Join our fan page

- Views:

- 8869

- Rating:

- Published:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

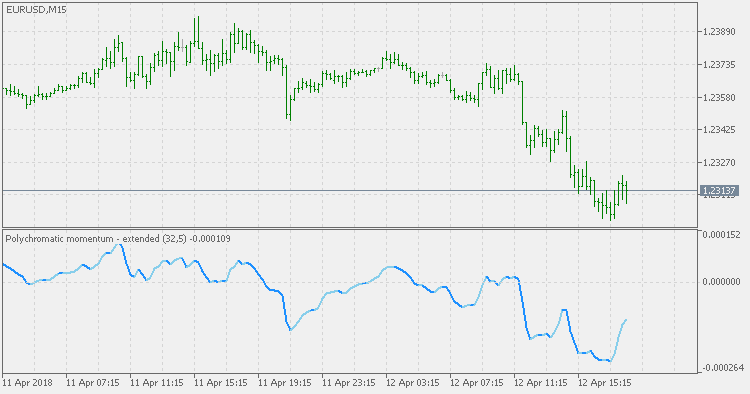

Denis Meyers that invented Polychromatic Momentum, describes it as:

Momentum is defined as the difference, or percent change, between the current bar and a bar some lookback period in the past. The major problem with using momentum based indicators is that the optimum lookback period seems to change over time creating losses with the current chosen lookback period.

To avoid the errors due to a single lookback period we create an indicator that takes an weighted average of all significant lookback periods for the tradable. We named this indicator polychromatic because poly means many and chromatic means colors. Thus, Polychromatic Momentum for this indicator translates into the sum of many Momentums.

The Polychromatic Momentum is by all means a useful indicator. But, as many "raw" momentum indicators do, when used without any form of smoothing, the usefulness of it is somewhat limited by the fact that it "overreacts" to even small changes in some situations, and that makes it difficult to be used for signals.

This version is using double smoothed EMA for smoothing. DSEMA has been proven for producing very good smooth results with a lag that is almost non-existent, hence, in combination with it, the Polychromatic Momentum indicator becomes much more usable when it comes to signals.

Polychromatic Momentum

Polychromatic Momentum

Polychromatic momentum takes an weighted average of all significant lookback periods for the tradable.

Vortex

Vortex

Two lines representing positive and negative directional movement. These will intersect and cross during a change of trend and diverge wider and wider as the strength of the trend increases.

Composite Index

Composite Index

The Composite Index was developed to solve the divergence failure problem in the RSI, but its ability to provide specific horizontal levels of support within the indicator adds to its value. The Composite Index takes the normalized formula of RSI and removes the normalization range restrictions. The formula for the Composite Index uses an embedded momentum calculation with a short-term RSI smoothed.

Synthetic RSI

Synthetic RSI

Instead of using one RSI, the Synthetic RSI indicator is using 3 instances of RSI. Those 3 instances of RSI are then used to calculate the "synthetic" value (that is not an average of the 3 since the calculation differs from an average).