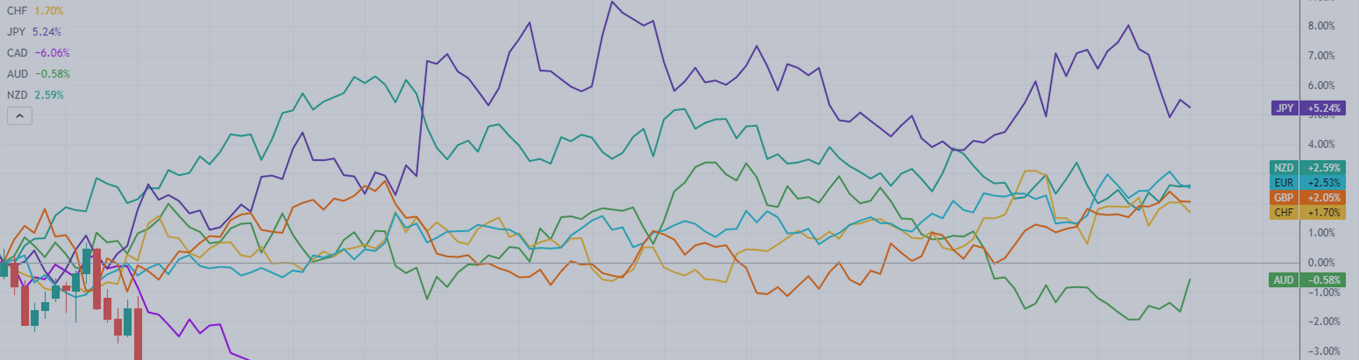

When it comes to trading on the forex market, it's important to know which currency pairs are the most volatile. Volatility refers to the magnitude and frequency of price movements, and it's a crucial factor in determining potential profits and risks.

So, what forex pairs move the most? Let's take a closer look.

- EUR/USD

The EUR/USD is the most traded currency pair in the world, and it's also one of the most volatile. The euro and the U.S. dollar are the two most widely used currencies in the global economy, and any news that affects either of them can cause significant price movements in the pair.

The EUR/USD is also highly sensitive to changes in interest rates, economic data, and political events in both Europe and the United States. Traders should be prepared for rapid price swings and consider using risk management tools like stop-loss orders.

- GBP/USD

The GBP/USD, also known as the "cable," is another highly volatile currency pair. Like the EUR/USD, it's sensitive to economic data and political events in both the UK and the US.

In addition, the GBP/USD is often influenced by Brexit-related news and the Bank of England's monetary policy decisions. Traders should pay close attention to these factors and use caution when trading this pair.

- USD/JPY

The USD/JPY is a popular currency pair for traders looking to take advantage of the volatility in the Japanese yen. Japan is one of the world's largest economies, and its currency is often used as a safe-haven asset during times of economic uncertainty.

The USD/JPY is also affected by changes in interest rates, economic data, and political events in both the US and Japan. Traders should be prepared for rapid price movements and consider using risk management strategies.

- USD/CAD

The USD/CAD is a currency pair that is strongly influenced by the price of oil. Canada is one of the world's largest oil producers, and any changes in the price of crude oil can have a significant impact on the value of the Canadian dollar.

In addition, the USD/CAD is also affected by economic data and political events in both the US and Canada. Traders should be aware of these factors and use caution when trading this pair.

- AUD/USD

The AUD/USD is a currency pair that is heavily influenced by commodity prices, particularly gold and iron ore. Australia is a major producer of these commodities, and any changes in their prices can affect the value of the Australian dollar.

The AUD/USD is also sensitive to economic data and political events in both Australia and the US. Traders should be prepared for rapid price movements and consider using risk management tools.

In conclusion, these five currency pairs are among the most volatile in the forex market. Traders should be aware of the factors that can influence their prices and use caution when trading them. By understanding the risks and potential rewards of these pairs, traders can make informed decisions and improve their chances of success.