Join our fan page

- Views:

- 6606

- Rating:

- Published:

- Updated:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

Some indicators are working equal for all calculation lengths some are not. One example that is not is RSI. Even though it is taken for granted that it oscillates in 0-100 range (so it is normalized already) and regardless of it's obvious usefulness, every serious study stresses not to use lengths > 10 for RSI.

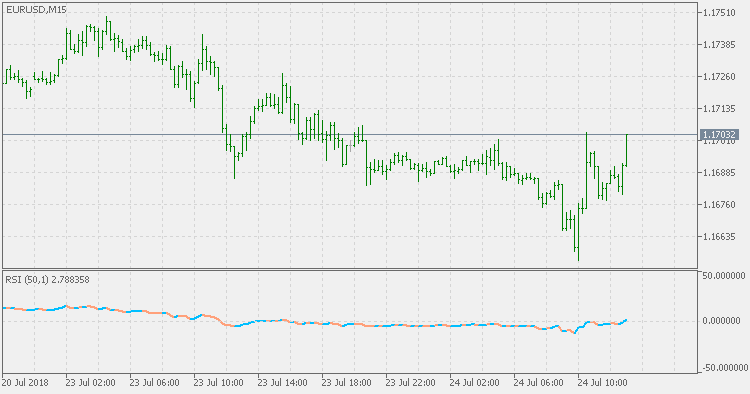

The "RSI problem" is simple: the longer the calculating period, the flatter the RSI becomes. Here is an example of a 50 period RSI:

As it is obvious, it is hardly usable for anything in the original for such a long calculating periods. There were quite a few attempts to change that: Smoothed RSI (that partially avoids that trap, but it quickly loses the advantage over standard RSI), Inverse Fisher Transform of RSI (which also is flattened after some time - here is a comparison of RSI 50 and Inverse Fisher Transform of 50 RSI), and some more.

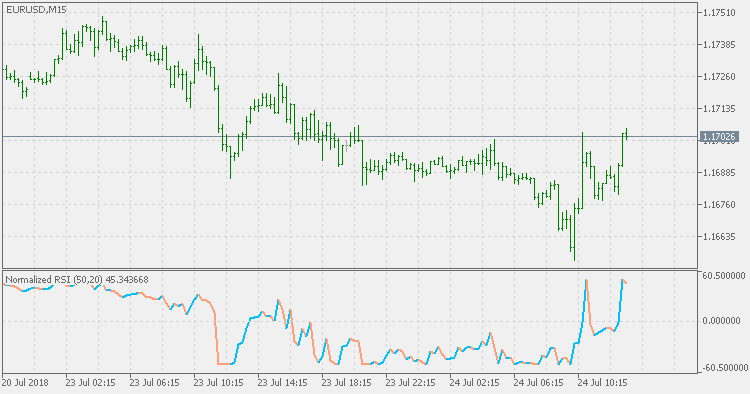

This is one more way that it can possible be done. Here is the example of the same RSI from above but "normalized" to -50 to +50 range:

Some of the issues that were observed are fixed and, the most important, "flattening" is not there any more.

PS: some experimenting is advised (as usual when it comes to "experiments" like these).

Price Zone Oscillator - Floating Levels

Price Zone Oscillator - Floating Levels

Compared to the Price Zone Oscillator indicator, this version is using floating levels to find out the significant levels.

Price Zone Oscillator

Price Zone Oscillator

The formula for Price Zone Oscillator (PZO) depends on only one condition: if today's closing price is higher than yesterday's closing price, then the closing price will have a positive value (bullish); otherwise it will have a negative value (bearish).

Normalized RSI JMA Smoothed

Normalized RSI JMA Smoothed

This version of Normalized RSI is adding JMA smoothing to it in order to make that volatility lesser and to attempt to make the slope of the RSI more usable without adding significant lag.

Sigmoidal Normalized RSI

Sigmoidal Normalized RSI

This is sigmoidal normalized version of RSI. Additional JMA smoothing is used in order to produce smooth results.