Why Almost Every US30 EA Fails — And How US30 Scalper Turbo Finally Cracks the Code

Have you wondered why most US30 EAs don’t last long in the market? Sure, they will perform well initially, but they quietly disappear from MQL5 because their results go downhill. I could list a few examples, but naming them might cause unnecessary drama.😉 Before diving into why so many US30 EAs fall short, it’s important to understand why the US30 itself is such a challenging index to consistently profit from.

What Makes US30 So Hard to Profit From

1️⃣ Slippage:

It is no secret that higher the volatility higher the slippage. And because the US30 is one of the most volatile instruments, it’s no surprise that traders often encounter slippage. As a result, you will get bad entries, your stop losses will be bigger which naturally puts a dent in your trading results.2️⃣ Not suited for averaging strategies:

Currency pairs that tend to move sideways—like AUD/CAD, AUD/NZD, and NZD/CAD are best suited for averaging strategies like Grid/martingale. But if there is one instrument that is worst suited for such strategy, it’s definitely the US30. Given its extreme volatility, using averaging strategies on the US30 can end up wiping out your entire account balance.

3️⃣ Weak strategies usually don’t work on it:

I’ve noticed some authors rely on a basic approach of placing buy stops at the previous day’s high and sell stops at the previous day’s low (PDH/PDL). These levels act as liquidity points, and once the price hits them, it often reverses—making this strategy far from profitable. This strategy used to churn out impressive profits, but it’s lost its edge and no longer delivers the same results. This is one of many weak strategies that often fail on US30.

What Separates the US30 Scalper Turbo from the Pack

1️⃣ Entry only in high-volatility windows

The EA looks for volatility around New York session open, when market makers and institutional volume create real movement. Volatility is the lifeline of scalpers and breakout EAs. And my EA trades at a time when the volatility is at its highest.

2️⃣ Solid risk to reward ratio

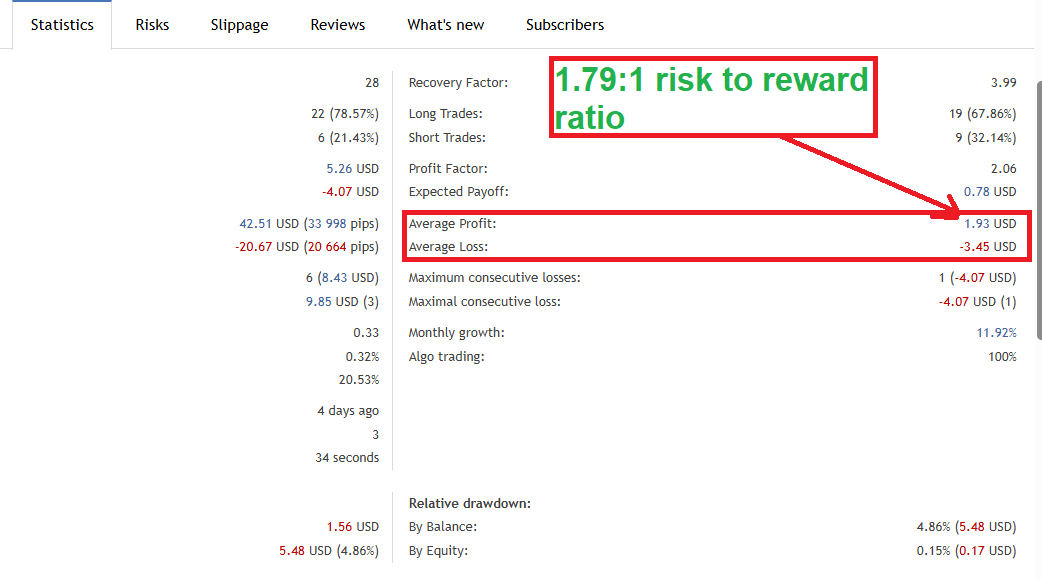

What separates my EA from the rest of the pack is its solid risk to reward ratio. Most of the EAs I have seen on MQL5 share have 1 common denominator: horrible risk to reward ratio. Some of them have 1:5, 1:6 and even 1:7 R to R ratios. This approach may boost your win rate, but if you hit 2–3 stop losses in a row, good luck recovering that. The minimum risk-to-reward ratio of my EA is usually 1:3, though there are times when it gets as high as 1:1. Even if my EA hits a 2–3 trade losing streak, it recovers quickly, all thanks to its strong risk-to-reward ratio.

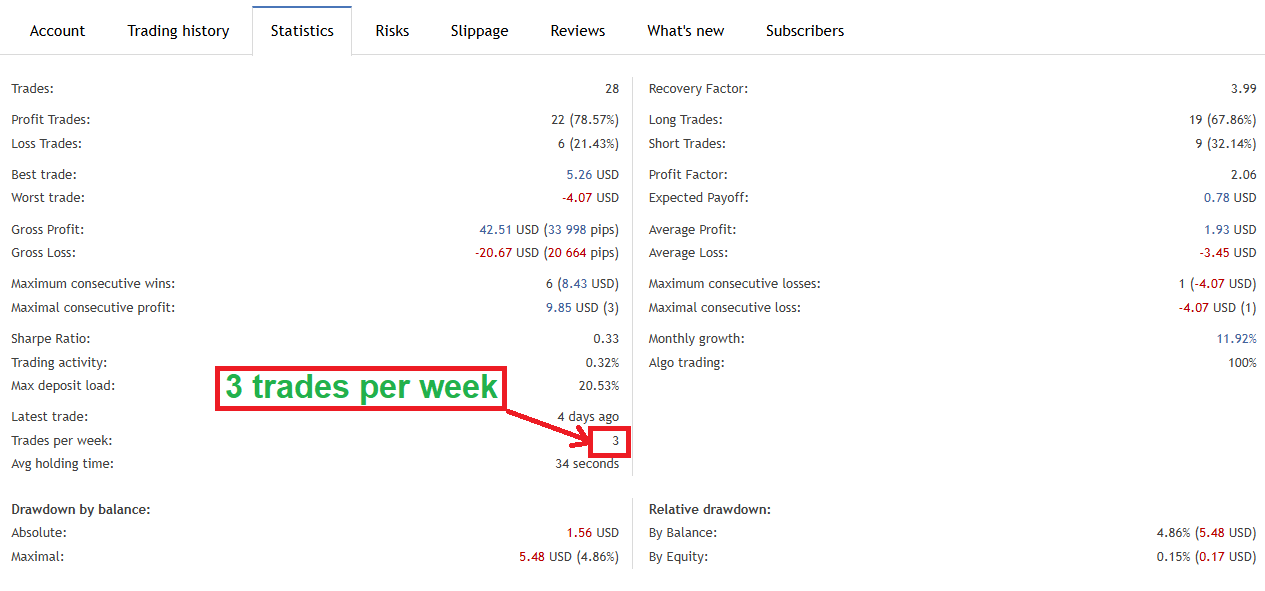

3️⃣ No over trading

After testing hundreds of EAs, one pattern kept showing up: those EAs that over trade don’t last long in the market. Too many trades usually point to weak entry logic. Think about it—have you ever taken a random trade with barely any trading logic? It probably didn’t end well, right?” This is exactly why EAs that trade less often—but rely on solid entry logic—tend to stay profitable much longer. My EA embodies this principle, executing just 3–4 trades weekly.

4️⃣ Spread filter

Placing trades when the spread is sky-high rarely leads to anything positive. If anything, you will get bad entries and book less profit. To tackle this problem, I built a spread filter into my EA, making sure it avoids opening trades whenever the spread gets too high.

🧠Final Thoughts — Scalping Isn’t About Magic, It’s About Discipline

Scalping the US30 index is rewarding, but only with good entry logic, solid risk to reward ratio, no over trading, strict discipline, and realistic expectations. Because the market is always changing it’s essential to update and fine-tune your EAs to adapt to such new conditions. I’m not throwing around buzzwords like AI or neural networks just to boost sales. Instead, I’m openly sharing the actual trading logic behind my EA. For transparency, I’ve also published its signal through a reputable broker—IC Markets.

🔗 ![]() Link to my US30 Scalper Turbo EA: https://www.mql5.com/en/market/product/146875

Link to my US30 Scalper Turbo EA: https://www.mql5.com/en/market/product/146875