Fundamental Weekly Forecasts for US Dollar, GBPUSD, GOLD, USDJPY and AUDUSD

20 October 2014, 12:11

0

218

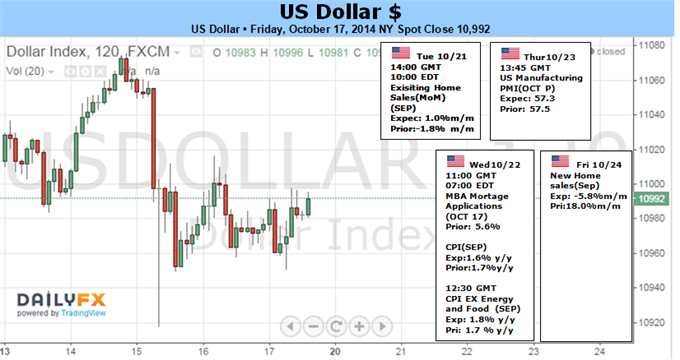

US Dollar Forecast- Dollar and the Markets Contemplate Volatility and QE

Amid extreme financial market volatility swings and talk of US stimulus plans, the US Dollar finished out a second consecutive week in the red. A final consideration for those trading the Majors: counterpart activity. This past week’s shudder in risk has clearly exposed the Euro-area’s troubles. Whether a trigger for global risk aversion or a direct counterbalance for the Dollar, this has considerable potential.

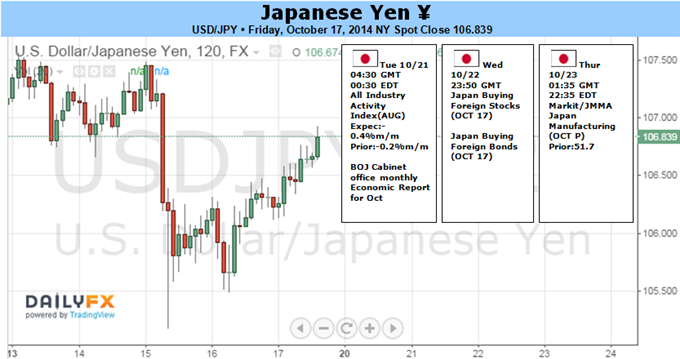

Japanese Yen Forecast – Japanese Yen To Extend Gains on Global Slowdown, Fed Tightening Fears

A lull in homegrown event risk will keep macro-level trends in focus for the Japanese Yen in the week ahead.

Finally, the US data docket is headlined by September’s CPI report. The headline year-on-year inflation rate is expected to slow to 1.6 percent, the lowest since March. However, leading survey data warns that price growth accelerated, with factory-gate prices rising at the sharpest pace yet in 2014 and service-sector output costs reaching a five-month high. That opens the door for an upside surprise, which would help rebuild 2015 Fed rate hike expectations. The prospect of tightening in one of the world’s three main growth hubs even as the other two decelerate bodes ill for risk appetite, amplifying liquidation of Yen-funded carry trades and helping the Japanese unit upward.

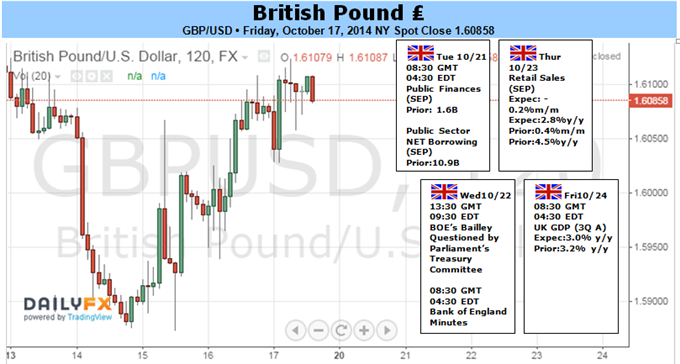

British Pound Forecast – GBP/USD Rebound Vulnerable to Dovish BoE Minutes, Slowing 3Q U.K. GDP

The British Pound may face additional headwinds in the week ahead should the fundamental developments coming out of the U.K. drag on interest rate expectations. Nevertheless, the technical outlook highlights a more meaningful recovery for GBP/USD as the Relative Strength Index (RSI) breaks out of the bearish momentum carried over from the end of June, and we will continue to keep a close eye on the ongoing divergence in the oscillator amid the string of lower highs in price.

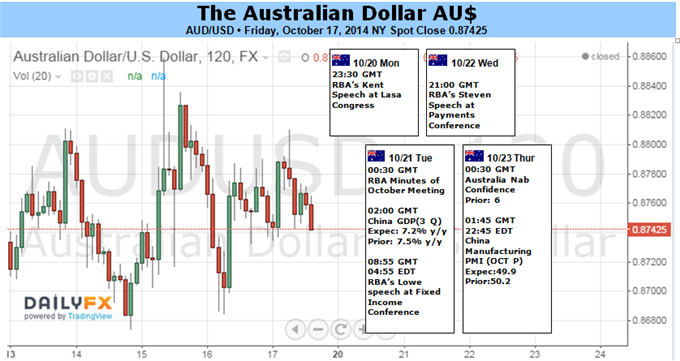

Australian Dollar Forecast – AUD Faces Further Swings On Market Jitters, Q3 Inflation, & China GDP

The Aussie may be in store for another wild week with shifts in general market sentiment, local CPI figures and top-tier Chinese data to offer the currency guidance. Sellers appear intent on keeping the AUD/USD capped below the 89 US cent handle, leaving the risk focused on the 0.8660 barrier for the pair. If broken on a ‘daily close’ basis it could open the next leg lower to the July 2010 low near 0.8320.

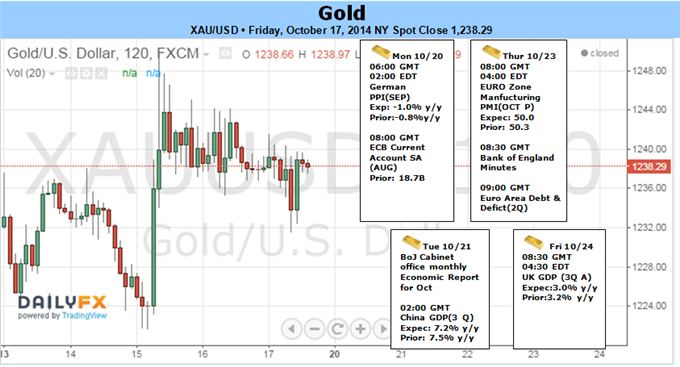

Gold Forecast - Gold Rally at Risk Amid Sticky US Inflation- $1222 Key Support

Gold prices pushed higher for a second consecutive week with the precious metal rallying 1.27% to trade at $1238 ahead of the New York close on Friday. From a technical standpoint, gold tested and defended a key resistance level noted in last week’s update at $1243/44. This region is defined by the 38.2% retracement off the July high, the June close low and is the confluence of two pitchfork resistance lines. Although the broader outlook for gold remains weighted to the downside, we cannot rule out continued strength into the monthly close on account of the monthly opening range break which was validated this week. Bottom line: near-term the trade remains constructive while above $1222 with only a break sub-$1206 putting the bears back in control. A breach above $1244 eyes more significant resistance at $1260/63 and $1283 where ultimately we would start looking for favorable short entries.

Amid extreme financial market volatility swings and talk of US stimulus plans, the US Dollar finished out a second consecutive week in the red. A final consideration for those trading the Majors: counterpart activity. This past week’s shudder in risk has clearly exposed the Euro-area’s troubles. Whether a trigger for global risk aversion or a direct counterbalance for the Dollar, this has considerable potential.

Japanese Yen Forecast – Japanese Yen To Extend Gains on Global Slowdown, Fed Tightening Fears

A lull in homegrown event risk will keep macro-level trends in focus for the Japanese Yen in the week ahead.

Finally, the US data docket is headlined by September’s CPI report. The headline year-on-year inflation rate is expected to slow to 1.6 percent, the lowest since March. However, leading survey data warns that price growth accelerated, with factory-gate prices rising at the sharpest pace yet in 2014 and service-sector output costs reaching a five-month high. That opens the door for an upside surprise, which would help rebuild 2015 Fed rate hike expectations. The prospect of tightening in one of the world’s three main growth hubs even as the other two decelerate bodes ill for risk appetite, amplifying liquidation of Yen-funded carry trades and helping the Japanese unit upward.

British Pound Forecast – GBP/USD Rebound Vulnerable to Dovish BoE Minutes, Slowing 3Q U.K. GDP

The British Pound may face additional headwinds in the week ahead should the fundamental developments coming out of the U.K. drag on interest rate expectations. Nevertheless, the technical outlook highlights a more meaningful recovery for GBP/USD as the Relative Strength Index (RSI) breaks out of the bearish momentum carried over from the end of June, and we will continue to keep a close eye on the ongoing divergence in the oscillator amid the string of lower highs in price.

Australian Dollar Forecast – AUD Faces Further Swings On Market Jitters, Q3 Inflation, & China GDP

The Aussie may be in store for another wild week with shifts in general market sentiment, local CPI figures and top-tier Chinese data to offer the currency guidance. Sellers appear intent on keeping the AUD/USD capped below the 89 US cent handle, leaving the risk focused on the 0.8660 barrier for the pair. If broken on a ‘daily close’ basis it could open the next leg lower to the July 2010 low near 0.8320.

Gold Forecast - Gold Rally at Risk Amid Sticky US Inflation- $1222 Key Support

Gold prices pushed higher for a second consecutive week with the precious metal rallying 1.27% to trade at $1238 ahead of the New York close on Friday. From a technical standpoint, gold tested and defended a key resistance level noted in last week’s update at $1243/44. This region is defined by the 38.2% retracement off the July high, the June close low and is the confluence of two pitchfork resistance lines. Although the broader outlook for gold remains weighted to the downside, we cannot rule out continued strength into the monthly close on account of the monthly opening range break which was validated this week. Bottom line: near-term the trade remains constructive while above $1222 with only a break sub-$1206 putting the bears back in control. A breach above $1244 eyes more significant resistance at $1260/63 and $1283 where ultimately we would start looking for favorable short entries.