INTRODUCTION

Trade Planner is a money management tool that helps control and analyze multiple potential account scenarios within a trading account.

At the core of the program lie two main trading elements:

• VPO— virtual positions, pending orders, or open positions.

• EP — evaluation points acting as target levels that define distinct account scenarios.

By default, a newly created VPO functions as a harmless virtual position trade point. It does not expose your real account to any risk, yet it has all the necessary properties to plan and prepare trades effectively, such as placing pending orders.

When VPOs of any trade type are linked with Evaluation Points (EPs), the Trade Planner provides insight into how key account parameters — including equity, free margin, and margin level — would change, taking into account the profits and swaps of the linked VPOs. This enables traders to anticipate outcomes and manage risk more effectively before significant market movements occur.

QUICK INSTALLATION

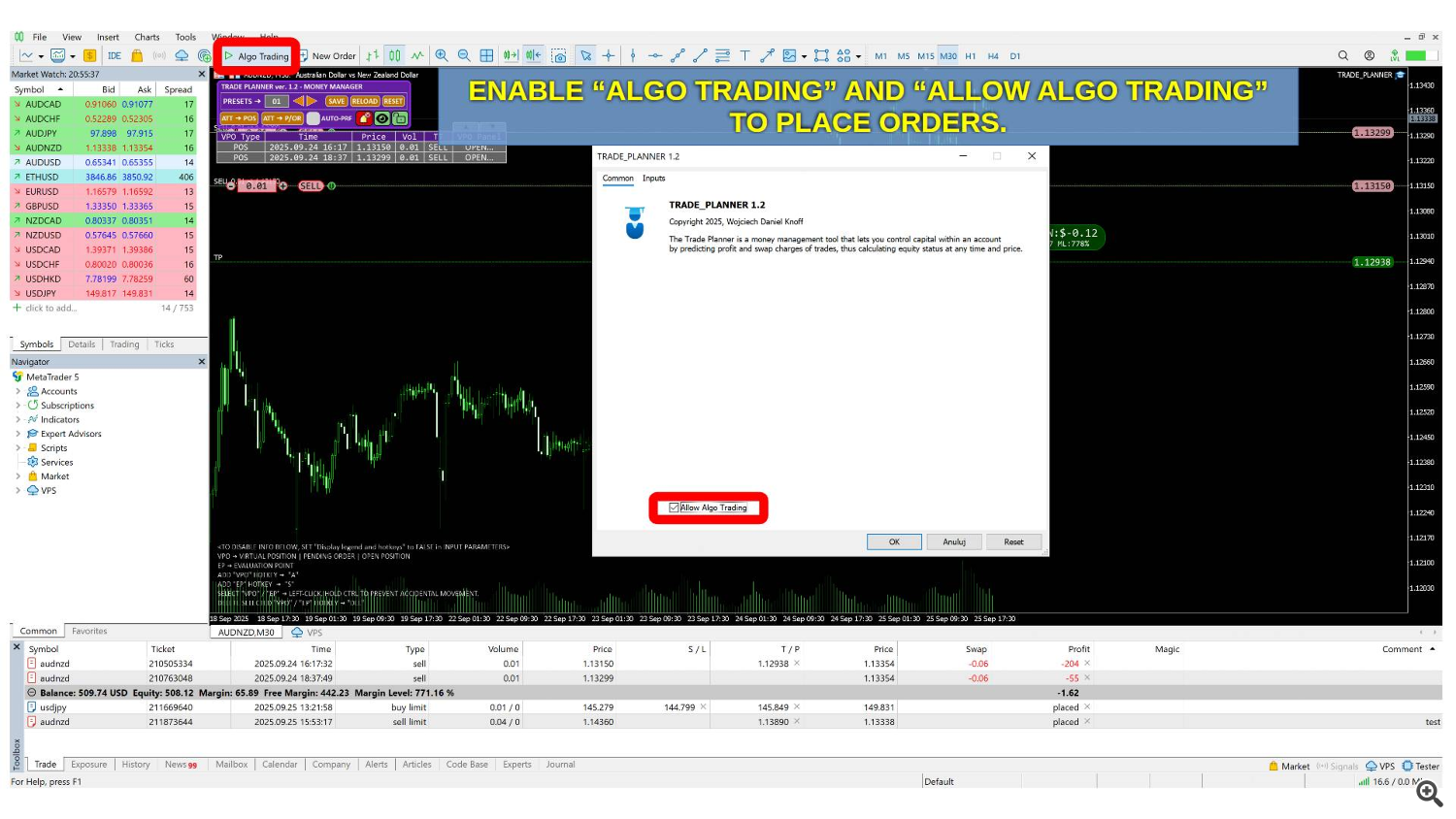

The program functions as an Expert Advisor, allowing it to place pending orders and manage open trades. To enable order management, both “Algo Trading” and “Allow Algo Trading” must be switched on.

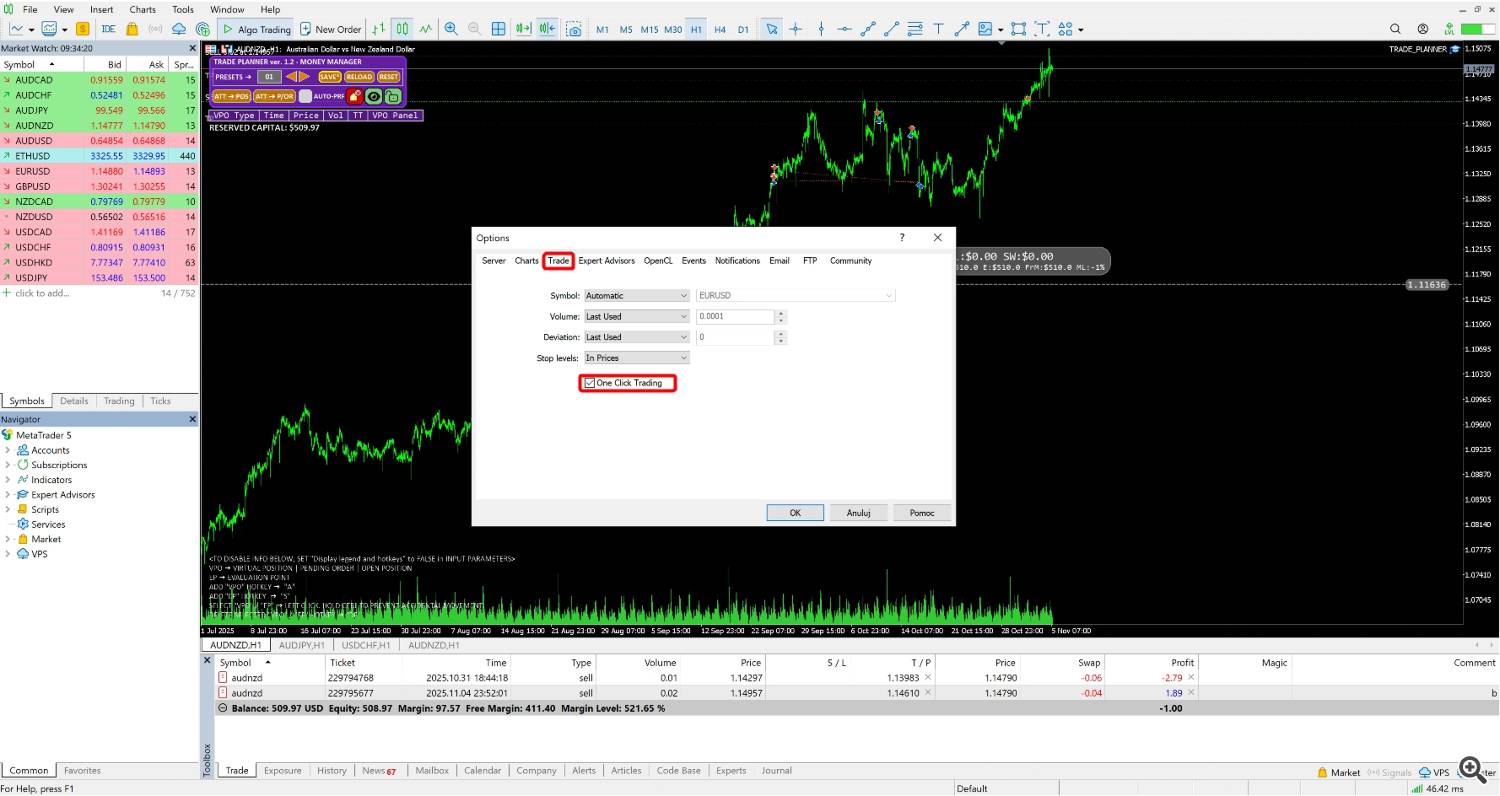

If you wish to skip the order window and modify or delete pending orders instantly from Meta Trader platform, enable One-Click Trading in the terminal options under the ‘Trade’ tab.

Instruction how to install The Trade Planner

FIRST STEPS IN THE TRADE PLANNER

Adding trading points (VPOs) and evaluation point (EP).

Working with VPO-EP lines.

VPO Panel and placing pending orders.

How to attach VPOs trading objects to open positions.

TRADE PLANNER'S GRAPHICAL USER INTERFACE (GUI)

Picture 1. Trade planner’s graphical user interface (GUI).

1. Main Panel – Consists of: presets controls (a) and program tools (b).

1a. Presets controls - allows to save current objects state (layout) at different number (up to 10 presets) per symbol. This part consists of following elements:

- Numeric input box allows change presets by mouse wheel up / down or duplicate existing preset to any other – enter a field by mouse click and type any number in range 1 – 10, then press ENTER. Current layout will be saved on a desired preset program number.

- The left and right arrows for quick move to the previous or next preset.

- The Save, Reload, and Reset buttons allow you to save the current layout, reload the last saved version, or reset everything to the default preset that starts with a single evaluation point.

Here’s the animation showing how to use this section.

1b. Program tools which includes following functions:

- Attaching VPO objects to existing positions (ATT ➔ POS) or pending orders (ATT ➔ P/OR). Before use, make a sure that proper magic number of tracked EA is set (see “Input parameters” section). By default 0 corresponds to all pending orders / open positions for chart symbol. Once the attached VPOs are created, most parameters can be modified except for the volume, trade direction, and comment for this trade point — just like in the terminal.

- ”AUTO-PRF” checkbox. Once VPOs are connected to EP and ”AUTO-PRF” checkbox is enabled, the EP prices will be adjusted to assumed profit (see “Input parameters” → “"AUTO-PRF" profit value (acc. currency). For example it is possible to automatically find breakeven level for VPO group connected to EP, by changing volume, price, trade of any VPO regardless is it virtual position, pending order or open position.

In the case of hedged EP positions (BUY volume = SELL volume), the calculated profit remains almost unchanged regardless of changing EP price. Therefore, this feature is irrelevant in this situation.

- Alarm switch button notify user if distance between current price and any VPO is less or equal to value determined in input parameters.

- Show / hide objects button.

- Lock / unlock objects button.

- VPO / EP Circle Movement Mode: toggle to set the movement axis: XY, X-only, or Y-only. (New in 1.42).

2. VPO Table

A list of all VPOs helps you identify and access any trading point when multiple VPO objects overlap on the chart. To highlight a specific trading point, use the left mouse button or the navigation arrows located in the top-right corner of the table. When a large number of VPOs is present, an additional arrow appears on the right side of the table to help you quickly locate the selected entry in the list.

See an example below how to use the table. Column with the TT title indicates the Trade Direction (trade trend), showing whether the trading point is set to BUY or SELL.

3. Evaluation point (EP)

This is a time-price point acting as separate account (or sub-account) status based on allocate capital. Here, total profits and swaps are calculated from connected VPOs. EP label located above circle consists of :

- P/L – EP summarized profit or loss (account currency)

- SW – EP summarized swap (account currency)

- B - EP balance (account currency)

- E – EP equity (account currency)

- FrM – EP free margin(account currency)

- ML – EP margin level (%)

3A, 3B - A and B corresponds to “optimistic” and “pessimistic” scenario, respectively.

For hedged positions connected to EP (if total volume for BUY positions = total volume of SELL positions), additional *HED* message appears in the label.

4. VPO trade point

It represents a trading element that can function as a virtual position, a pending order, or a real open position. It provides all the necessary parameters—such as volume, trade direction, and price levels—for preparing risk-management setups, placing pending orders, and managing open trades.

5. VPO panel.

This is a control panel that provides additional parameters for preparing or modifying pending orders or open positions. Below is the list of controls inside the panel.

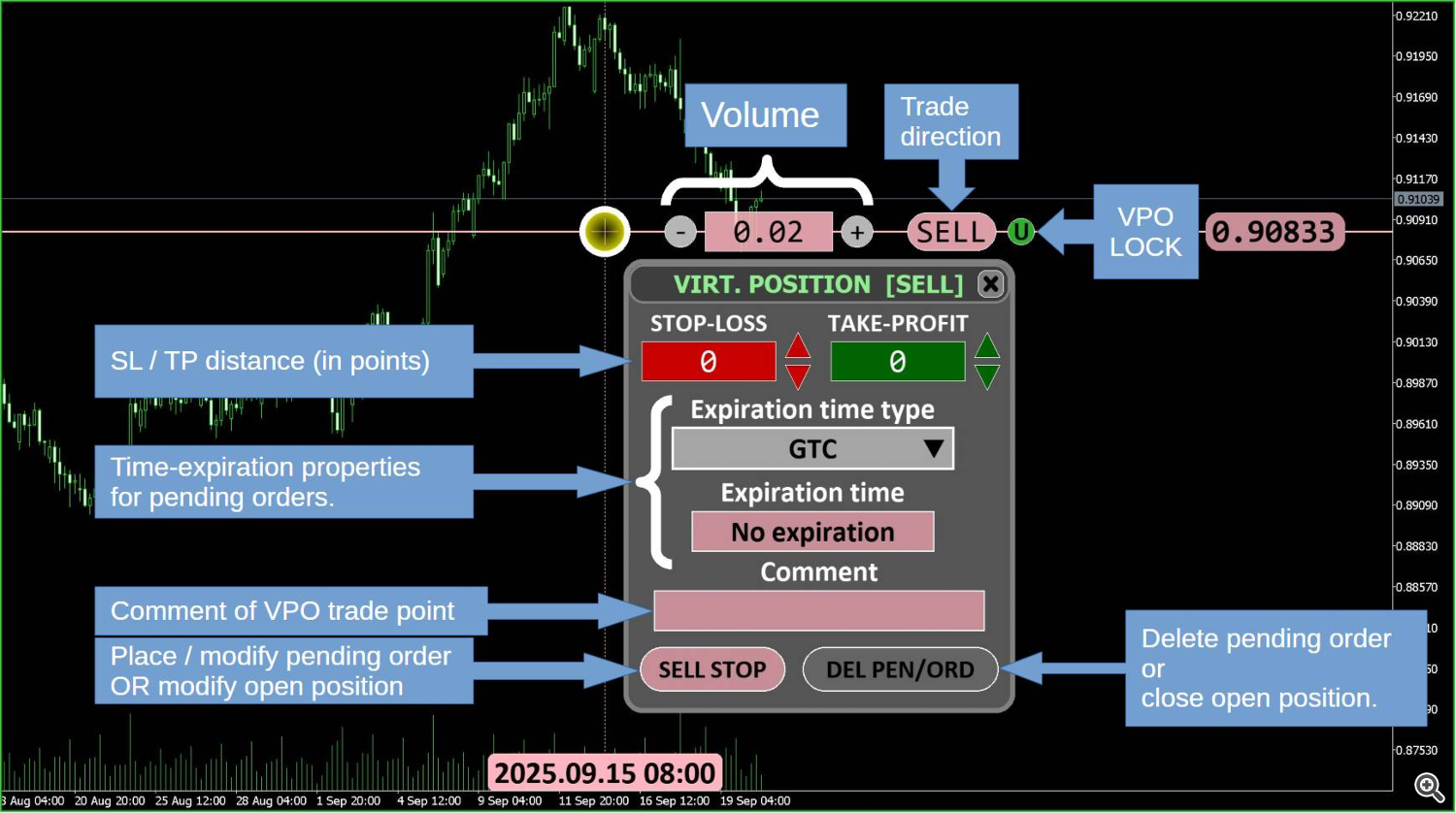

Picture 2. VPO Panel control. Once VPO will be open, volume, trade direction and lock controls will automatically shift to the top / bottom position of this panel.

- Stop-Loss / Take-profit level controls. Trade Planner allows you to set protective orders either from the VPO Panel or directly using VPO circles. The latter method can be applied by holding the SHIFT key and hovering the mouse over a VPO circle, then dragging it up or down to adjust the desired Stop-Loss or Take-Profit distance from the VPO’s open price.

The Trade Planner also makes it possible to check how the EP balance would be affected when the price hits any order of a connected VPO.

Below is a quick instruction how to set protective orders.

- Expiration time type determines mode of order expiration.

| Order Time Type | Description |

|---|---|

| GTC | Good till canceled (not applicable for “order time expiration”) |

| TIME DAY | Until end of day |

| TIME SPEC. | Good till specified time |

| TIME SPEC. DAY | Good till specified day |

- Order type. Based on VPO trade direction program automatically set proper order type to place according to conditions presented in the table below.

| Order Type | Placing order condition |

|---|---|

| BUY LIMIT | VPO open price < Ask price |

| BUY STOP | VPO open price > Ask price |

| SELL LIMIT | VPO open price > Bid price |

| SELL STOP | VPO open price < Bid price |

| NONE | Bid price ≤ VPO open price ≤ Ask price |

- Expiration time of placed order.

- Comment for any type of trade. Please be aware that for a pending order or an open position, this parameter cannot be changed.

- Place / modify pending order.

- Delete pending order / close open position.

6. VPO volume, trade direction and lock controls.

In this part volume size can be change by few methods using:

- “Plus” and “minus” buttons by step defined in a symbol specification.

- Typing number in the volume edit field. If user enters e.g. “0,23” or “,23”, program automatically converts the text input into the number “0.23”.

Next to the volume controls, there are toggle buttons used to change the trade direction and to lock all VPO parameters, respectively.

7. Label with profit, price distance (points) and swap for each VPO-EP connection.

8. Information about VPO / EP meaning and basic program hotkeys.

9. Margin call or stop out warning (located at EP price line).

Once VPOs are connected to EP, it is possible to find a price at which margin call or stop out level may occurs. This can be done easily, by dragging EP circle (or its price line) to desired price. Stop-out and Margin-Call levels can be modified from ”input” paramaters tab.

INPUT PARAMETERS

A. General settings - Introducing the key parameters necessary to work with VPOs / EPs.

- Reserved balance – This value corresponds to amount of cash (in account currency) you are planning to use in trade per symbol. By default balance account is used (0 – value). It is possible to enter a value higher than the funds currently in the account if additional deposits are planned and you want to test capital distribution.

- ”AUTO-PRF” profit value – sets the target profit level at which the Evaluation Point (EP) price is automatically calculated from the parameters of the connected VPO trading objects.

- Margin Call level (%) and Stop out level (%) – Threshold values of margin level necesseary for notification (appearing above EP horizontal price line) if equity level is around margin call or stop out. Simply move EP circle / price line on a chart to see the result.

- Ignore calculations if VPO open time > EP time – If FALSE, calculation will be performed only if VPO time is earlier than EP time, as this represents a realistic scenario.

- Magic Number for place pen. orders – This number will be added to pending orders placed by Trade Planner. Once they will be executed, trade will open with this number also.

- Magic Number of tracked EA – This parameter is required for attaching the Trade Planner to pending orders or open positions that use this Magic Number. When set to 0, all trades for the symbol are taken into account by default.

- Lock VPOs when attached to positions / orders – When attaching to position / pending orders procedure is activated, all parameters of newly created VPOs cannot be changed. This feature protect attached object for unintentional change.

B. Alert.

Before using the following input parameters, ensure that the alert icon on the main program panel (see section 1b in the TRADE PLANNER'S GRAPHICAL USER INTERFACE (GUI) manual) is green. The alert state (ON/OFF) is saved for each preset.

- Price distance (points) to VPO – If price is within distance to VPO, alert will be triggered.

- Set a reminder every X seconds – Alert will trigger every X seconds continuously. Until user disable it by toggle alert button (to red color)

- One-shot alert (if true, reminder is disabled) – If switched on, alert trigger only once for met condition. If distance between price and VPO price will be higher than threshold and price back close to VPO (within distance), alert will be triggered again.

- Send notification when alert – Send alert message to Meta Trader 5 mobile application.

C. Style, colors, view.

- GUI scale (%) – Size GUI program for user comfort. However, please note that high value can impact program performance, because Trade Planner have to draw more pixels.

- GUI style – Select option concerning graphical style of GUI:

- “no circles” draw only selected / hovered circles for VPO or SP, other circles are skipped,

- „simple” draw less objects ( higher performance),

- „fancy” gives higher visibility of VPOs for performance cost.

- GUI line thickness – Set thickness of all lines drawn in program.

- EP / VPO description font size – Choose small or normal font size for EP and VPO-EP labels.

- Color for BUY / SELL / PROFIT / LOSS / NONE accordingly - Change mostly used colors. Color None representing situations where profit is equal to zero, EP is isolated (VPOs not linked), VPO - EP lines(s) are bypassed.

- The main panel chart position – Main panel localization on the chart.

- VPO's volume, trade direction, lock chart positions – Sets the position of volume, trade direction, and lock along the VPO horizontal price line.

- Keep VPO Panel visible all the time – When drag VPO circle, this panel is visible all the time until user close it by “ESC” key or close button inside panel (cross).

- Show all VPO-EP lines descriptions – If set to FALSE, the program hides all labels on VPO–EP lines. Swap and profit information is displayed only for the VPO–EP line currently hovered by the mouse.

- Show SL/TP results for all VPOs - Display potential profit or loss for all VPOs according to their SL/TP levels.

- Show VPO table – Displays a table with all VPO trading objects. Useful when there are many VPOs or when two or more trades are very close and hard to distinguish visually. You can easily navigate to any object by clicking its row.

D. Hotkeys

In this section, it is possible to customize important hotkeys for a better workflow. See description in ”inputs” tab in a dialog window of program. Full list of used shortcuts is presented in ADDITIONAL NOTES section of this article.

E. Misc. Settings.

- Presets folder located in the "\Files" directory – Enter a folder name to continue working with the presets located in the specified folder.

- Display hints when hovering over objects – Shows additional notes about the hovered object, such as: VPO Circle, VPO Horizontal Line, main panel buttons etc.

- Display legend and hotkeys – Shows some information about what is VPO and EP objects and some important hotkeys for basic operations.

- Display warnings at program startup – Notify if there are problems with account or symbol data.

ADDITIONAL NOTES.

1. MONEY ALLOCATION

All metrics within Evaluation Points are derived from the reserved capital and the trading points linked to them.

When analyzing a single symbol and the Reserved Money parameter is set to 0 (meaning the full account balance is applied), the EP objects in Trade Planner represent your actual account status.

In every other situation — such as when other instruments already have open trades — each EP functions as an independent sub-account that utilizes only a portion of your total funds assigned to the analyzed symbol.

This setup reduces overall exposure and limits risk compared to using the entire balance for one market.

You may also allocate more virtual capital than currently available in your account to simulate future deposits or explore higher-capital strategies.

Nevertheless, the user can also open multiple charts with Trade Planner for the same symbol, each using a different amount of allocated capital to test and select the most optimal trading strategy from the others chart.

Please choose the amount of allocated balance wisely, as it directly affects all calculated EP account parameters (equity, free margin, margin level, etc.).

Note that the reserved balance is used for calculation purposes only and does not affect the actual margin or account balance on the trading platform.

2. IMPROPER USE OF THE PROGRAM

When changing the volume size of linked VPO to an EP make a sure that EP free margin remains positive and no over-leveraged situation will occur. However, if you increase the volume while the free margin is already negative, additional warning messages may appear along the EP line.

Below is a full list of possible errors which may occurred due to improper volume size, small amount of allocated capital or if EP price is set too low or high relatively to connected trading points.

These warnings are:

- INVALID MARGIN LEVEL (ML < 0 WITH EQUITY > 0)

- NEGATIVE FREE MARGIN WITH PROFIT

- INVALID MARGIN LEVEL (MARGIN USED = 0)

- FREE MARGIN TOO LOW

- EQUITY < 0

3. HOW THE PROGRAM PERFORMS CALCULATIONS?

Margin and profit are calculated using the native MetaTrader 5 functions OrderCalcMargin and OrderCalcProfit based on current market conditions, allowing you to see how profit would change if the market moves to a specific price.

For the most reliable results, it is recommended to use trading symbols whose profit is directly denominated in the account currency (e.g., EURUSD when the account currency is USD). For symbols requiring cross-currency conversion, the system uses the most recent exchange rates available at the time of calculation. For each symbol, the current profit and swap of every open position linked to an evaluation point include broker-provided data, with any additional profit or swap estimated based on simulated price and time changes from the current market conditions.Swap charges are determined by the symbol specifications (type, applicable days, and values). Calculations cover all standard swap modes except Reopen positions. The reopen positions modes apply swaps via technical position rollover at a new price rather than as interest or points.

4. NET PROFIT / LOSS COLOR CONVENTION.

Since version 1.4, the colors of VPO–EP connection lines, EP price lines, EP circle markers, EP vertical time lines, and all VPO/EP labels update automatically according to the following rule:

- profit + swap > 0 → PROFIT color

- profit + swap < 0 → LOSS color

- profit + swap = 0 → NEUTRAL (gray) color

5. NOTES ABOUT MAGIC NUMBER SETTINGS.

Please, don’t confuse the magic number for placing pending orders with the magic number of tracked Expert-Advisor. First one corresponds to placing orders by this program only, the second is for attaching VPOs to orders / open positions created by another EA. However, user can use both, same numbers for placing orders / opening positions simultaneous tracking the same types of trades.

Magic number 0 (zero) applies to all orders or open positions for the symbol.

6. KEYBOARD AND MOUSE SHORTCUTS

Here's a list of all shortcuts used in the program.

| DESCRIPTION | SHORTCUT |

|---|---|

| Add VPO trade point | "A" key (customizable) |

| Add EP evaluation point | "S" key (customizable) |

| Select VPO / EP | Left-click. To prevent changing the VPO/EP position, hold the CTRL key during the operation. |

| Highlight the connections for a specific VPO / EP object | Hold SHIFT and hover over VPO / EP circle marker. |

| Connect VPO to EP | Hold CTRL and left-click on VPO circle, then drag toward any EP. |

| Connect all VPOs to selected EP | “C” key (customizable) |

| Disconnect all VPOs from selected EP (EP isolation) | “D” key (customizable) |

| Delete selected EP / VPO | “DEL” key |

| Set VPO Stop-Loss / Take-Profit | Hold SHIFT and start dragging up or down from the upper or lower part of the VPO circle. An additional filled half-circle will appear inside the VPO circle. |

| Display SL / TP levels with prices for current VPO | Hold SHIFT and hover over VPO Circle. |

| Move the selected EP/VPO up or down along the price axis. | arrow keys (↑ / ↓) |

| Hide / show all Trade Planner’s objects | “H” key (customizable) |

| Lock / unlock all Trade Planner’s objects | “L” key (customizable) |

If you have any suggestions or questions, feel free to send me a private message via MQL messenger.