Unlocking Trading Success with Supply and Demand Zones: A Comprehensive Guide

In the dynamic world of financial markets, understanding and harnessing the power of key price regions is crucial for successful trading. Supply and Demand Zones, often interchangeably referred to as support and resistance zones, are integral elements that savvy traders leverage to create effective strategies. In this article, we'll explore what these zones are, their significance, and how they form the foundation for robust trading approaches.

What are Supply and Demand Zones?

Supply and Demand Zones are horizontal price levels on a chart where the market has shown a historical imbalance between buying and selling interest. In simpler terms, they represent areas where significant buying or selling activity has occurred, leaving a lasting impact on the market's memory.

The Significance of Supply and Demand Zones:

-

Regions of Price Importance:

- These zones act as critical markers, highlighting levels where price has previously reacted.

- Traders view these zones as potential areas for future price reactions, making them invaluable for decision-making.

-

Market Velocity and Reversal Actions:

- Inside Supply and Demand Zones, market velocity tends to decrease. This slowdown often precedes significant market movements.

- Reversal actions, where the market changes direction, frequently occur within these zones.

-

Identification of Important Price Levels:

- The velocity of price movements within these zones can signal the importance of specific price levels.

- A breakout or breakdown from these zones with low velocity can indicate a crucial shift in market sentiment.

Incorporating Strategies within Supply and Demand Zones:

-

Price Action Patterns:

- Engulfing patterns, pin bars, and other price action signals are more trustworthy when they occur within these key zones.

- Traders often wait for these patterns within Supply and Demand Zones to confirm their validity.

-

Trend Reversals:

- Identifying reversal patterns or divergences within these zones can be a precursor to trend reversals.

- Traders look for signs of exhaustion or the weakening of the prevailing trend within these areas.

-

Breakout Strategies:

- Breakouts from Supply and Demand Zones with increased velocity can signal the initiation of strong trends.

- Breakout traders often wait for confirmations within these zones before entering trades.

The Need for a Reliable Tool:

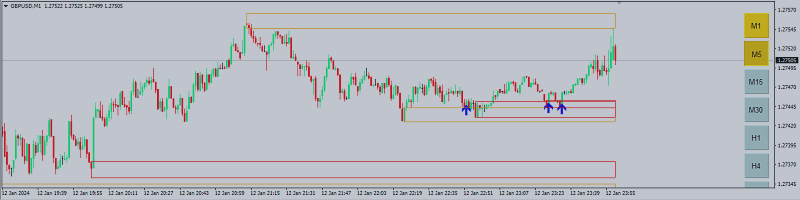

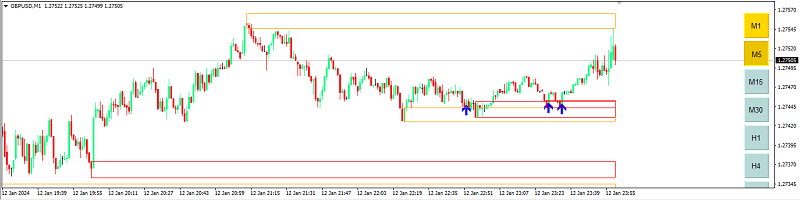

To effectively navigate and draw Supply and Demand Zones across different time frames, having the right tool is paramount. Supply Demand Zone Indicator provides a comprehensive solution for traders seeking a multi-timeframe zone-drawing tool. This tool allows users to monitor and analyze key price levels seamlessly, offering a holistic view of the market.

Conclusion:

Supply and Demand Zones are the bedrock of many successful trading strategies. Recognizing their importance, understanding their dynamics, and implementing strategies within these zones can significantly enhance your trading performance. Empower your trading journey by leveraging tools that simplify the process of monitoring and drawing these crucial zones, giving you a competitive edge in the dynamic financial markets. Visit Supply Demand Zone Indicator to explore and download the demo, revolutionizing the way you analyze and trade within Supply and Demand Zones. 📊✨