Introduction of Multi-Currency Expert Advisor "UP": Smart Grid Trading System for MQL5

Introduction

The UP MT5 advisor is a sophisticated algorithm incorporating 5 different indicators simultaneously, each with unique restriction settings to provide the best equity curve

This means that the advisor does not execute trades on a daily basis. If you are trader seeking daily random trader, I suggest to exploring other advisors on the website, as there are many available. For advanced traders, you will discover, after conducting a thorough test, that the advisor has been meticulously created to produce high probability entries and a protection system that provides cutting-edge performance. This algorithm promptly monitors up to 5 different currency pairs and executes a substantial number of trades with protective points of entries to turn any trades in drawdowns to profitable positions.

Through thousands of hours researching, testing, and optimizing cutting-edge technologies, to apply them to my proven algorithms and long-term trading strategies. During testing we rapidly through massive amounts of market data, find correlated patterns, and apply mathematical analysis to predict where prices are heading. After learning from that data we improved on its accuracy over time, based on past asset prices, trading volumes, and different technical indicators, making an extremely powerful tool for financial trading

UP is a well-known trading robot that combines a safe trading strategy using indicators like the Alligator and MACD with an averaging system with martingale elements

Please note that Waka Waka EA only works with up to 5 currency pairs. These are currency pairs that are characterized by flat dynamics of movement (with small waves of price movement). However, this Expert Advisor can be used on other currency pairs. You can determine other currency pairs to trade through self-tests.

UP MT5 represents years of research & development that I have carefully crafted, and I hope that through this time and sacrifice, that system system will be among the best momentum traders on the market.

What smart grid trading is so popular:

It is convenient. You can figure it out quickly and there are no too complicated calculations that require a lot of experience.

This is effective in terms of risk management.

It is safe when using low risk management when trading. The trading approach has been proven over the years and many traders practice it in a wide variety of markets.

Flexible tactic. It easily adapts to different market conditions.

Finally, smart grid trading is perfect for automation. It is extremely logical, has a clear structure and does not depend on the market behavior.

What sets UP MT5 apart from others in the market?

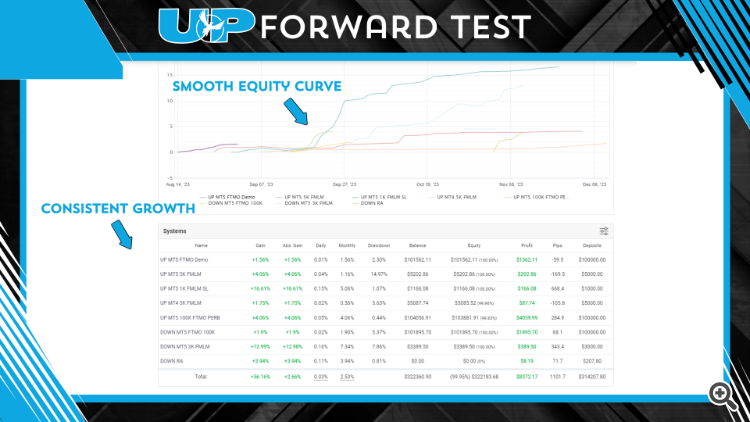

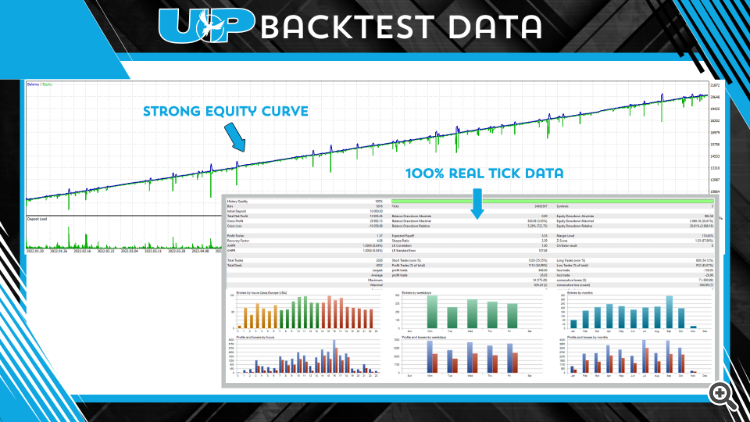

I've identified a pattern that creates short to mid term bursts with the use of 3 trend indicators and 2 pivot indicators that display impressive test results, but more importantly consistent growth with little to none equity drawdown if used properly.

Price Prediction Models

Staying ahead of the curve is paramount for traders and investors. The integration of sophisticated tools, such as Price Prediction Models, can significantly enhance the capabilities of Expert Advisors (EAs), providing a competitive edge in decision-making processes.

Price Prediction Models utilize advanced algorithms to analyze historical price data, market trends, and various technical indicators. These models aim to forecast future price movements, enabling traders to make informed decisions on entry and exit points. When integrated into an Expert Advisor like UP, these predictive models can revolutionize the way trading strategies are executed.

The key advantage of incorporating Price Prediction Models into UP lies in the ability to automate trading decisions based on data-driven insights. By leveraging machine learning and artificial intelligence, UP can adapt to changing market conditions and adjust its strategies in real-time. This adaptability is crucial in today's fast-paced markets, where opportunities and risks can emerge and dissipate rapidly.

Multiple Currency Trading

In the ever-expanding global marketplace, currency traders are increasingly seeking strategies that capitalize on diverse opportunities across multiple pairs. Recognizing this need for adaptability and agility, the Expert Advisor UP has stepped into the spotlight, showcasing its proficiency in monitoring and trading up to five currency pairs simultaneously.

This diversification not only spreads risk but also opens the door to a wider array of trading opportunities. The Expert Advisor's capability to seamlessly navigate and analyze data from up to five pairs at a time positions traders to capture trends and capitalize on price movements across various currencies.

UP's multi-pair trading functionality is not just about diversification; it's about optimizing trading strategies for enhanced performance. Traders can implement tailored strategies that take advantage of the unique characteristics of each currency pair, utilizing UP's adaptability to switch between pairs seamlessly based on prevailing market conditions.

Risk management is another area where UP excels in multiple currency trading. The Expert Advisor can dynamically adjust position sizes and risk parameters for each currency pair, ensuring a balanced and well-considered approach to risk across the entire portfolio. This granular control contributes to a more resilient trading strategy that can weather fluctuations in individual currency pairs.

Trend, Momentum & News Filters

UP elevated its capabilities by incorporating advanced filters—Trend, Momentum, News, and Volatility—that act as gatekeepers, selectively allowing only high-probability trades. These filters not only refine trading strategies but also shield traders from low-probability setups, enhancing the overall performance of UP.

The Trend filter acts as a safeguard against entering positions that go against the established trend, minimizing the risk of being caught in unpredictable market reversals.

This Momentum filter allows UP to enter trades during periods of heightened momentum, increasing the likelihood of catching significant price movements and avoiding stagnant market conditions with limited trading opportunities.

The News Filter is designed to interpret and react to major news events that may impact currency pairs. By factoring in economic releases, geopolitical developments, and other market-moving news, UP steers clear of trades that could be adversely affected by unforeseen events, adding an extra layer of risk management.

I set out to develop a strategy that stands the test of time. Drawing inspiration from time-proven

strategies like level breakthroughs, news trading, price action, and more while adding equity saving restrictions. After compiling data from various approaches. I integrated the fundamental elements into UP MT5.

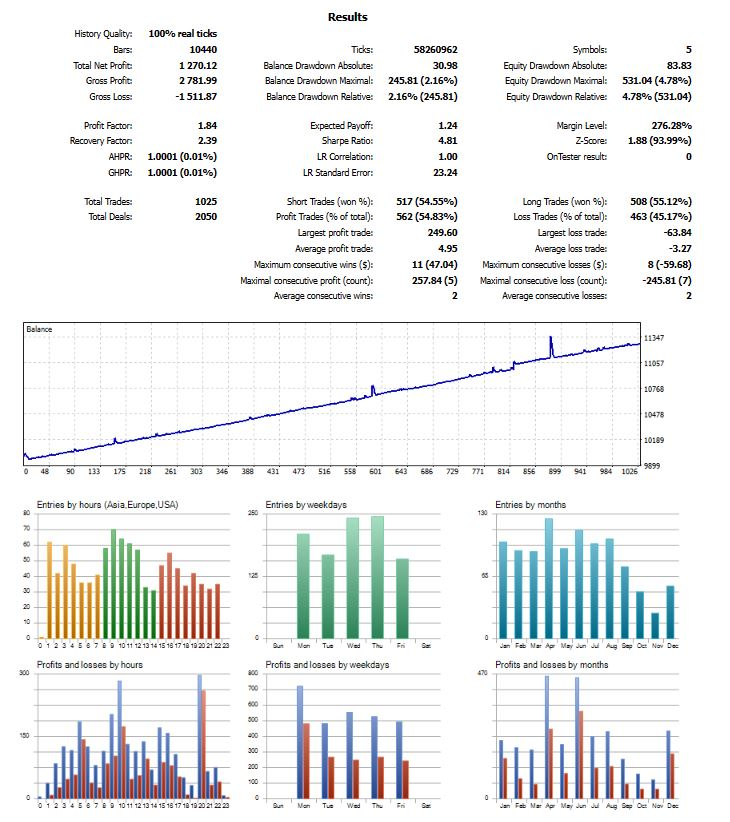

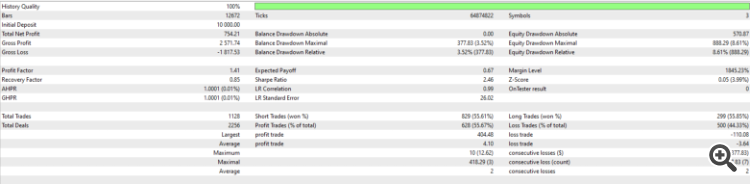

Results

Initial test results weren't overly impressive, however with the mindset of long-term growth without constant manual intervention we created preset files that would fit any account size as low as $500 to $200,000.Through extensive optimization and continual refinement.

Dive into a personalized trading experience with our UP Expert Advisor, offering dynamic risk settings to match your financial goals and risk tolerance.

Low Risk Setting: Aiming for a steady 10-30% yearly gain, the Low Risk setting delivers consistent results with an average of 1.5-2% gains per month. Ideal for those seeking a balanced and stable approach to trading.

Mid Risk Setting: Targeting an impressive 40-60% yearly gain, the Mid Risk setting pursues 2-6% gains per month. Strike a balance between growth and stability with this intermediate option.

Aggressive Risk Setting: For the bold and ambitious, the Aggressive setting aims for an exhilarating 70-120% yearly gain. With potential gains of 5-10% per month, this setting is tailored for those ready to embrace a higher level of risk for greater returns.

🚨 Important Note: Trading involves inherent risks, and equity management is paramount when selecting your preferred settings. Consider your risk tolerance and financial objectives carefully before choosing the risk setting that aligns with your trading strategy.

Being honest—I'm not proclaiming that you will generate billions in test results,

but I firmly believe that this system results can replicate itself month after month.