Quantitative Trailing Scalper (QTS) – User Guide and Detailed Configuration

The Quantitative Trailing Scalper (QTS) is a multi-indicator Expert Advisor (EA) designed for high-precision scalping.

Based on directional momentum logic, it combines RSI, double EMA, MACD, and ATR to identify optimal entry points while managing risk quantitatively.

The goal is simple: capture rapid market moves, protect capital at all times, and let profits run using an adaptive Trailing Stop system.

🔄 QTS – Key Changes in the New Version

This update represents a major structural evolution of the Quantitative Trailing Scalper (QTS), focusing on modularity, robustness, and professional-grade risk control, while preserving its high-performance scalping DNA.

🧠 1. Configurable Base Timeframe

-

Introduction of BaseTimeframe as a centralized timeframe for all calculations (RSI, EMA, MACD, ATR, S/R).

-

Allows QTS to operate independently from the chart timeframe.

-

Fully compatible with any symbol and timeframe (recommended: M1).

✔ Improves consistency, flexibility, and multi-symbol deployment.

📈 2. Fully Modular Entry Architecture

Each entry logic can now be enabled or disabled independently:

-

RSI-based entries

-

Support / Resistance entries

-

MACD-based entries

✔ Enables precise .set configurations

✔ Facilitates targeted backtesting

✔ Improves strategy readability and control

🔀 3. Advanced Support & Resistance Logic

-

Two selectable modes:

-

Breakout

-

Pullback

-

-

Confirmation logic includes:

-

Multi-bar validation

-

Anti-fake buffer in pips

-

-

Dynamic position closure:

-

Take Profit at S/R levels

-

Logical Stop Loss on structural breaks

-

➡ S/R is now both an entry and exit engine, not just a filter.

🧮 4. Dynamic Fibonacci Stop Loss

-

New automatic Fibonacci SL module

-

Based on:

-

Recent swing high / low detection

-

Standard Fibonacci levels (23.6 → 78.6)

-

Adjustable safety buffer

-

-

Can fully replace or complement fixed Stop Loss logic

✔ Provides market-structure-based protection.

⏱️ 5. Reinforced Trade Timing Protection

-

Global post-trade cooldown ( SecurityDelayBars )

-

Extended cooldown specifically for SHORT trades

-

Averaging cooldown logic

✔ Strong reduction of overtrading and execution clustering.

📊 6. Improved H1 Higher-Timeframe Filters

-

H1 RSI:

-

LONG only if RSI < 70

-

SHORT only if RSI > 30

-

-

H1 MACD:

-

Strict directional confirmation

-

➡ Effectively blocks counter-trend entries during complex market phases.

🧷 7. Independent Trailing Stop & Break Even

-

Trailing Stop fully optional and configurable

-

Break Even logic with:

-

Profit trigger

-

Post-BE offset distance

-

-

Fully compatible with:

-

Take Profit

-

Stop Loss

-

Fibonacci SL

-

✔ Active position management without logical conflicts.

🧩 8. Controlled Averaging (Anti-Wild Martingale)

-

Optional averaging for LONG and SHORT

-

Minimum distance in pips between entries

-

Hard limits on:

-

Maximum positions

-

Maximum lot size

-

-

Progressive multiplier with safety caps

⚠ Averaging remains strictly constrained by filters and delays.

🌍 9. Session Filter with Accurate UTC Synchronization

-

Independent session control:

-

Tokyo

-

London

-

New York

-

-

Manual broker UTC offset

-

Reliable session detection on non-UTC servers

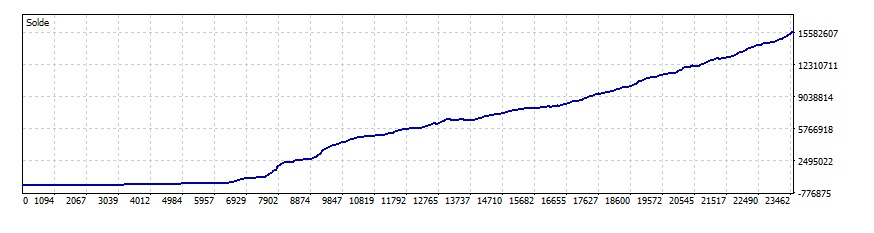

QTS3 L&S TRAILING ON MATRIN ON 151125 :

Results of the QTS1.90highriskmartingalok.set file from 01/01/2025 to 01/01/2026

Note: There's a reason for such a small test range. Testing too far back on the timeframe (one minute) is detrimental to the backtest (it's already borderline with a one-year range given the price difference between the beginning and end).

I remind you that QTS is an Expert Advisor (EA) that takes significant risks, even though it can potentially generate substantial returns. The most important advice is to take your profits when appropriate, and otherwise, let it run its course.

For any questions or support, you can contact the author on MQL5.

(QTS is still in the improvement phase; updates and .set proposals will be added in the coming weeks.)