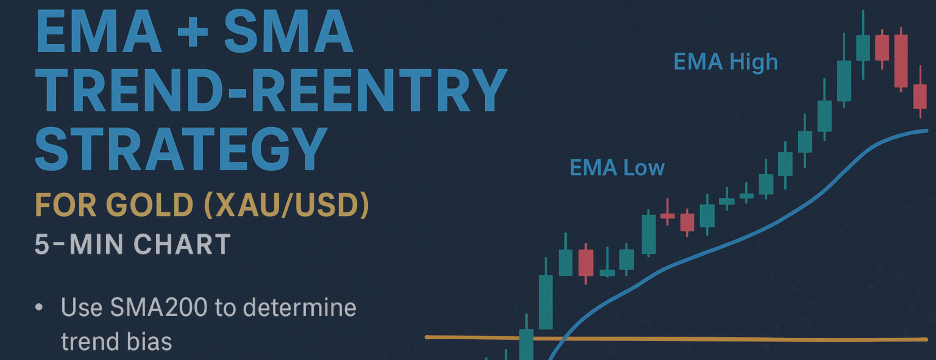

EMA + SMA Trend-Reentry Strategy for Gold (XAU/USD) - Free Indicator Available

In trending markets, most profitable trades don’t happen at the very beginning of a move—but during clean pullbacks within the trend. The strategy we’re presenting here is designed exactly for that: capturing high-probability re-entry opportunities in the direction of the prevailing trend.

At the heart of this system is a blend of two powerful moving averages:

Strategy Logic: The Core Setup

Step 1: Define Trend Direction using SMA200

The 200-period Simple Moving Average (SMA) acts as the long-term trend filter. This is a widely accepted line in the sand for institutional and retail traders alike.

-

Above SMA200 = Uptrend Bias

-

Below SMA200 = Downtrend Bias

Only trades in the direction of this bias are allowed—helping avoid false setups and trendless conditions.

Step 2: Use EMA55 (High/Low) Envelope for Entry Zones

Instead of a single EMA line, we create a dynamic price channel using:

-

EMA55 of Highs → Top band

-

EMA55 of Lows → Bottom band

This defines a short-term momentum envelope that price typically respects within a trending phase.

Step 3: Look for Breakout & Pullback Combination

A trade setup is triggered when:

-

Buy Setup:

-

EMA High > SMA200

-

EMA Low > SMA200

-

Close > EMA High → Breakout above momentum band

-

Wait for pullback to touch EMA High, then enter Buy

-

-

Sell Setup:

-

EMA High < SMA200

-

EMA Low < SMA200

-

Close < EMA Low → Breakout below band

-

Wait for pullback to touch EMA Low, then enter Sell

-

This two-step condition ensures:

-

Breakout confirms trend strength

-

Pullback improves entry precision

Recommended Timeframe: This strategy performs exceptionally well on the 5-minute chart, especially for Gold (XAU/USD), where intraday momentum and pullbacks are frequent and measurable.

Turning Strategy into a Smart MT5 Indicator (Free Indicator Available)

While the strategy sounds logical, spotting these setups in real time is a challenge. Manually checking for cross-zones, breakouts, and retracements across dozens of candles is not ideal—especially in fast markets like XAU/USD.

So we automated it.

The Indicator Advantage

We coded the logic into a smart MetaTrader 5 indicator that does everything:

-

Continuously checks for zone conditions based on EMA/SMA alignment

-

Waits for breakouts in price structure

-

Then looks for precise pullbacks to trigger arrows

-

Shows Live Buy/Sell Arrows on current candle for real-time re-entries

-

Displays a floating label like “Buy Zone” or “Sell Zone” in the top-right corner to inform trader bias

How It Performs in Live Trading

The result is a highly disciplined, visually clean, low-noise signal system:

-

No signals in sideways markets — it filters noise using SMA200

-

Waits for price confirmation before alerting — using breakouts of EMA bands

-

Doesn’t repaint arrows — once an entry is confirmed, it's locked

-

Perfect for scalping or swing entries — depending on chart timeframe

Especially in Gold (XAU/USD), where false breakouts are frequent, this strategy helps enter pullbacks safely without guessing.

Conclusion

The EMA55 + SMA200 trend re-entry strategy is not a typical crossover system. It's a smart, rule-based approach designed to:

-

Identify strong trend phases

-

Confirm momentum with breakouts

-

Wait for clean pullback entry zones

-

Alert re-entries in real time

When paired with a custom-built MT5 indicator, it becomes a complete solution for disciplined, trend-based trading—ideal for Gold scalpers and short-term traders on the 5-minute chart who want less noise and more structure.