Generator

Project Template Generator

This script serves as a practical example of how developers can programmatically work with files using MQL5. One of its key objectives is to demonstrate effective project file organization, which is essential for developers working on large-scale systems or aiming to create portable, self-contained projects. The concept can be expanded further and refined with additional ideas to support more advanced development workflows.