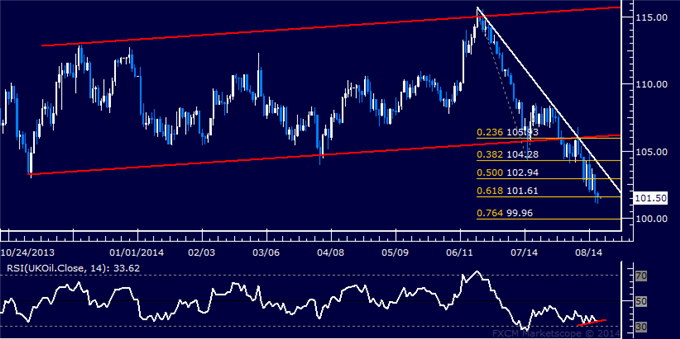

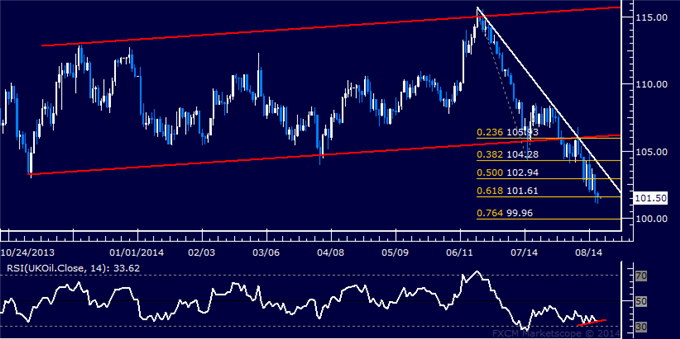

Prices are testing support at 101.61, the 61.8% Fibonacci expansion,

with a break below that on a daily closing basis exposing the 76.4%

level at 99.96. Positive RSI divergence points to ebbing downside

momentum however, warning a bounce may be ahead. A move above the 50%

Fib at 102.94 targets the 103.81-104.28 area marked by a falling trend

line and the 38.2% expansion.

By the way, crude oil prices were mixed in Asia yesterday as investors await the release of US Federal Reserve minutes from its July meeting, while keeping an eye on the latest stockpiles data. US benchmark West Texas Intermediate (WTI) for September delivery rose 34 cents to USD 94.82 on its last day of trading. It tumbled USD 1.93 in New York yesterday as speculative traders sold off ahead of its expiration date. Brent crude for October eased three cents to USD 101.53.

By the way, crude oil prices were mixed in Asia yesterday as investors await the release of US Federal Reserve minutes from its July meeting, while keeping an eye on the latest stockpiles data. US benchmark West Texas Intermediate (WTI) for September delivery rose 34 cents to USD 94.82 on its last day of trading. It tumbled USD 1.93 in New York yesterday as speculative traders sold off ahead of its expiration date. Brent crude for October eased three cents to USD 101.53.

Desmond Chua, market analyst at CMC Markets in Singapore, said dealers

are squaring positions before they scrutinise the minutes of a two-day

Fed meeting that ended on July 30. Investors will be looking at whether the minutes “reveal anything

insightful pertaining to tightening monetary policy”, Chua said.